|

|

|

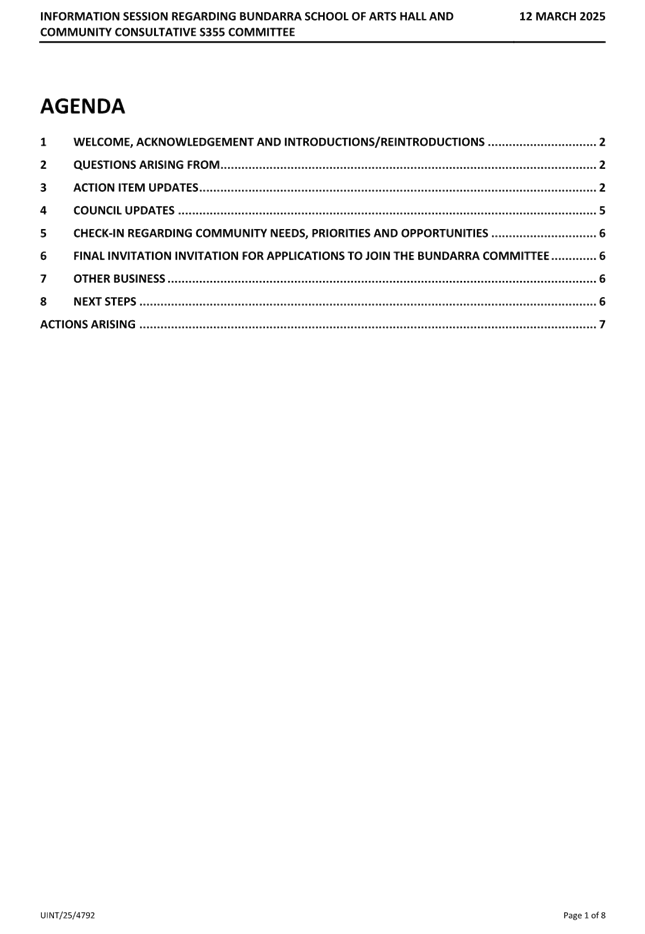

Agenda & Business

PAPERS

|

|

Notice is hereby given, in accordance with the

provision of the Local Government Act 1993 that a meeting of Uralla

Shire Council will be held in the Council Chambers, 32 Salisbury Street,

Uralla.

|

|

Ordinary Council Meeting

25 March 2025

|

|

Commencing at 4:00 PM

|

|

|

|

Statement of Ethical Obligations

The Mayor and Councillors are bound by the Oath/ Affirmation of

Office made at the start of the Council term to undertake their civic duties

in the best interests of the people of Uralla Shire and to faithfully and

impartially carry out the functions, powers, authorities and discretions

vested in them under the Local Government Act or any other Act, to the

best of their skill and judgement.

It is also a requirement

that the Mayor and Councillors disclose conflicts of interest in relation to

items listed for consideration on the Agenda or which are considered at this

meeting in accordance with Council’s Code of Conduct and Code of

Meeting Practice.

|

|

Toni Averay

General

Manager

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

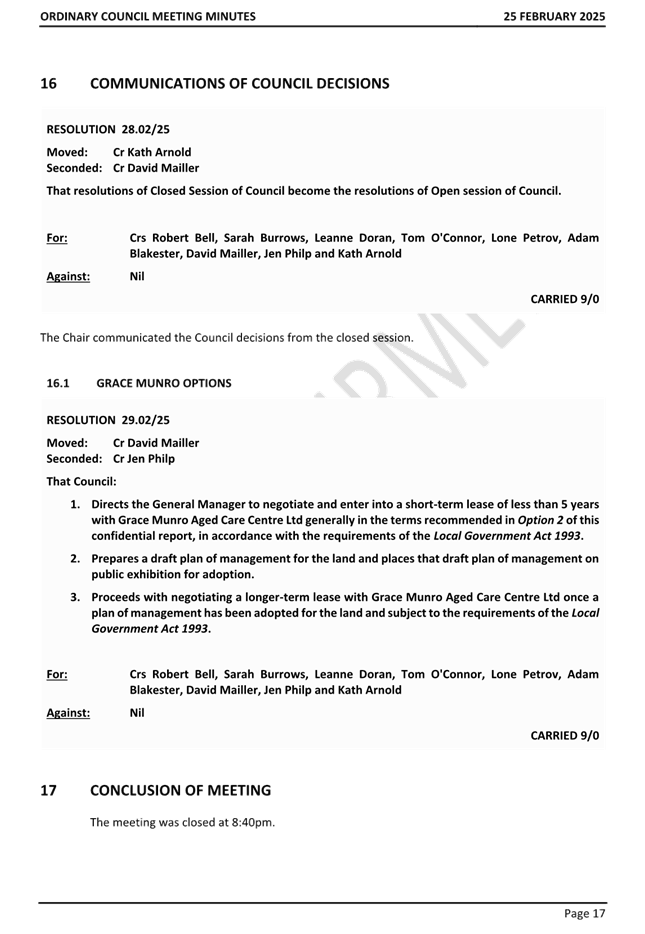

7 Confirmation

of Minutes

7.1 Confirmation

of Minutes Ordinary Meeting held 25 February 2025

|

Department:

|

General Manager’s

Office

|

|

Prepared By:

|

Executive Assistant

|

|

Authorised By:

|

General Manager

|

|

Reference:

|

UINT/25/4679

|

|

Attachments:

|

1. Minutes

Ordinary Meeting held 25 February 2025 ⇩

|

|

Recommendation

That Council adopts the minutes of the Ordinary Meeting

held 25 February 2025 as a true and correct record.

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

8 Urgent,

Supplementary, and Late Items of Business (Including Petitions)

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

9 Written

Reports from Delegates

9.1 Mayor's

Activity Report for February 2025

|

Department:

|

General Manager’s

Office

|

|

Prepared By:

|

Executive Assistant

|

|

Authorised By:

|

Mayor

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.1. Informed

and collaborative leadership in our community

|

Summary

The Mayor’s Activity Report outlines activities conducted

during the month of February 2025.

|

Recommendation

That Council Receives the Mayor’s Activity report

for February 2025.

|

Report

|

DATE

|

COMMITTEE/MEETING/EVENT

|

LOCATION

|

|

3 Feb 2025

|

Mayor & GM Catch up Meeting

|

Uralla

|

|

4 Feb 2025

|

Induction Information

Sessions

|

Uralla

|

|

10 Feb 2025

|

Mayor & GM Catch up Meeting

|

Uralla

|

|

11 Feb 2025

|

New England REZ

Steering Committee Meeting

|

Uralla

|

|

11 Feb 2025

|

Squadron Energy Meeting

|

Uralla

|

|

11 Feb 2025

|

Information Session

- NBN –

briefing

- ORIGIN – Presenting on projects for :

· Northern Tablelands Wind Farm

· Salisbury Solar Farm

· Ruby Hills Wind Farm

- ACEN – Progress on:

· NES1 Operating site

· NE BESS in construction

· NES2 pre-construction planning

· Deeargee development planning

· General update on our social investment program,

partnerships, scholarships and donations

- ACE POWER

· Plan progressing on Hillview Energy Hub

- ENERGY Co

· EnergyCo’s Transmission Lines.

|

Uralla

|

|

12 Feb 2025

|

2AD Interview

|

Online

|

|

13 Feb 2025

|

Meeting GM Review

|

Uralla

|

|

17 Feb 2025

|

Engagement Session –

Chancellor UNE

|

Armidale UNE

|

|

17 Feb 2025

|

Mayor & GM Catch up Meeting

|

Uralla

|

|

18 Feb 2025

|

Interagency Meeting

|

Bolt Inn Uralla

|

|

18 Feb 2025

|

Information Session

- Strategic Housing Strategy – RemPlan

|

Uralla

|

|

19 Feb 2025

|

BFMC Meeting

|

RFS Armidale

|

|

21 Feb 2025

|

New England Solar Farm

Battery Hub SOD turned Ceremony

|

NE Solar Farm Uralla

|

|

24 Feb 2025

|

Mayor & GM Catch up Meeting

|

Uralla

|

|

25 Feb 2025

|

Long Service Awards

|

Uralla

|

|

25 Feb 2025

|

Citizenship Ceremony

|

Uralla

|

|

25 Feb 2025

|

Council Ordinary Meeting

|

Uralla

|

|

26 Feb 2025

|

2AD Interview

|

Online

|

|

26 Feb 2025

|

Brendan Moylan MP

|

Uralla

|

|

27 Feb 2025

|

New England Solar SIP

Presentation

|

Uralla

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

14 Reports to

Council

14.1 Councillor

Representative Report - Bundarra Community Meeting 12 March 2025

|

Department:

|

General Manager’s

Office

|

|

Prepared By:

|

Councillor

|

|

Authorised By:

|

Director Infrastructure & Development

|

|

Reference:

|

UINT/25/4728

|

|

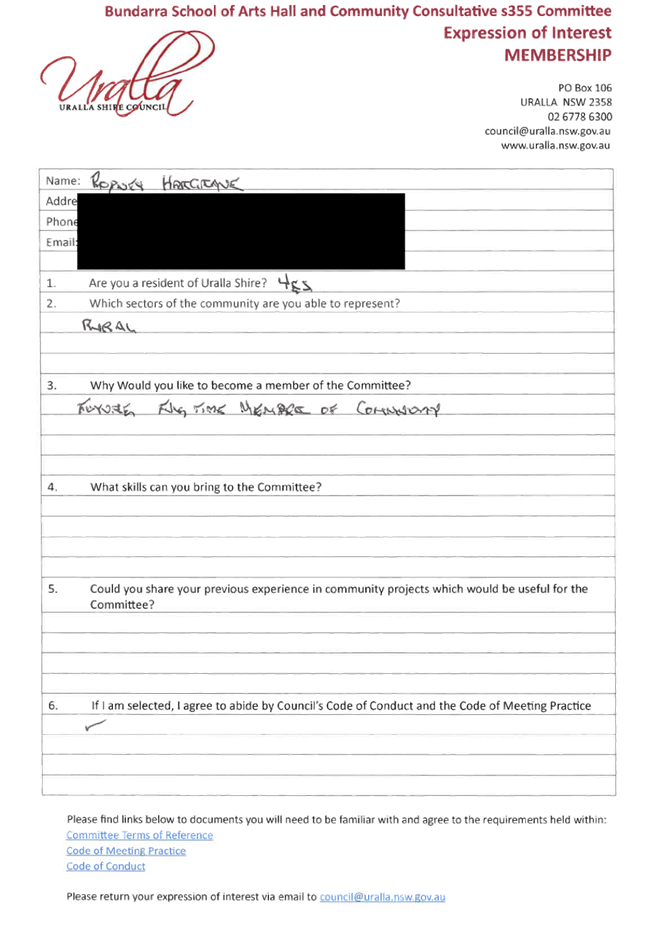

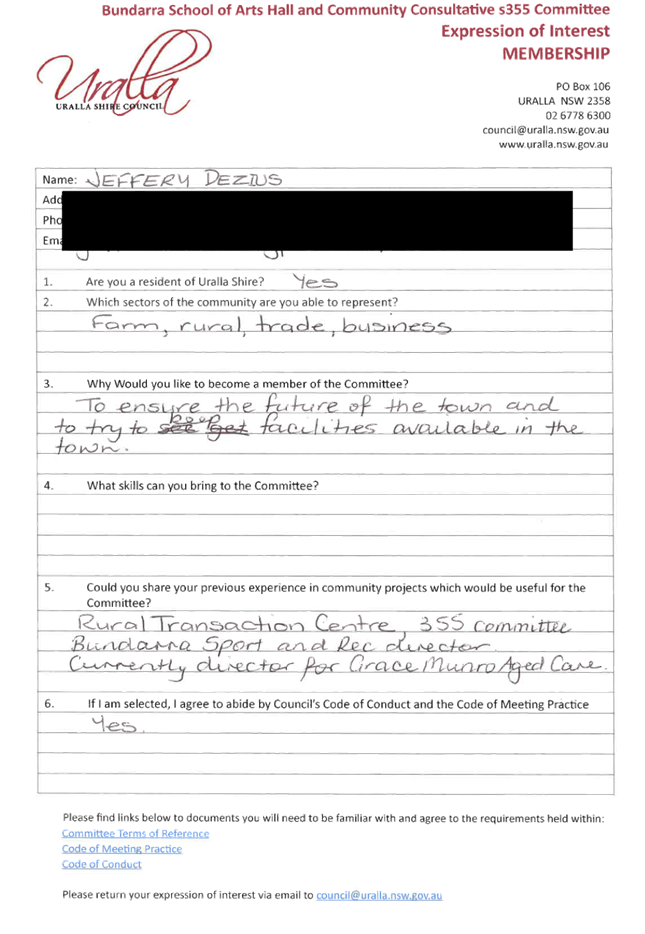

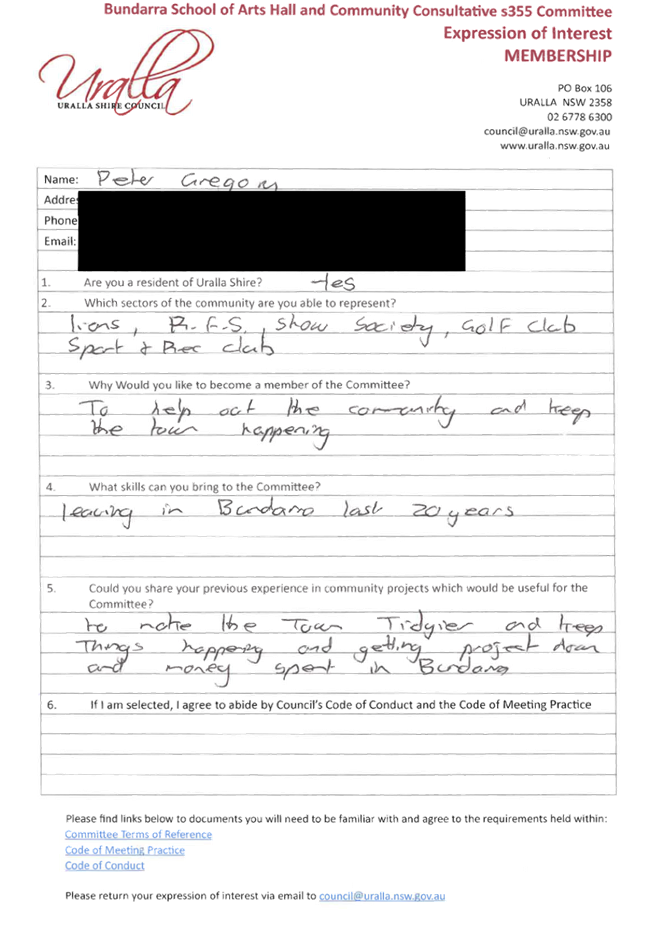

Attachments:

|

1. EOI

- Peter Gregory ⇩

2. EOI

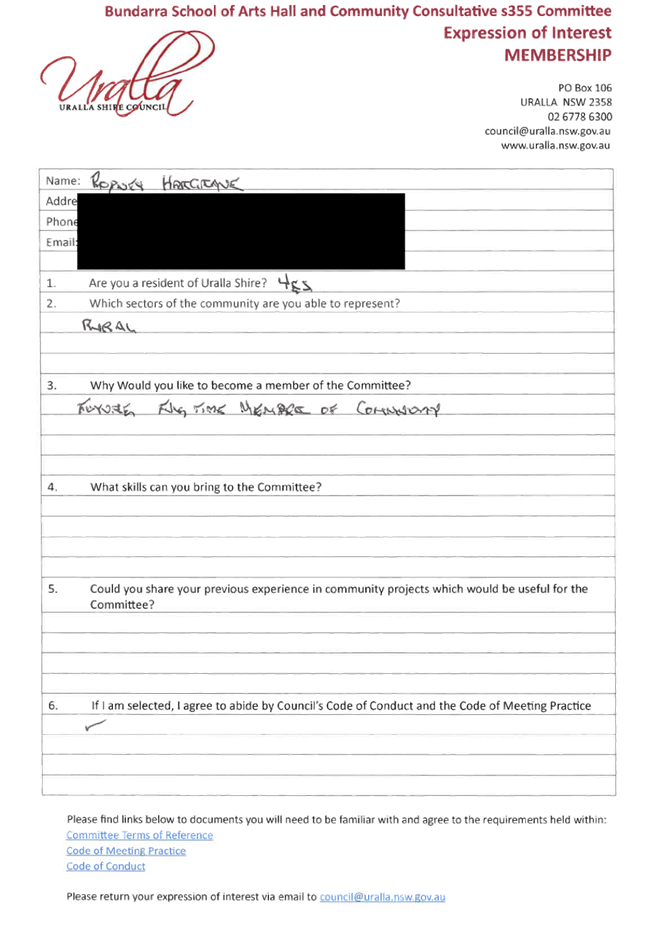

- Rodney Hargrave ⇩

3. EOI

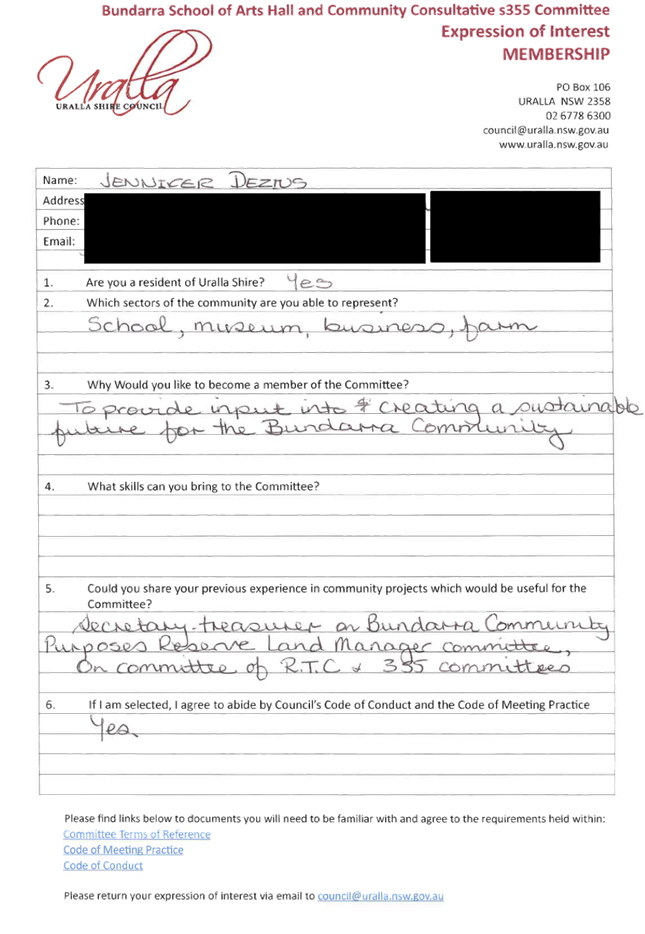

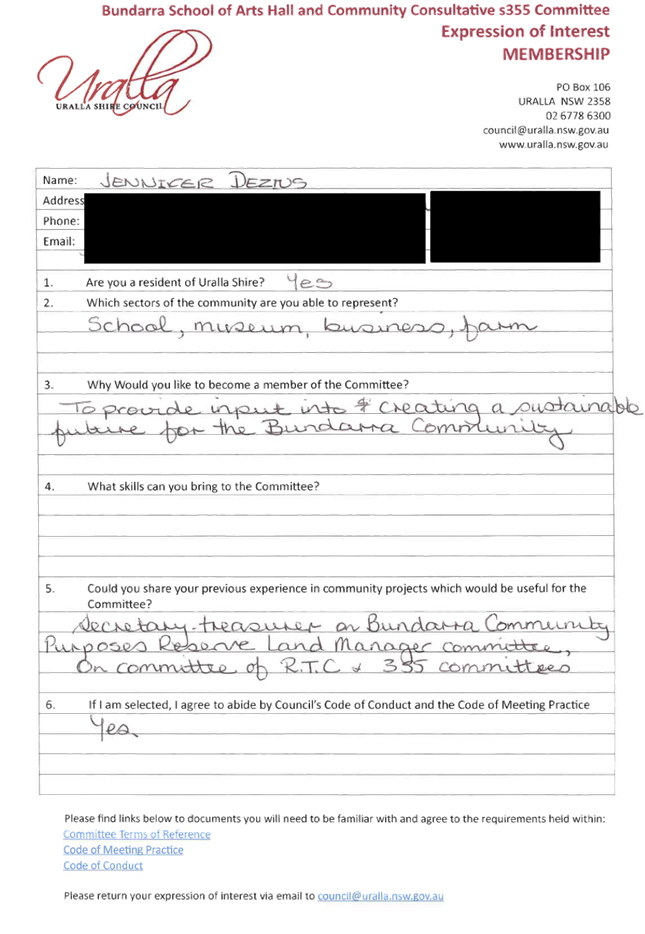

- Jennifer Dezius ⇩

4. EOI

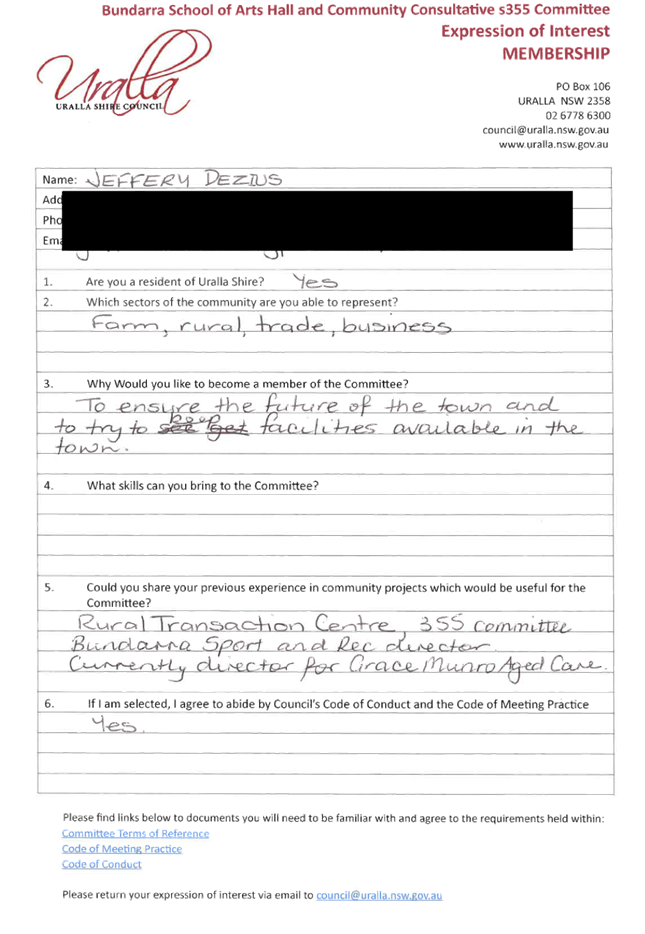

- Jeffery Dezius ⇩

5. EOI

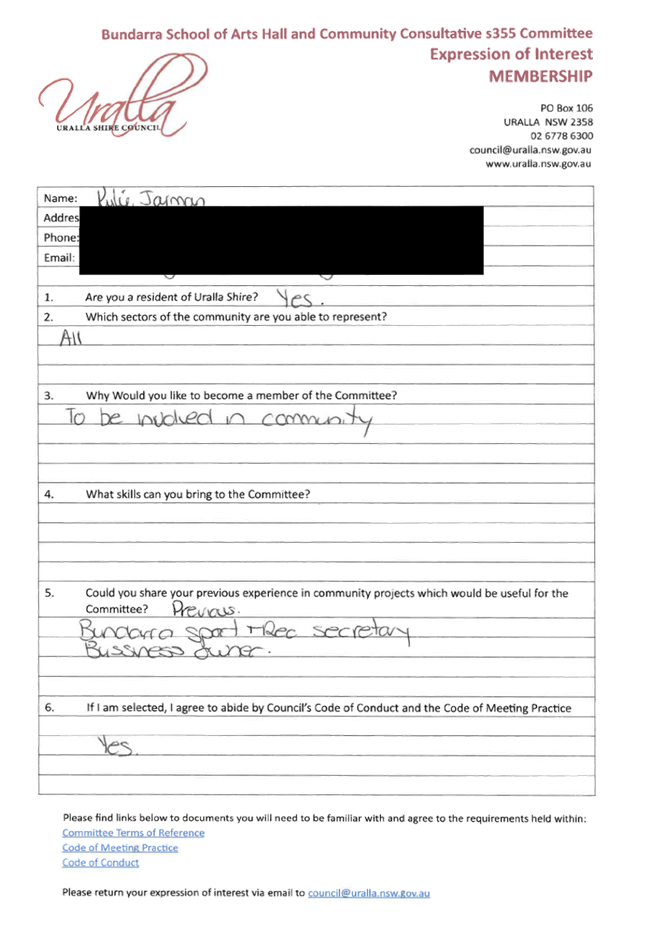

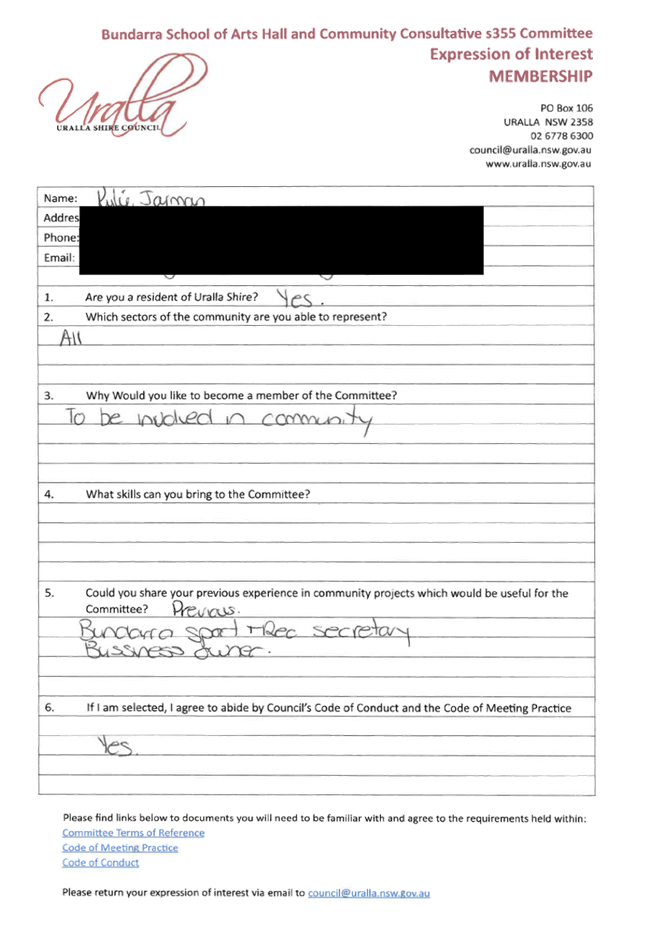

- Kylie Jarman ⇩

6. EOI

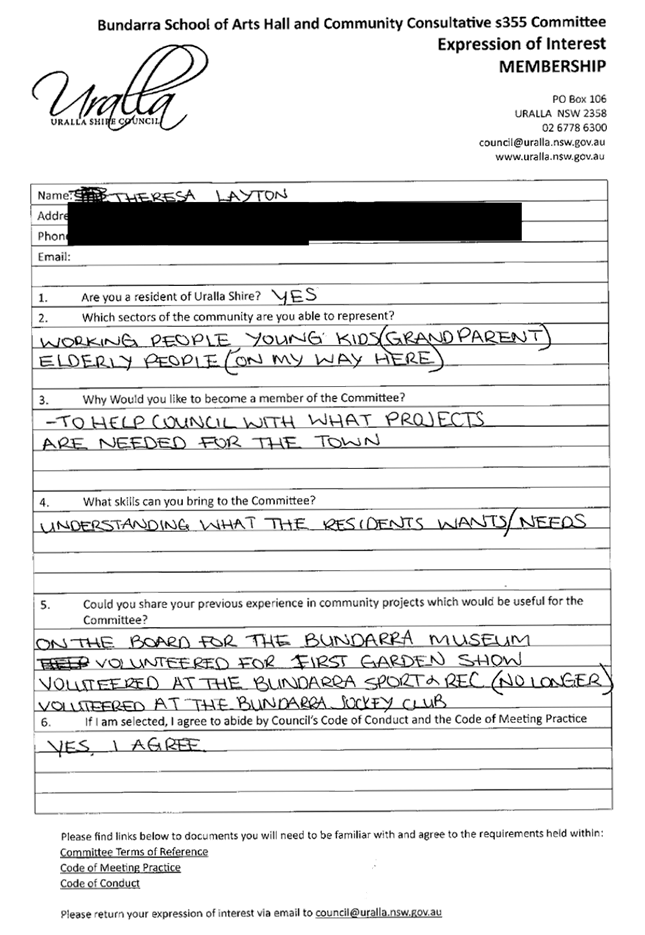

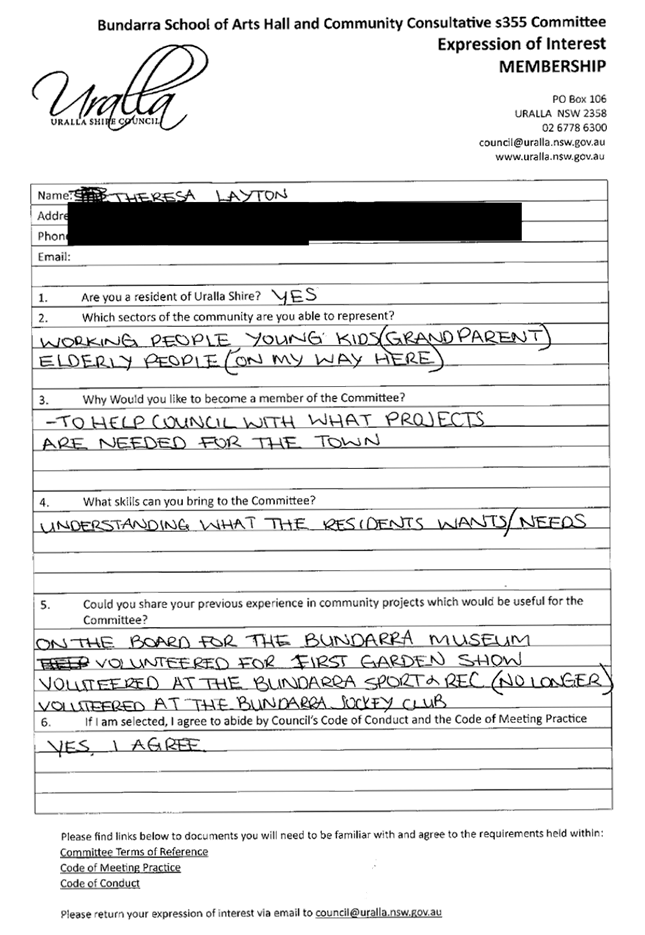

- Theresa Layton ⇩

7. EOI

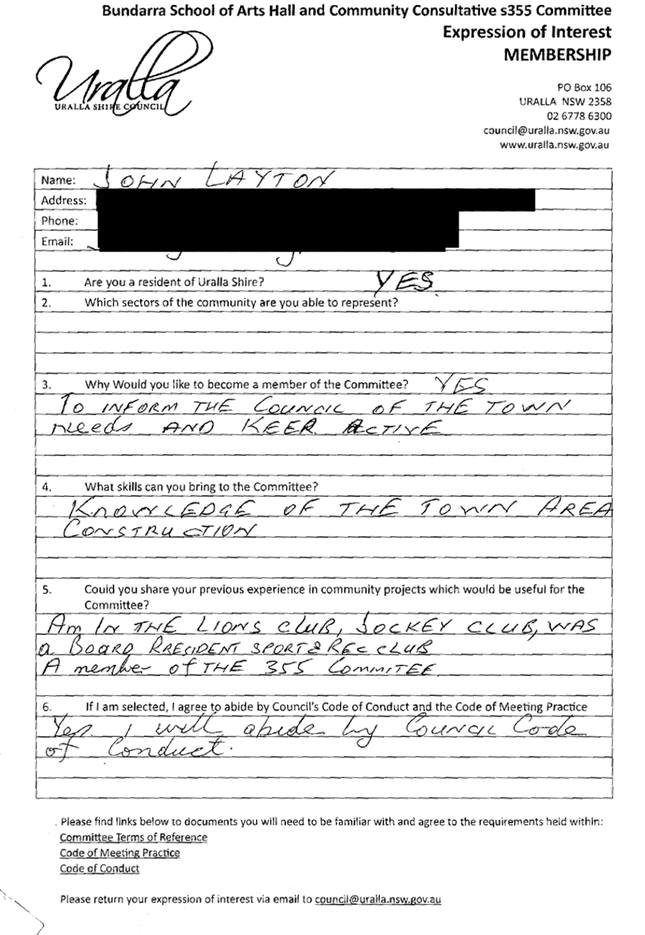

- John Layton ⇩

8. EOI

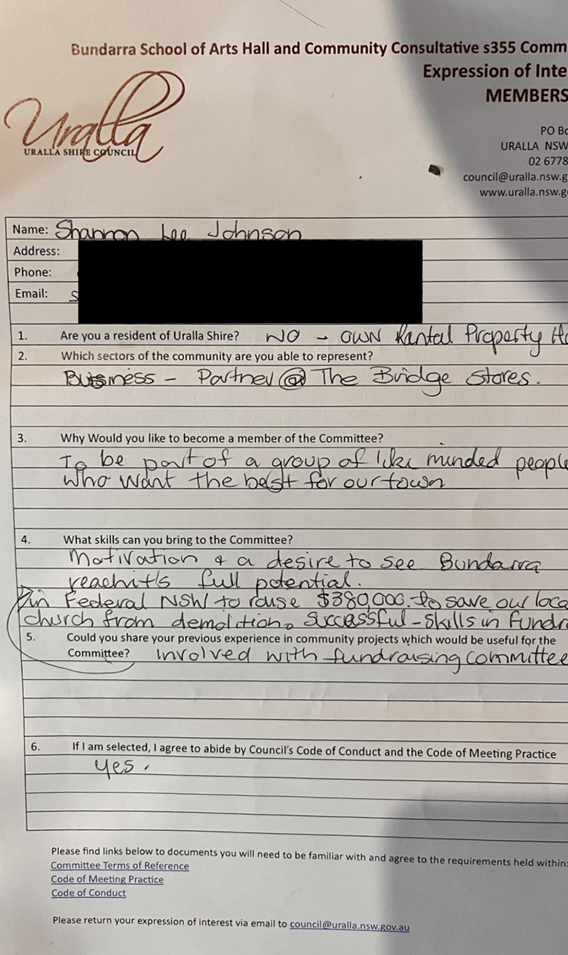

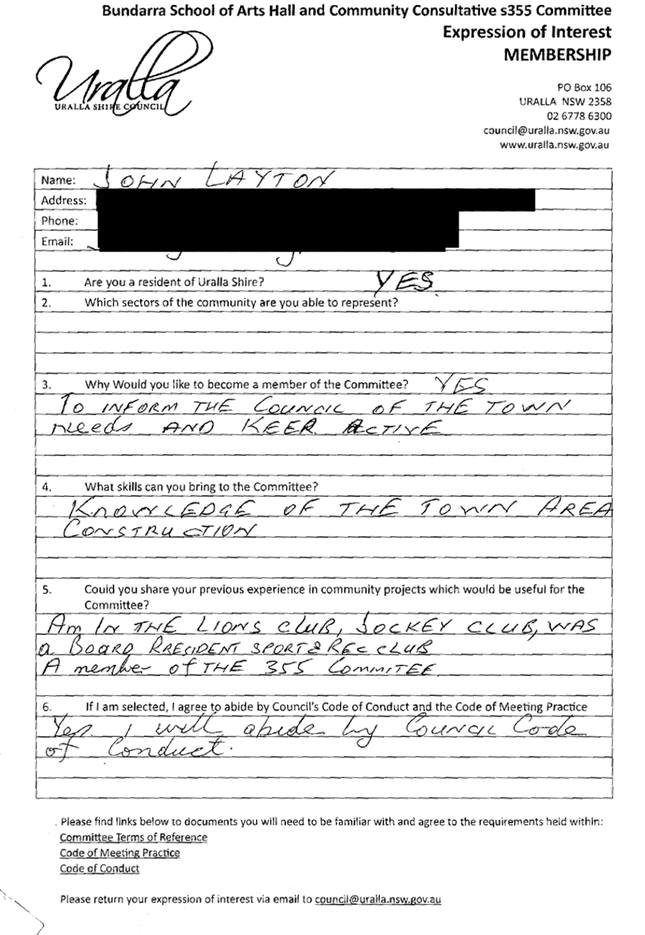

- Shannon Lee Johnson ⇩

9. EOI

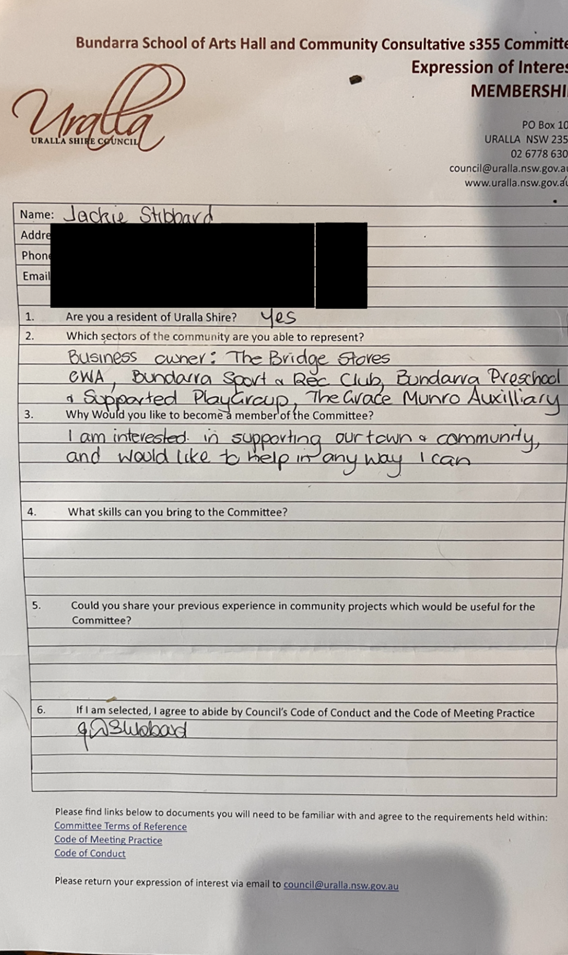

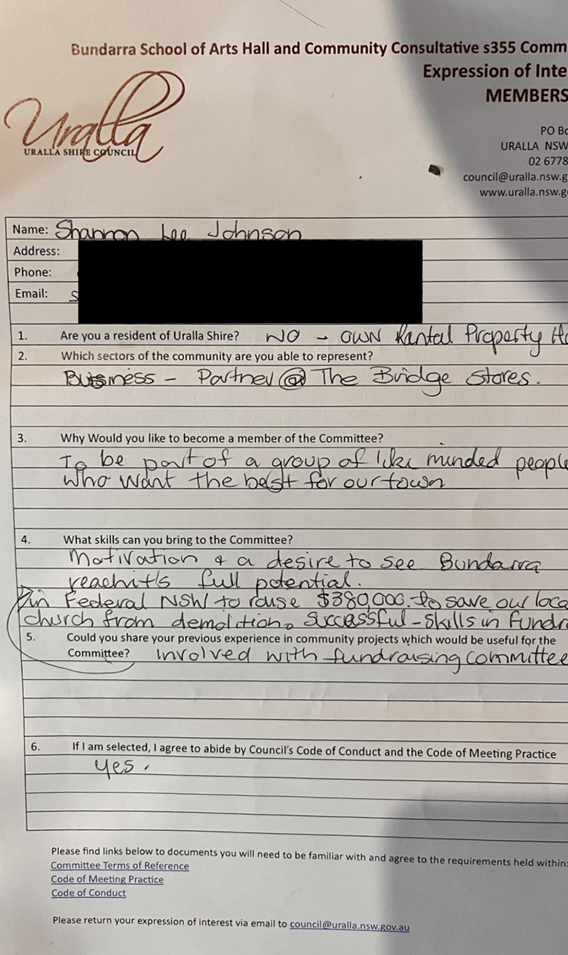

- Jackie Stibbard ⇩

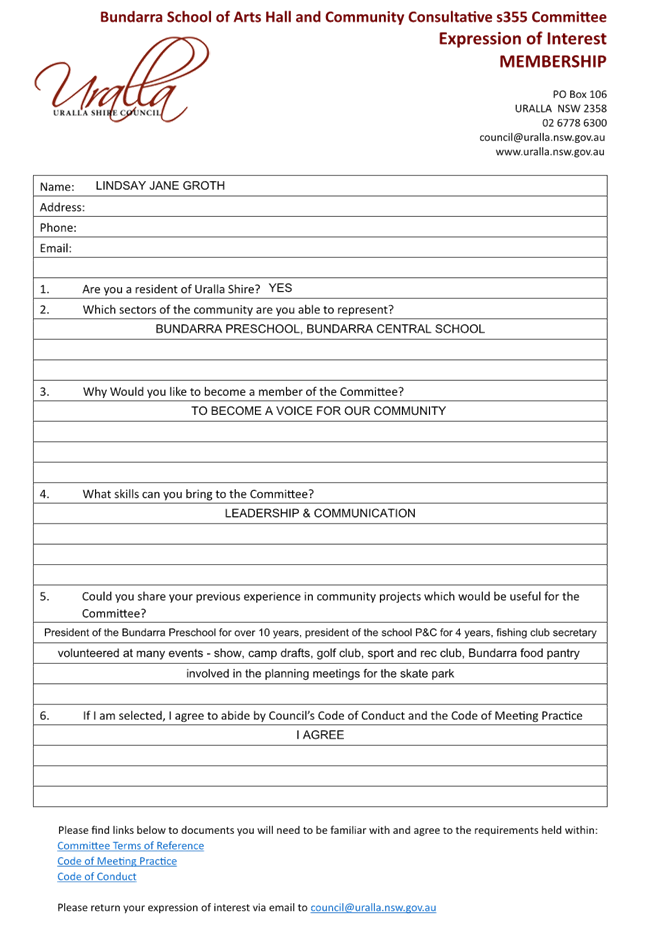

10. EOI

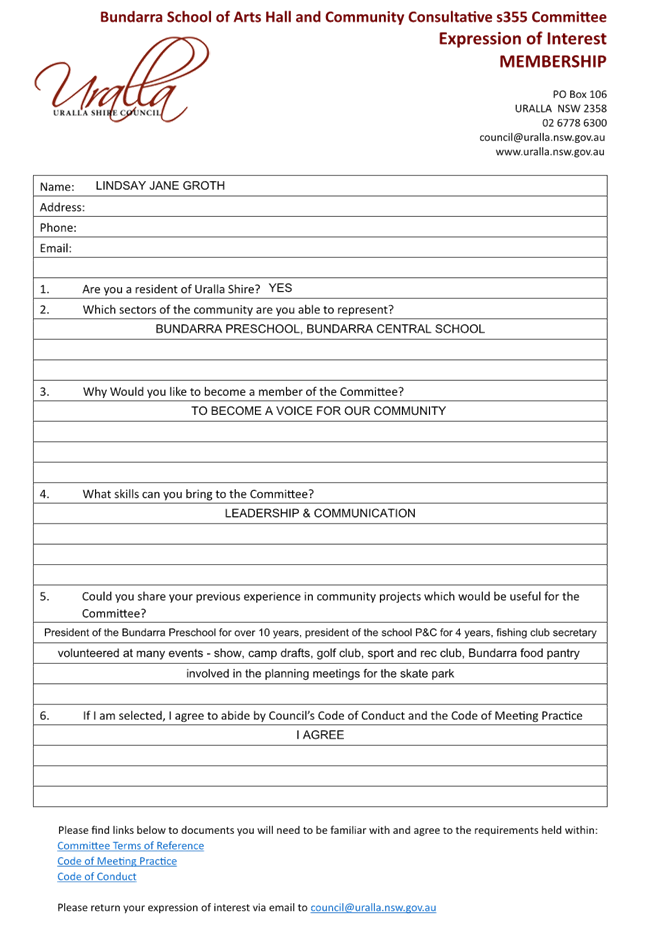

- Lindsay Groth ⇩

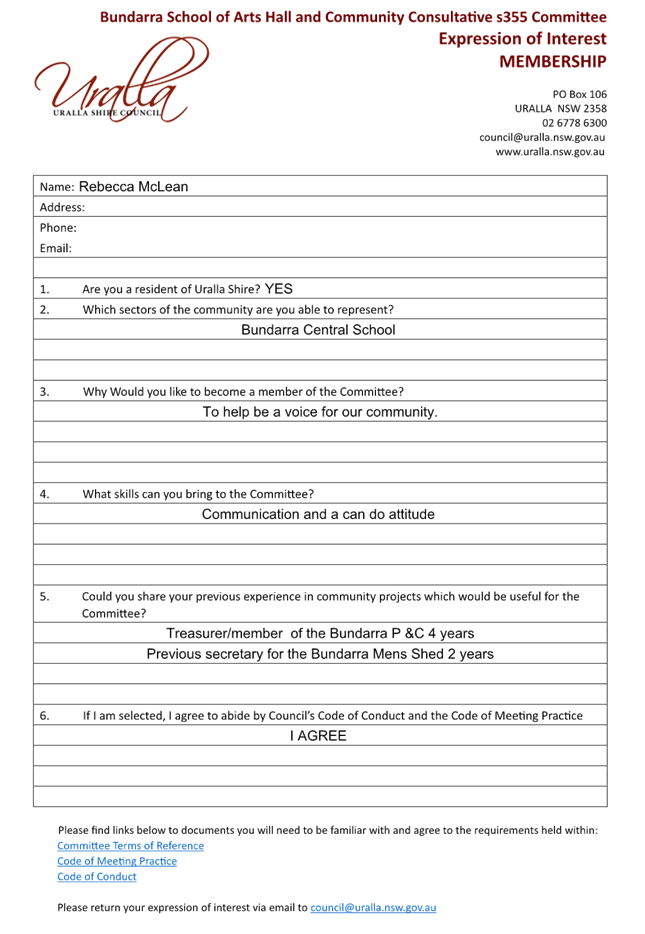

11. EOI

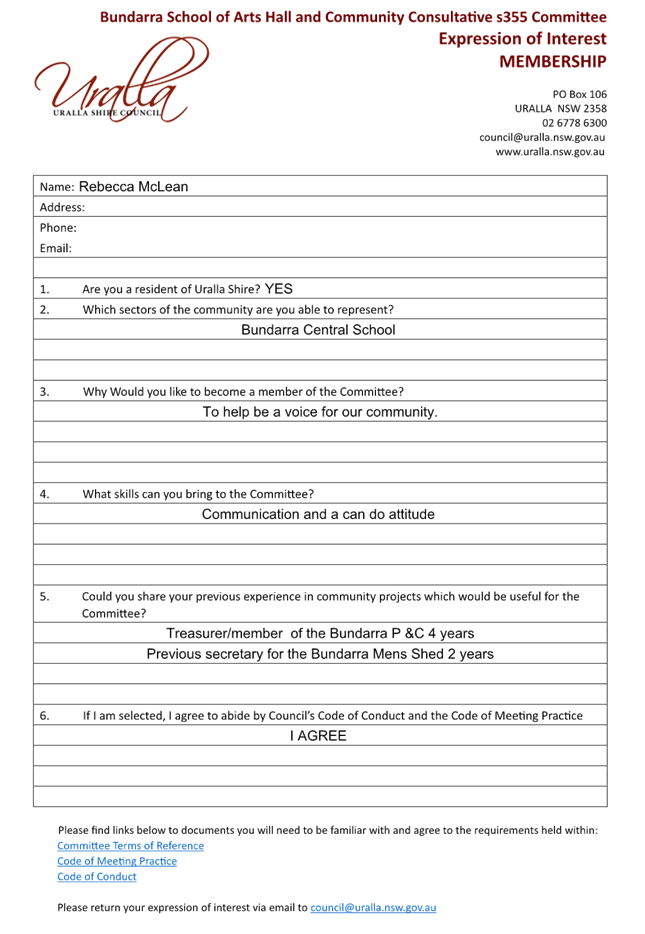

- Rebecca McLean ⇩

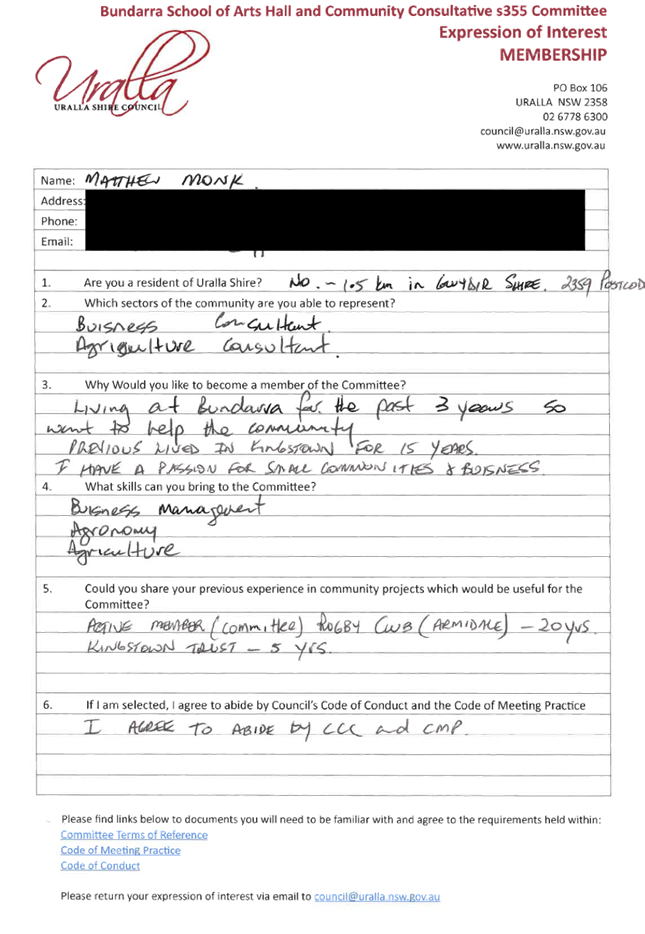

12. EOI

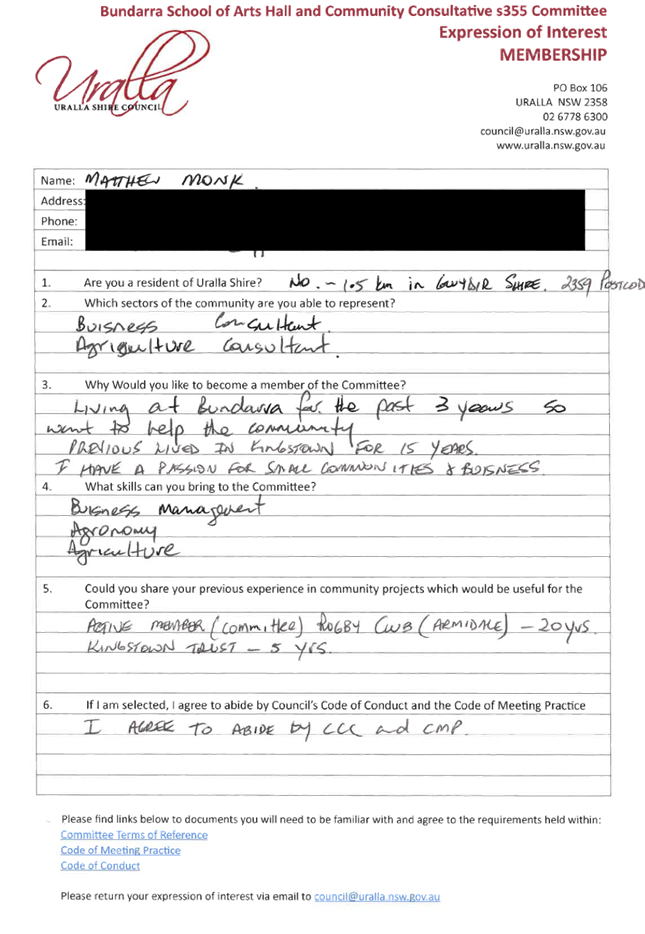

- Matthew Monk ⇩

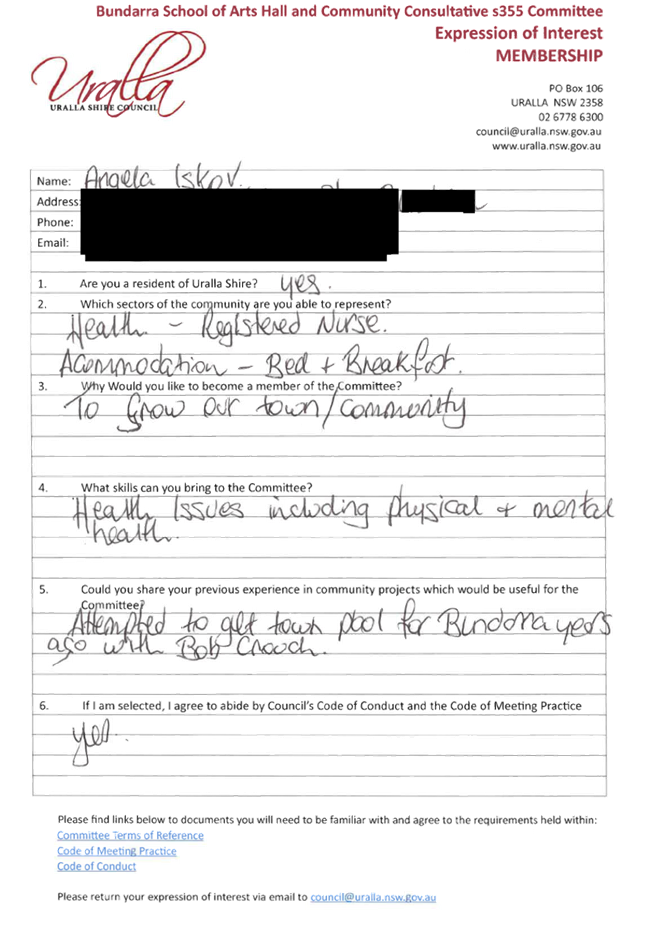

13. EOI

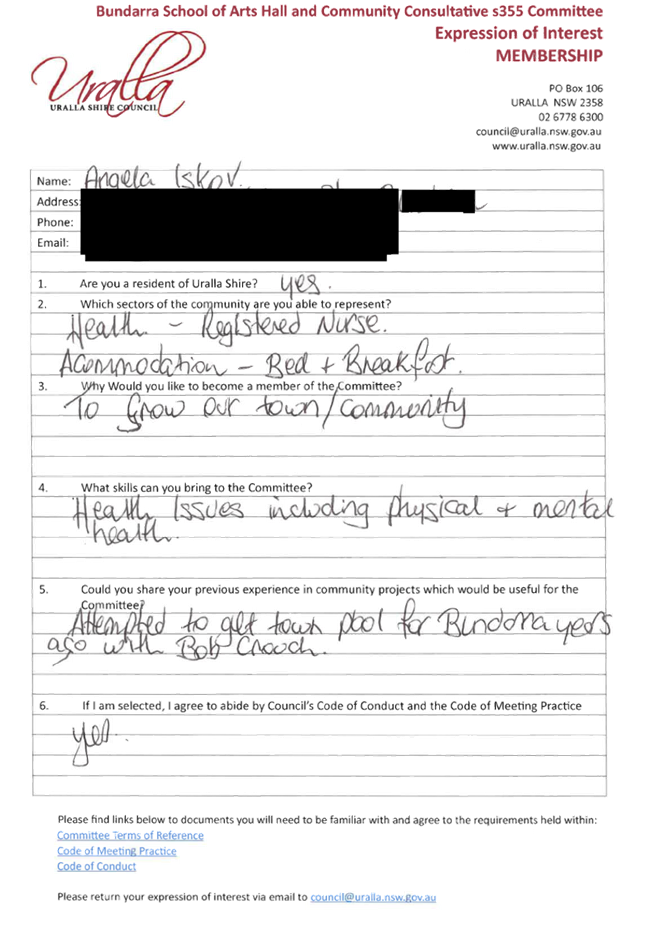

- Angela Iskov ⇩

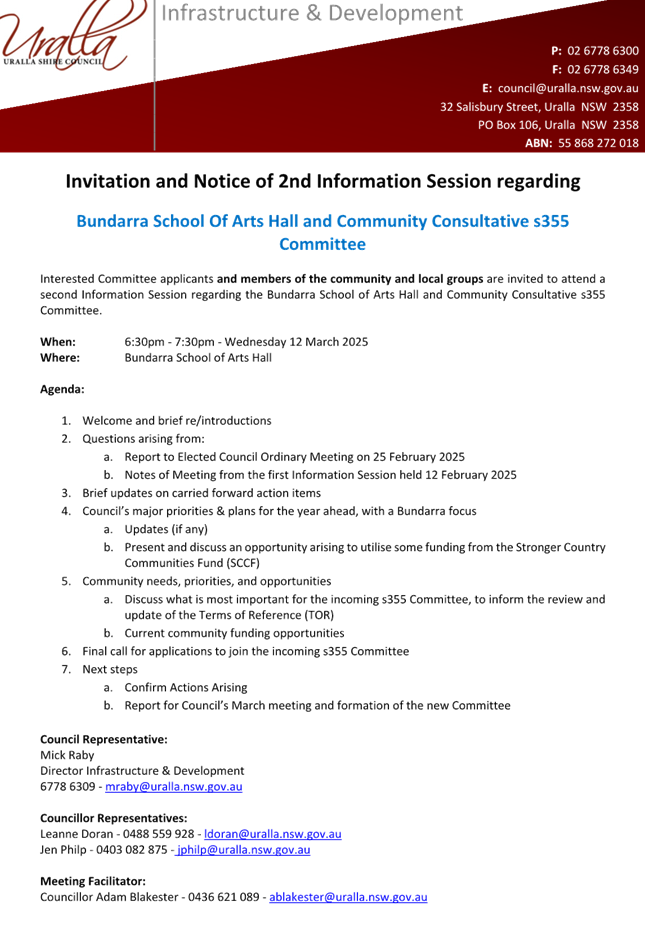

14. Invitation

/ Agenda - Bundarra Community Meeting - Bundarra School of Arts Hall &

Community Consultative s355 Committee - 12 March 2025 ⇩

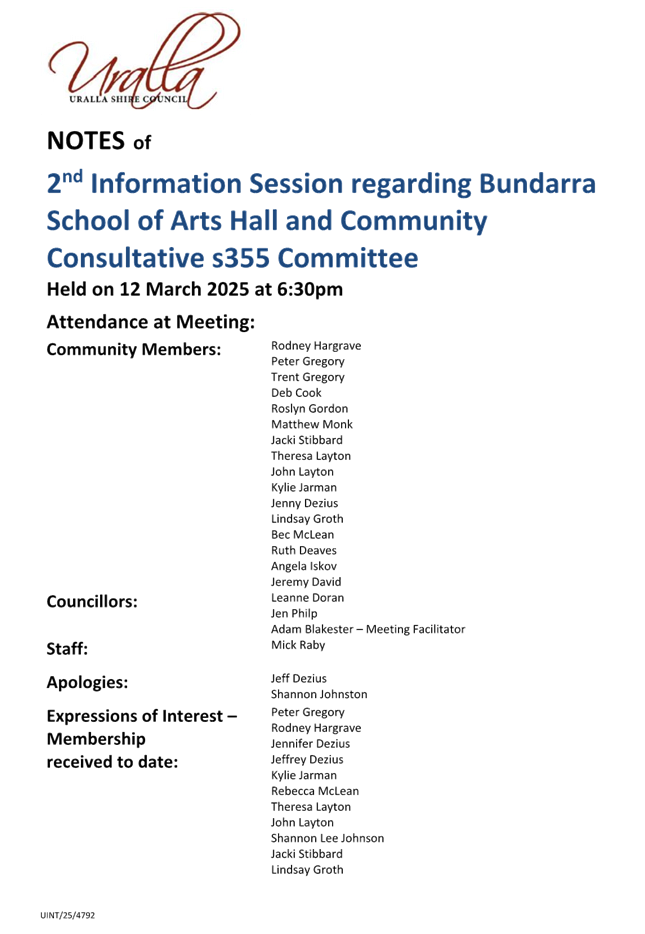

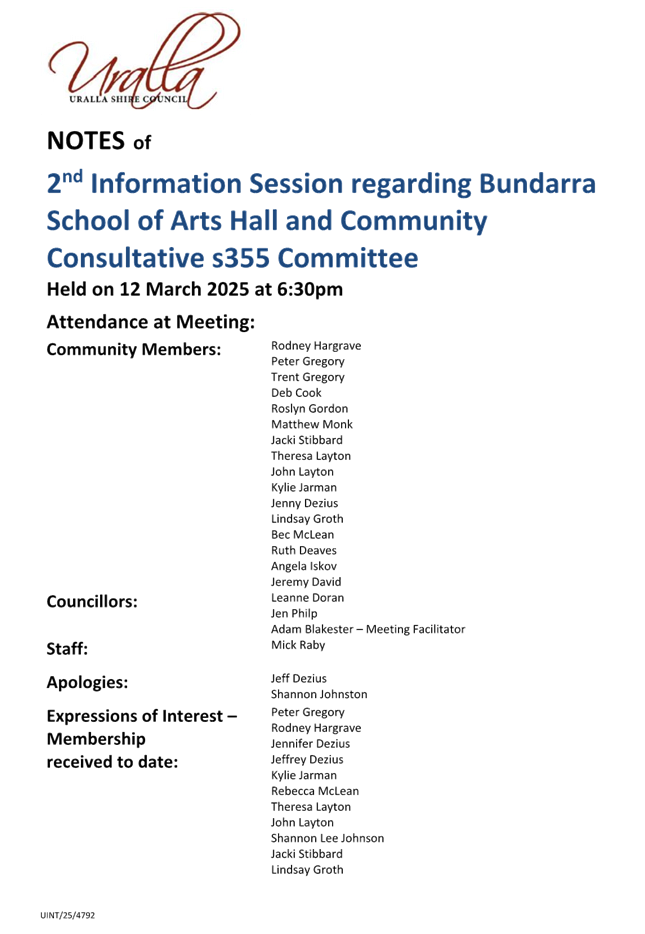

15. Notes

- 2nd Bundarra Community Information Session Meeting - 12 March 2025 ⇩

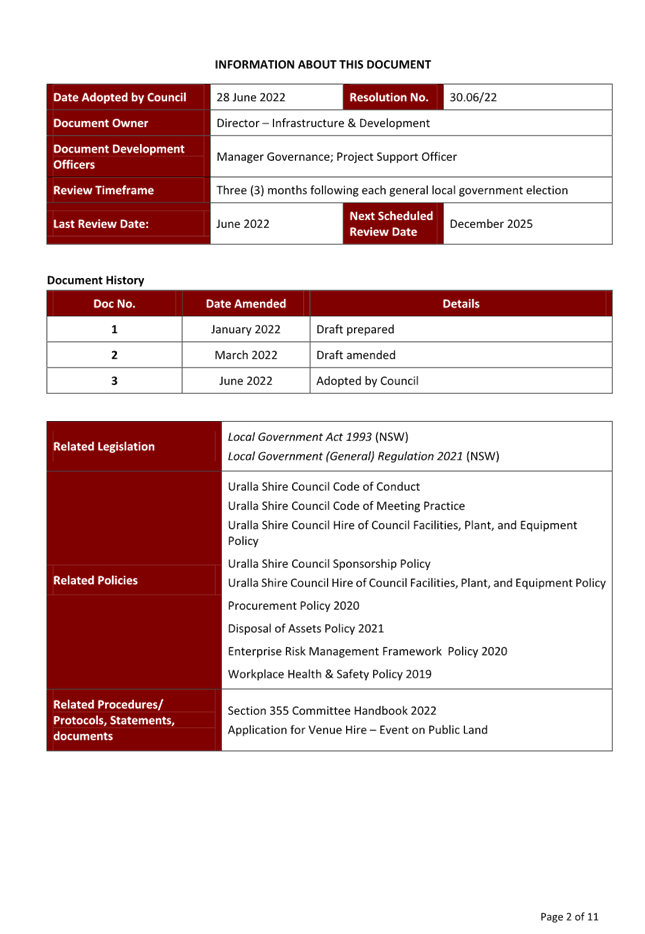

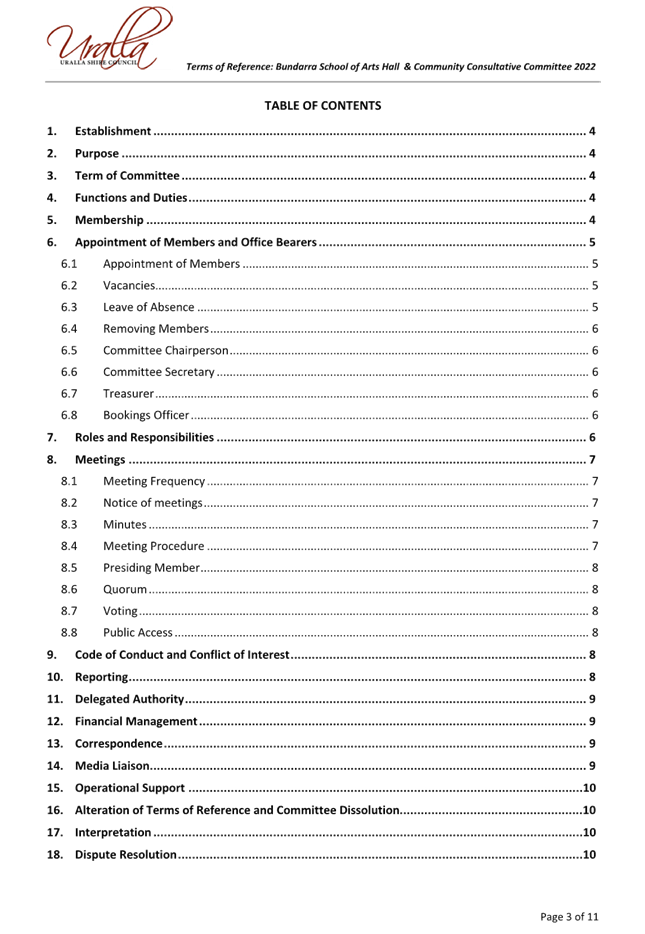

16. Terms

of Reference - Bundarra School of Arts Hall and Community Consultative s355

Committee ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

1. We

have an accessible inclusive and sustainable community

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

1.4. Access

to and equity of services

4.1. Informed

and collaborative leadership in our community

4.3. An

efficient and effective independent local government

|

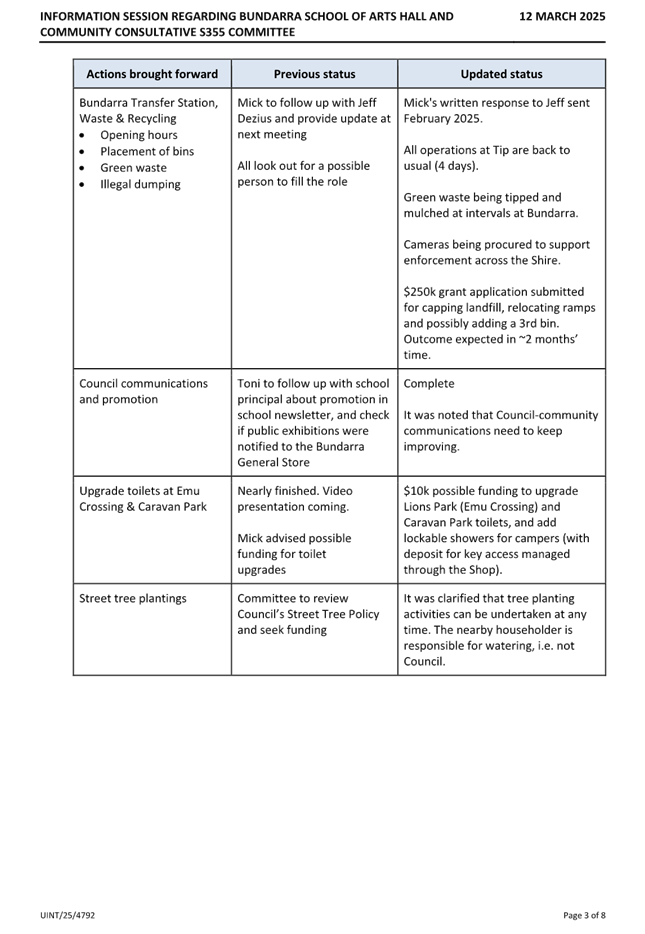

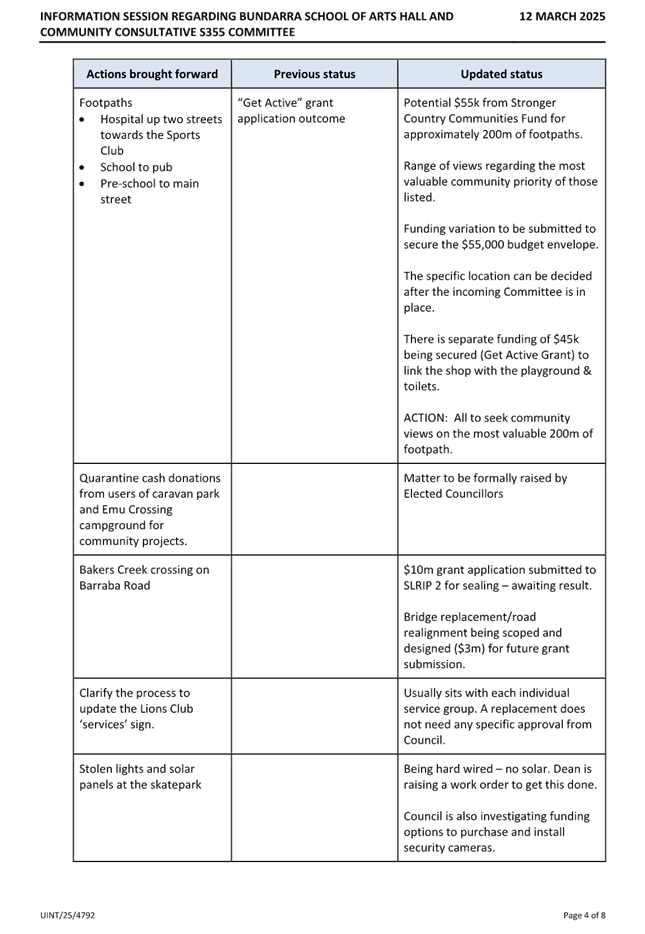

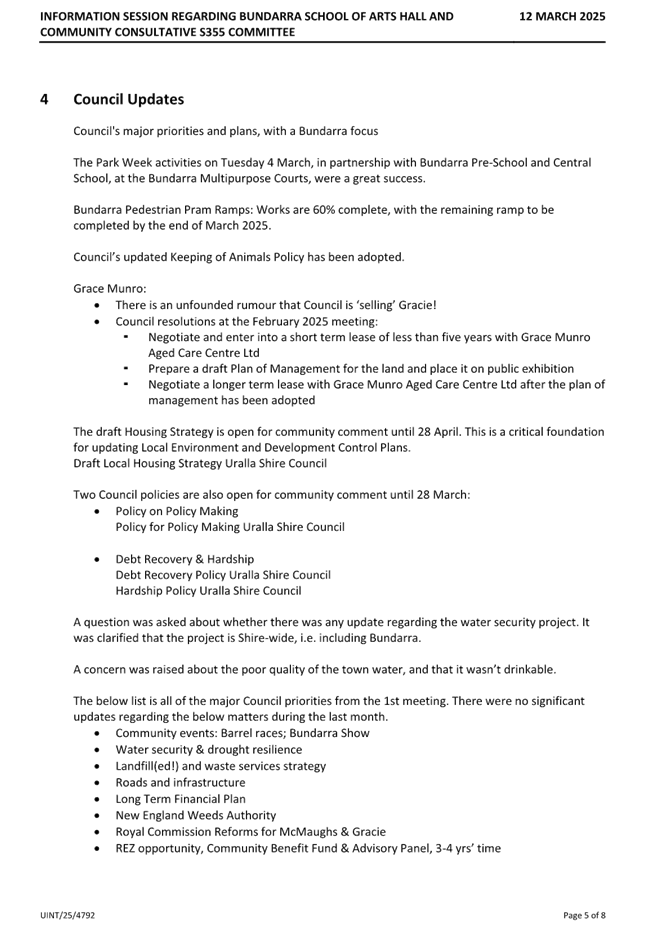

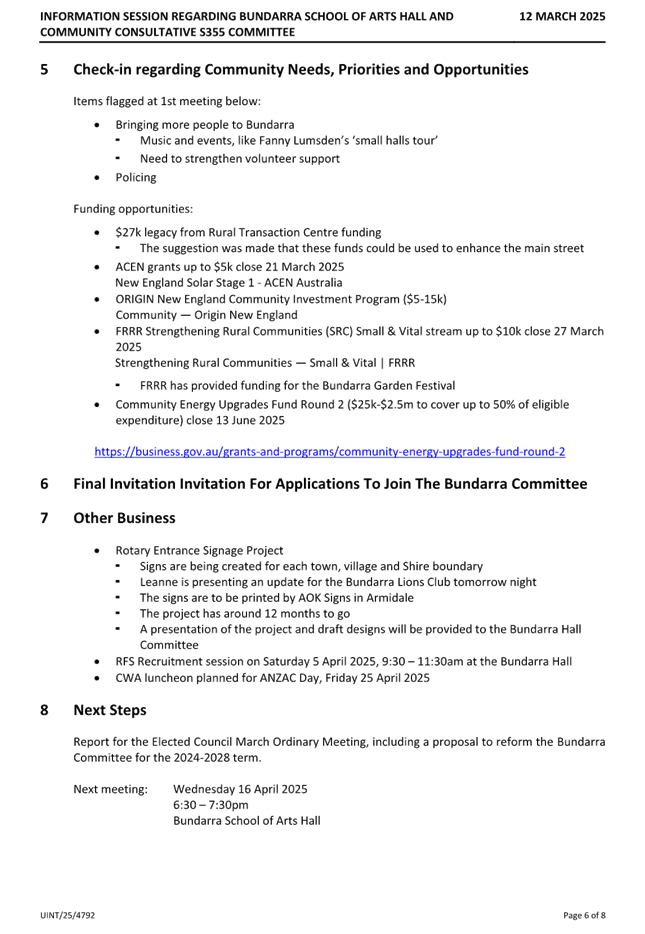

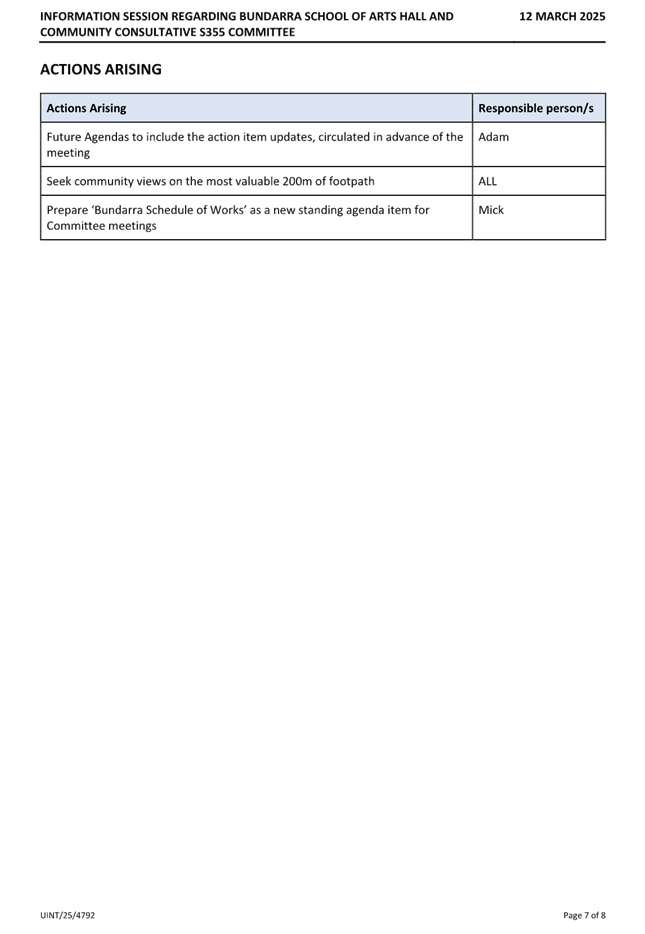

Summary

This report is an update regarding Council’s

continuing exploration of the opportunities to re-establish a Section 355

Committee in Bundarra. The first community meeting was previously described in

the Councillor Representative Report to the February 2025 Ordinary Meeting of

Council.

Council’s previously appointed Bundarra

School of Arts Community Consultative 355 Committee ceased its tenure on 14

December 2024. In consideration of the future, Council determined that it would

pursue the reestablishment of the Committee and appointed three Councillor

Representatives for that purpose.

To that end a second community meeting was

arranged with the broader Bundarra community on Wednesday 12 March 2025 to

further explore options for the reinstatement of a Bundarra 355 Committee.

The most recent meeting was again well

attended with three councillor representatives and the Director Infrastructure

and Development along with further new participants from the community. The number

of interested participants has increased since the last meeting and 11

Expressions of Interest for Membership have been received.

This report provides feedback from

the community meeting held on 12 March 2025 and recommends that Council

reestablishes the Bundarra 355 Committee and appoints community representatives

in accordance with the Expressions of Interest received.

|

Recommendation

That Council:

1. Establish a

Bundarra Committee utilising the provisions of Section 355 of the Local

Government Act 1993; and,

2. Adopt an

initial Terms of Reference for the new Committee comprising the existing

Bundarra School of Arts 355 Committee Terms of Reference as attached to this

report; and,

3. Note that the

first order of business for the new Committee will be to review the initial

Terms of Reference and recommend changes, if required; and,

4. Appoint the

following people, who have applied through an EOI process, as members of the

Bundarra 355 Committee:

(1) Peter

Gregory

(2) Rodney Hargrave

(3) Jennifer Dezius

(4) Jeffrey Dezius

(5) Kylie Jarman

(6) Theresa Layton

(7) John Layton

(8) Shannon Lee Johnson

(9) Jackie Stibbard

(10) Lindsay Groth

(11) Rebecca McLean

(12) Matthew Monk

(13) Angela Iskov

|

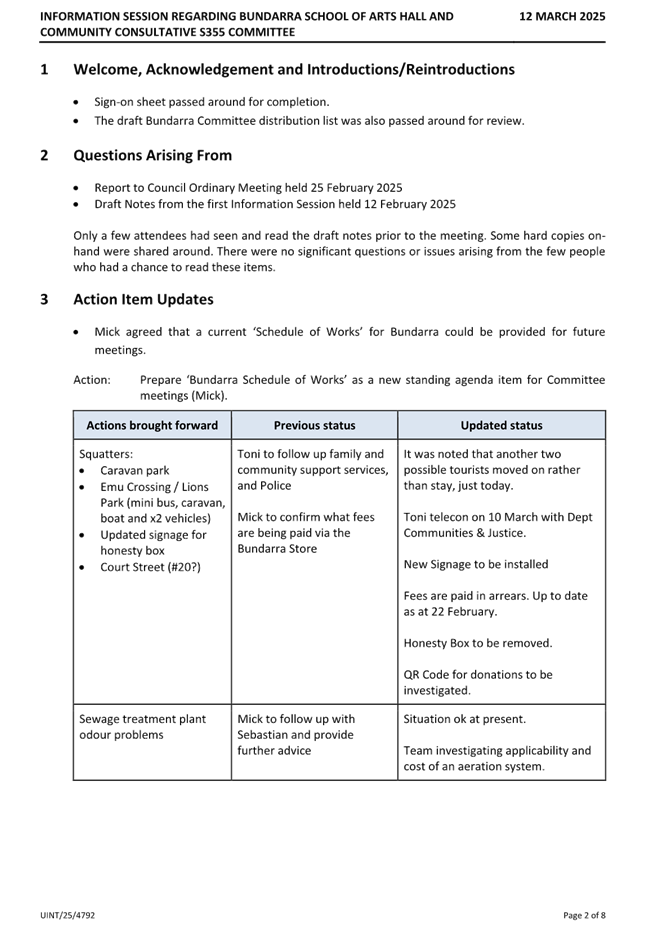

Report

A second Bundarra community meeting was held at the Bundarra

School of Arts Hall on Wednesday 12 March 2025.

The purpose of the two meetings recently held in February

and March was to explore the potential reinstatement of the original Bundarra

335 Committee following its disbandment three months following the last council

elections.

The Meeting Invitation / Agenda, meeting notes, matters

discussed, and issues raised in the most recent meeting are elaborated in the

attachment to this report entitled ‘Councillor Representative

Report’.

Conclusion

The two meetings with Bundarra community have been very well

attended by local participants. Significant councillor effort has resulted in

13 Expressions of Interest from motivated community members to form a permanent

355 Committee.

Council Implications

Community Engagement/Communication

Community will be informed of

Council’s decision and future intentions via the newly compiled Bundarra

Committee Email Distribution List. An inaugural meeting of a new Bundarra 355

Committee can be arranged, assuming Council’s consent for the

recommendation in this report, for Wednesday 16 April 2025.

Policy and Regulation

Previous S355 Bundarra School of Arts Community

Consultative Committee Terms of Reference 2022

Local Government Act 1993; section 355

Financial/Long Term Financial Plan

N/A

Asset Management/Asset Management Strategy

N/A

Workforce/Workforce Management Strategy

N/A

Legal and Risk Management

N/A

Performance Measures

N/A

Project Management

Infrastructure & Development Directorate

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

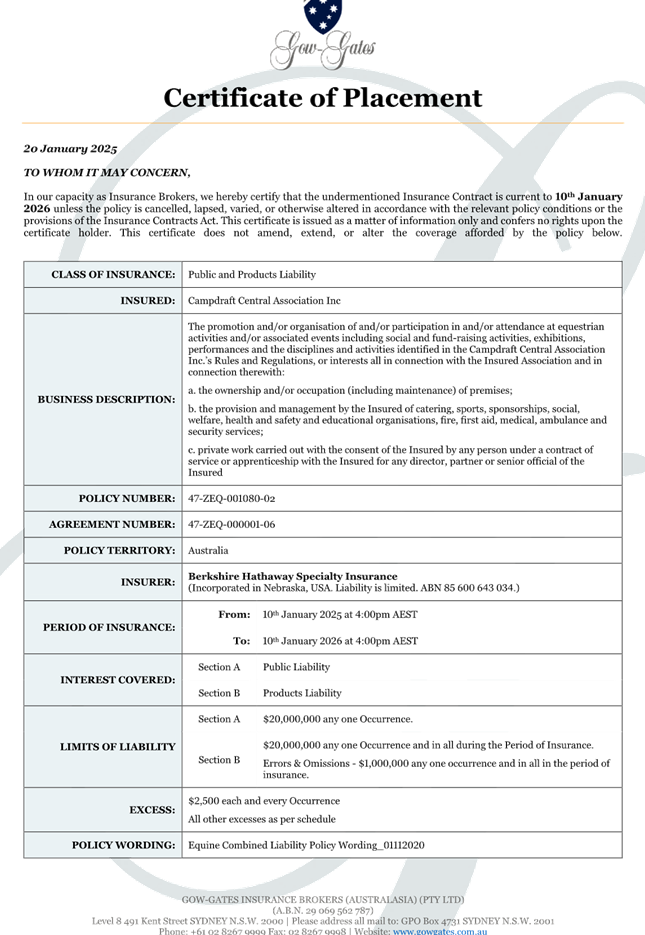

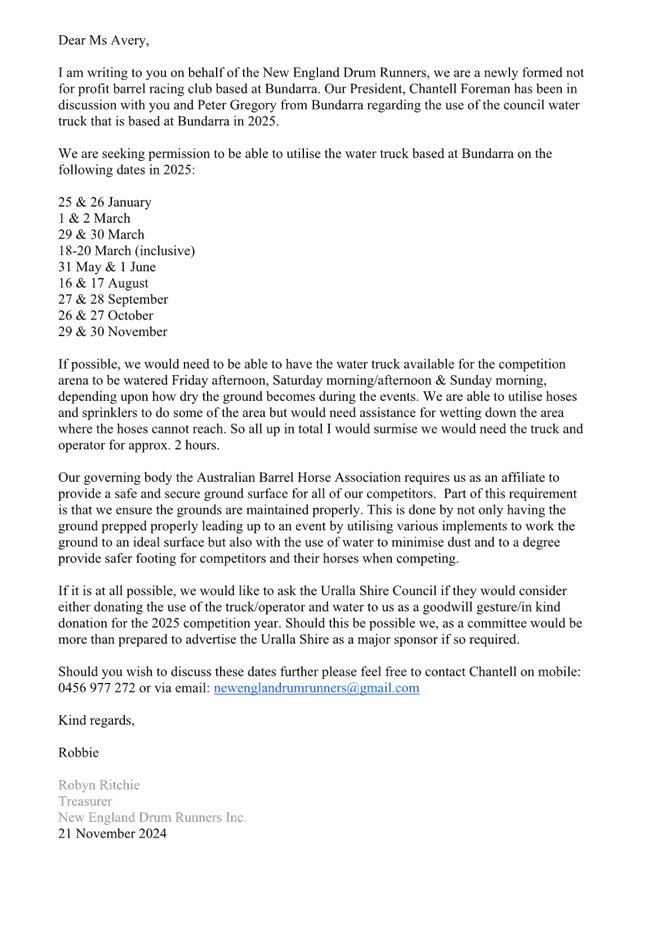

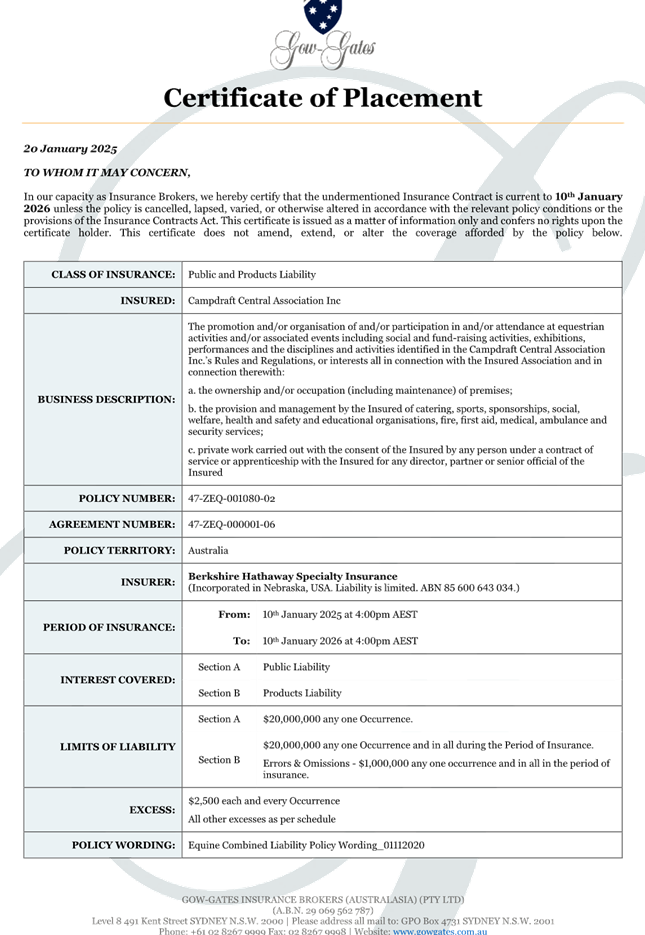

14.2 Council

Provision of In Kind Support Providing Water Cart to the Bundarra Pony Club and

the Bundarra & District Campdraft Association,

|

Department:

|

Infrastructure &

Development

|

|

Prepared By:

|

Group Manager Infrastructure

Services

|

|

Authorised By:

|

Director Infrastructure & Development

|

|

Reference:

|

UINT/25/3064

|

|

Attachments:

|

1. Request

for Water Truck from Bundarra Pony Club ⇩

2. Bundarra

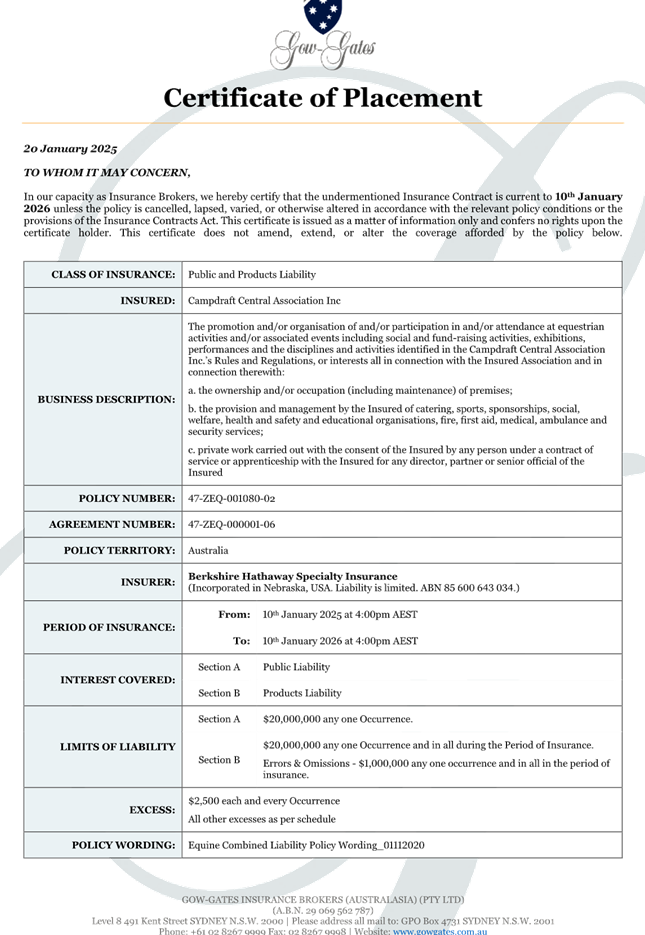

Pony Club - Certificate of Currency ⇩

3. Request

for Water Truck from Bundarra Campdraft ⇩

4. Bundarra

and District Campdraft Club Currency Certificate ⇩

5. Request

for Water Truck - NE Drumm Runners ⇩

6. NE

Drum Runners - Certificate of Currency ⇩

7. 10.12/24

Council Provision of In Kind Support to NE Drum Runners ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

2. We

drive the economy to support prosperity

4. We

are an independent shire and well-governed community

1. We

have an accessible inclusive and sustainable community

|

|

Strategy:

|

2.1. An

attractive environment for the business sector

4.3. An

efficient and effective independent local government

1.1. A

growing community with an active volunteer base and participation in

community events

1.2. A

safe, active and healthy shire

|

Summary

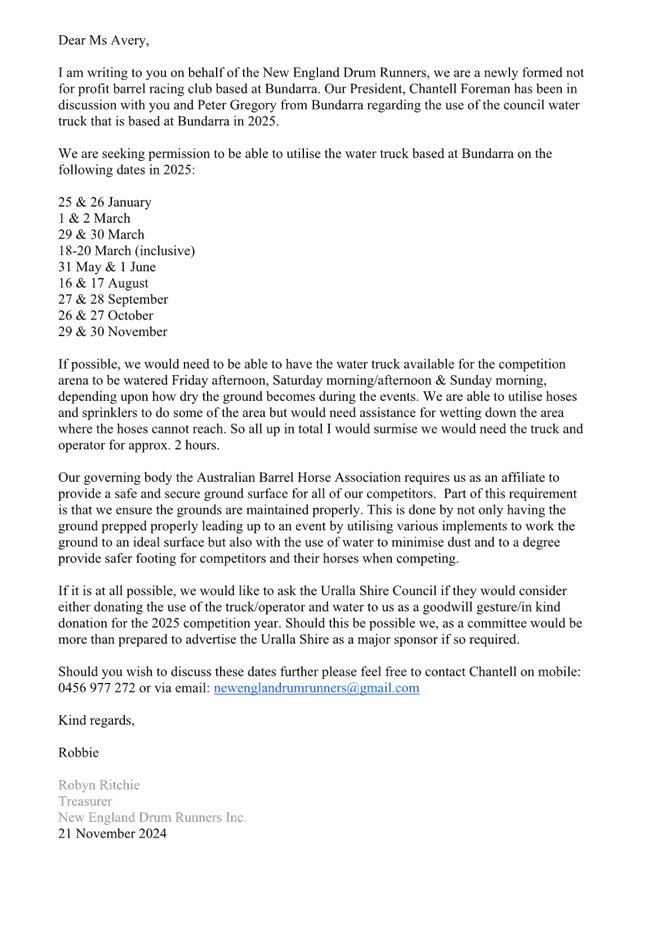

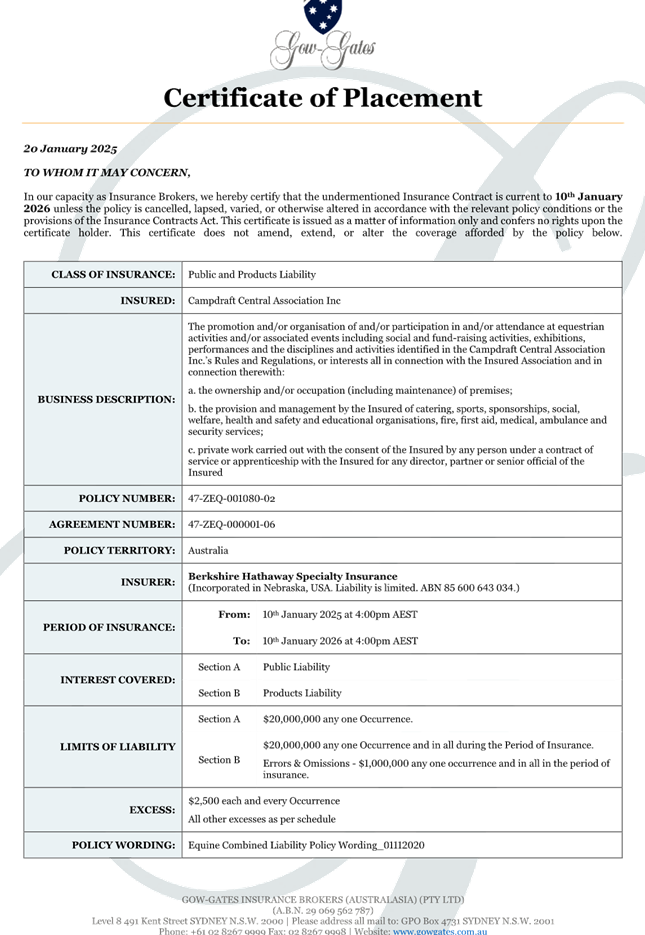

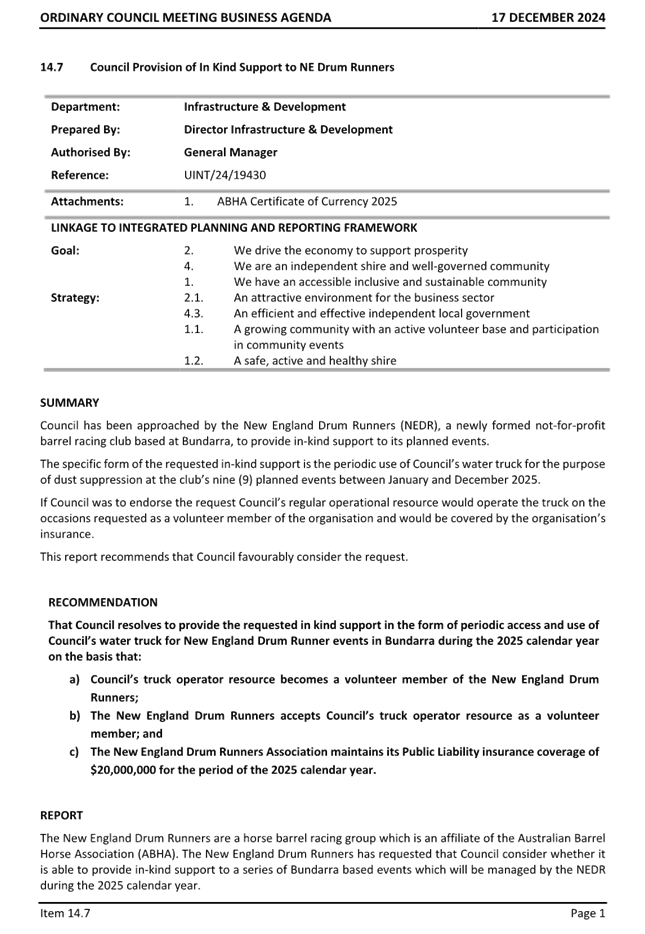

Council has been approached by the

Bundarra Pony Club, Bundarra & District Campdraft Association, and

previously, the New England Drum Runners, who are all not-for-profit clubs

based at Bundarra, to provide in-kind support to its planned events.

The specific form of the

requested in-kind support is the periodic use of Council’s water truck

for the purpose of dust suppression at the clubs’ planned events for 2025

& 2026.

Council’s regular

operational resource, or another suitably trained and licensed operator, would

operate the truck on the occasions engaged as a volunteer member of the

organisation and would be covered by the organisation’s insurance.

It is noted that the New England

Drum Runners has been granted permission under Resolution 10.12/24 (refer

Attachment 07). This group has been included in this report for ease of

reference for future event dates.

|

Recommendation

That Council:

1. Provides

the requested in-kind support in the form of periodic access and use of

Council’s water truck for the Bundarra Pony Club and Bundarra and District

Campdraft Association events to be held in Bundarra during the 2025 calendar

year and in January 2026 on the basis that:

a. Council’s

Water Truck is operated only by a suitably licensed and trained resource who

is a volunteer for the event organisers; and

b. The

Bundarra Pony Club and the Bundarra & District Campdraft Association each

maintain their Public Liability insurance coverage of $20,000,000.

2. Notes

that approval has previously been provided for similar support for the New

England Drum Runners.

3. The

General Manager is delegated to approve any further similar requests relating

to in-kind support utilising the Water Truck.

|

Report

Bundarra Pony Club

The Bundarra Pony Club is affiliated

with Pony Club NSW. The Bundarra Pony Club has requested that Council consider

whether it is able to provide in-kind support through supply of a Water Truck

for events which will be managed by the Bundarra Pony Club during the 2025

calendar year and for the January 2026 event (refer Attachment 01).

Event dates are:

· 12

Oct 2025

· 19-20

Oct 2025

· 9-10-11

January 2026

The Bundarra Pony Club holds

insurance coverage for Public Liability claims (refer to Attachment -2).

Currency Certification will be sought for the January 2026 event.

Bundarra & District

Campdraft Association

The Bundarra & District

Campdraft Association are affiliated with Australian Bushmen's Campdraft and

Rodeo Association (ABCRA). The Bundarra Campdraft has requested that

Council consider whether it is able to provide in-kind support through supply

of a Water Truck for Bundarra based events which will be managed by the

Bundarra Bundarra & District Campdraft Association during the 2025 calendar

year event.

Event dates are:

· 25-26

Apr 2025

The Bundarra & District

Campdraft Association hold insurance coverage for the Public Liability claims (refer

Attachment 04).

New England Drum Runners

(previously resolved)

Event dates are:

· 25-26

January 2025

· 1-2

March 2025

· 29-30

March 2025

· 18-20

March 2025

· 31

May to 1 June 2025

· 16-17

August 2025

· 27-28

September 2025

· 26-27

October 2025

· 29-30

November 2025

Council currently provides

“in-kind” support to several other existing worthy activations and

local events including, for example, schools-based sporting and swimming

activities, the annual Seasons of New England and Thunderbolts Festival, the

most recent Winter Solstice and Uralla Christmas celebrations, and the annual

Fairy Festival.

The principles Council has

considered when previously deciding to provide or not to provide such support

can generally be described as follows: to what extent will the activation

support or sustain healthy outcomes (sport-focussed events for example); build

community connections; build local business; or increase local amenity; social

celebration; or increased social amenity.

A secondary but important

consideration is also the extent to which the activation or event is actually

driven by, and organised by, the community itself.

In this instance it is

recommended that the proposed in-kind support would enable the Bundarra Pony

Club and the Bundarra & District Campdraft Association to deliver, under

their own resources and effort, a series of events in Bundarra which meet or

substantially progress many of the social and societal principles sought by

Council and its community.

Conclusion

This report recommends that

Council approve the provision of limited in-kind Council support requested by

Bundarra Pony Club and Bundarra & District Campdraft Association, ensuring

that volunteer operators are suitably trained and licensed, and allowing the

General Manager to approve similar such requests under their delegation.

Council Implications

Community

Engagement/Communication

The recommendation would provide

a substantive signal of increased engagement between the Bundarra community and

its Council.

Policy and Regulation

Nil.

Financial/Long Term Financial

Plan

Nil for staff, inconsequential

for plant.

Asset Management/Asset

Management Strategy

Nil.

Workforce/Workforce Management

Strategy

A single Council resource may

act in the capacity as a volunteer to the Bundarra Pony Club and Bundarra &

District Campdraft Association, but in their own time and out of hours.

Legal and Risk Management

Controlled. Refer to the risk

requirements as listed in the recommendation.

Performance Measures

Nil.

Project Management

Director Infrastructure and

Development.

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

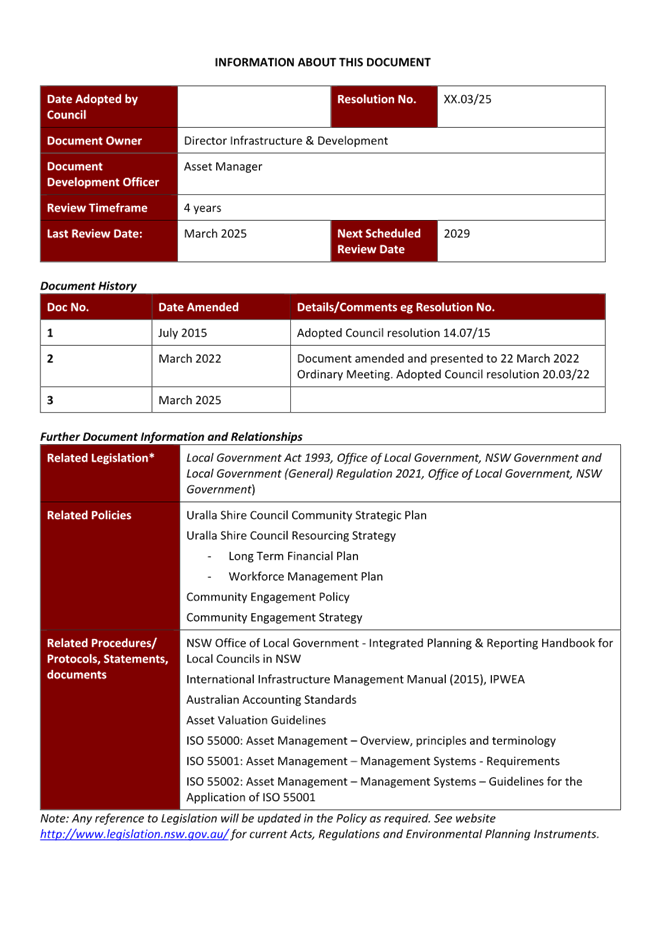

14.3 Draft

Asset Management Policy 2025

|

Department:

|

Infrastructure &

Development

|

|

Prepared By:

|

Manager Assets

|

|

Authorised By:

|

Director Infrastructure & Development

|

|

Reference:

|

UINT/25/3443

|

|

Attachments:

|

1. Draft

Asset Management Policy Review - Tracked 2025 ⇩

2. Draft

Asset Management Policy 2025 ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

1. We

have an accessible inclusive and sustainable community

2. We

drive the economy to support prosperity

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

1.4. Access

to and equity of services

2.3. Communities

that are well serviced with essential infrastructure

4.2. A

strategic, accountable and representative Council

|

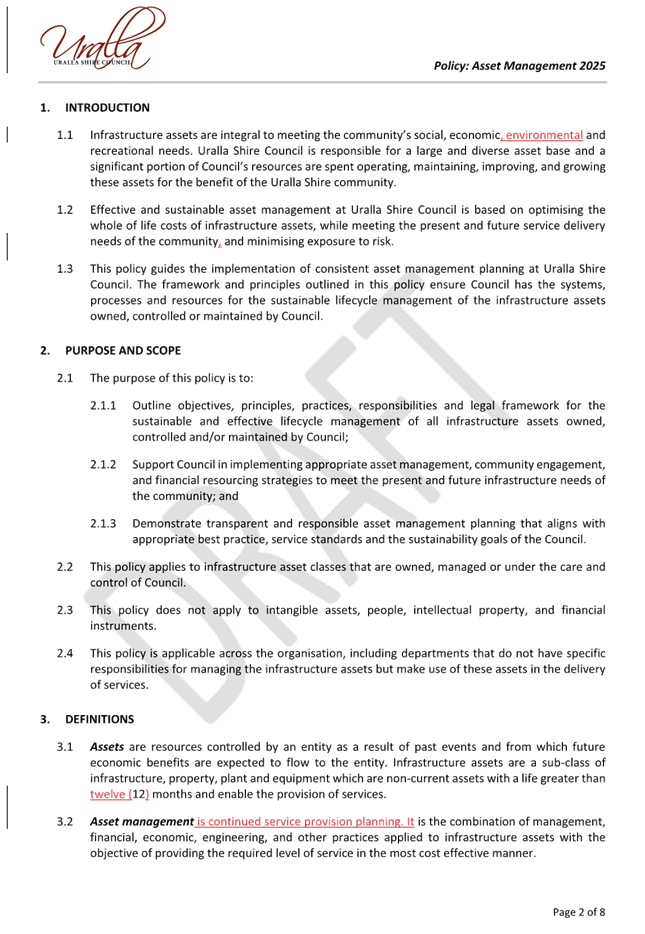

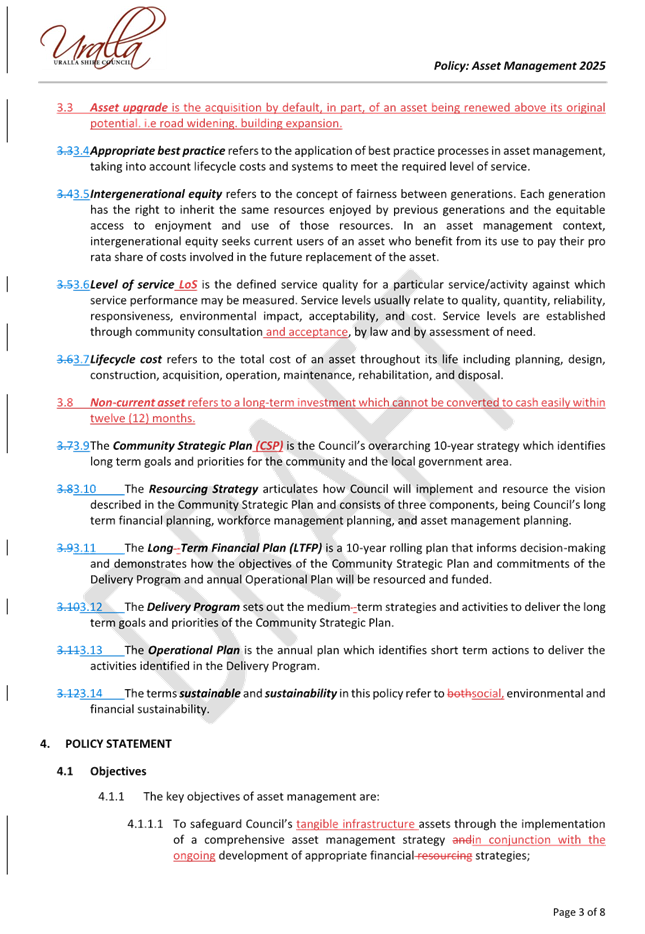

Summary

This report presents the Draft

Asset Management Policy for Council’s consideration.

Council sets its Asset Management

Policy as part of its Office of Local Government requirement for Integrated

Planning and Reporting (IP&R) strategic documents. These documents are

required to be endorsed within the first twelve (12) months of a new Council

term.

|

Recommendation

That Council:

1. Endorse

the Draft Asset Management Policy for public exhibition for a period of not

less than 28 days.

2. Receive

a further report on completion of the exhibition period if any submissions

are received and/or changes proposed.

3. Adopt

the Draft Policy if no submissions are received and/or no changes are

proposed.

|

Report

Asset management planning is a key

component of Uralla Shire Council's Resourcing Strategy, alongside long-term

financial planning and workforce management planning. Together, these elements

outline how work identified in the Community Strategic Plan will be delivered

in Council’s Delivery Program and Operational Plan, and how they will be

effectively resourced.

The primary goal of asset

management planning is to deliver the necessary level of service to the

community in line with the Community Strategic Plan, while ensuring

cost-effectiveness.

The Integrated Planning &

Reporting Guidelines for Local Government in NSW (IPR Guidelines) outline the

requirements for the asset management policy and strategy to be updated within

twelve (12) months of a new Council term. These documents, in turn, support the

Council’s Community Strategic Plan and Delivery Programs.

The draft

policy is an update of Council’s current infrastructure Policy: Asset Management

2022 and has been reviewed by internal stakeholders (with tracked changes as

Attachment 1), referencing the latest International Standards and the

Integrated Planning & Reporting Guidelines. The Draft Policy: Asset

Management 2025 is attachment 2.

The Policy guides the implementation of consistent and best

practice asset management planning for Uralla Shire Council.

Conclusion

The draft Policy: Asset Management

2025 is presented to Council for endorsement for public exhibition to invite submissions

from the public, and adoption if no submissions are received during the

exhibition period.

COUNCIL

IMPLICATIONS

Community

Engagement/Communication

The report proposes the document

is placed on public exhibition for a period of not less than 28 days with

submissions invited from the public.

Policy

and Regulation

Local

Government Act 1993

Local

Government (General) Regulation 2021

Integrated

Planning & Reporting Guidelines for Local Government

Financial/Long

Term Financial Plan

Asset management is a key

component of the Council’s long term financial sustainability.

Asset

Management Policy

The Asset

Management Policy guides the implementation of consistent and sustainable asset

management planning at Uralla Shire Council.

Workforce/Workforce

Management Strategy

The policy guides Councils staff

resourcing and direction regarding workforce management.

Legal

and Risk Management

Effective financial and asset

management is a requirement of the Local Government Act 1993. Policies

and Strategies are designed to mitigate Council’s various risks. The risk

associated with adopting the Policy is considered low.

Performance

Measures

Compliance with the Local

Government Act 1993 and the Integrated Planning &

Reporting Guidelines for Local Government.

Project

Management

Director Infrastructure and

Development; Asset Manager

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

14.4 Proposed

Quality Care and Governance Committee for Aged and Community Care

|

Department:

|

Corporate & Community

|

|

Prepared By:

|

Acting Director Corporate

& Community

|

|

Authorised By:

|

General Manager

|

|

Reference:

|

UINT/25/4375

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

1. We

have an accessible inclusive and sustainable community

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

1.4. Access

to and equity of services

4.2. A

strategic, accountable and representative Council

|

Summary

A Quality Care and Governance Committee (Committee)

is proposed to provide advice and clinical oversight for the aged care services

delivered by Uralla Shire Council (Council). This new Committee will

assist Council’s aged care services in meeting the current and

strengthened Aged Care Quality Standards through the delivery of safe, quality

care with a focus on continuous improvement.

From 1 July 2025, under the Aged Care Act 2024 (Cth) (Aged

Care Act) all councillors will be deemed to be ‘responsible

persons’ as members of the governing body of Council. This will result in

positive obligations on councillors to ensure compliance with the Aged Care

Code of Conduct and the conditions of registration for Council’s aged

care services. It is important to ensure that the governing body is adequately

informed by an independent committee of subject matter experts that its aged

care services are meeting the requirements of the strengthened Aged Care

Quality Standards.

The main purpose of the Committee is to:

· focus on matters

relating to the delivery of Council’s aged care services including

quality of care, clinical governance and responses to incidents and risks that

arise in the course of its operations;

· provide subject

matter expertise and unique perspectives that may otherwise be lacking in the

governing body; and

· allow for some

degree of separation between the subject matter and the governing body, to

ensure adequate accountability for relevant decisions.

This report proposes that Council seek expressions of

interest from suitably qualified applicants to serve as independent members of

the Committee. It is proposed that the members of the Committee include:

· a senior clinical

expert who is an experienced Quality Manager or who has clinical governance

oversight expertise (voting);

· an industry expert

(voting);

· a business expert

(voting); and

· a councillor

representative (non-voting), with suitable subject matter expertise.

|

Recommendation

That Council:

1. Calls for Expressions of Interest from

suitably qualified independent experts to sit on the Quality Care and

Governance Committee.

2. Adopts the fees for the independent members

and Chair as detailed in this report.

3. Appoints a Councillor representative to the

Committee.

4. Receives a further report on the proposed

Terms of Reference and the responses to the Expressions of Interest.

|

Report

The Committee will focus on ensuring that our aged care

services meet the Aged Care Quality Standards through the delivery of safe,

quality care with a focus on continuous improvement.

Additional functions of the Committee will be to monitor and

review the quality of care in line with the Aged Care Quality Standards,

implement quality improvement strategies and manage and mitigate clinical

risks.

Each Councillor is a ‘responsible person’ under Aged

Care Act, and each ‘responsible person’ has a duty to exercise due

diligence to ensure that the aged care provider complies with the responsible

provider duty. This includes taking reasonable steps to:

· acquire and

maintain knowledge of requirements applying to registered providers under the

Aged Care Act;

· gain an

understanding of the nature of the funded aged care service the registered

provider delivers and the potential adverse effects that can result to

individuals when delivering those services;

· ensure that the

registered provider has available for use, and uses, appropriate resources and

processes to manage adverse effects to the health and safety of individuals

accessing funded aged care services delivered by the provider;

· ensure that the

registered provider has appropriate processes for receiving and considering

information regarding incidents and risks and responding in a timely way to

that information;

· to ensure the

registered provider has, and implements, processes for complying with any duty

or requirement of the registered provider under the Aged Care Act.

The Committee will assist each ‘responsible

person’ in Council (including Councillors, the General Manager, and any

other person who has authority or responsibility for (or significant influence

over) planning, directing or controlling the activities of the provider) to

demonstrate that they are exercising due diligence to ensure that the provider

complies with the responsible provider duty.

Proposed Timeline:

The following timetable is proposed:

April 2025 - Expressions of

Interest advertised.

May 2025 – Report to Council

prepared on draft Terms of Reference and responses to Expressions of Interest,

with recommendations for the appointment of the Chair and other members of the

Committee.

Before or by 1 July 2025 –

Committee commences.

Expressions of Interest

Expressions of interest are proposed to be sought from:

· A senior clinical

expert who is an experienced quality manager or who has clinical governance

oversight expertise.

· An aged care

services industry expert.

· A business expert

with financial knowledge of aged care services.

It is also recommended that Council appoints a councillor

representative (non-voting) with suitable subject matter expertise.

Fees for Committee members

It is proposed that the independent Committee members will

be remunerated similarly to the independent members of Council’s Audit

Risk and Improvement Committee (ARIC) as follows:

· Independent

Members: $750 per meeting

· Chair: $1,000 per

meeting.

· Reasonable travel

and accommodation costs.

It is important to have the councillor representative as

non-voting to reinforce the public perception of independence in the review and

assessment of Council’s aged care services. A councillor with voting

power on the Committee could potentially be perceived to have a conflict of

interest when reviewing some issues or decisions made by Council at its

ordinary or extraordinary meetings. Potentially the Councillor would also

have to leave the Council meeting during debate and voting on the

Committee’s reports to Council.

Further, the Committee is intended to only function as an advisory

body, meaning that it provides recommendations to the Council rather than

making direct decisions, so a non-voting councillor can still contribute

valuable insights without having to vote on the recommendations to Council. The

role of the non-voting Councillor representative will be to:

· relay to the Committee

any concerns that the governing body may have regarding the council and issues

being considered by the Committee;

· provide local

insight to assist the Committee; and

· advise the

governing body (as necessary) of the work of the Committee and issues arising

from it.

Terms of Reference

Draft Terms of Reference are being developed and will be

reported to Council for endorsement in May 2025.

The Committee will consider all matters relating to quality

care, clinical care and compliance with registration conditions. The matters

relating to financial management and business risk management more broadly will

still be considered by ARIC.

It is proposed that the Committee will meet at least 4 times

a year, with the option for an additional meeting per year if required.

Conclusion

The Committee allows for an effective and efficient way for

the governing body to be across the issues and responsibilities relating to its

aged care services. It is intended that the Committee will be operational

before or by 1 July 2025 so that the governing body will be able to adequately

demonstrate compliance with the requirements of the Aged Care Act.

Council Implications

Community Engagement/Communication

Staff have consulted with the Mayor and councillors via an

information session and email.

Policy and Regulation

While the Committee is not strictly required under the Aged

Care Act due to an exemption for local government, implementation of the

Committee is strongly recommended to ensure adequate governance and oversight

in the delivery of Council’s aged care services.

Financial/Long Term Financial Plan

There are budget implications for the establishment and

funding of the Committee. This would be included in the budget for 2025/2026

and future budgets.

Asset Management/Asset Management Strategy

Not applicable.

Workforce/Workforce Management Strategy

Secretarial support for the Committee can be accommodated

within existing resources.

Legal and Risk Management

The Committee will reduce Council’s legal risks and

enhance compliance with the requirements of the Aged Care Act.

Performance Measures

The draft Terms of Reference will require the Committee to

undertake a self-assessment against the annual and term work plans and report

this back to the governing body.

Project Management

Director Corporate and Community will be responsible for the

establishment and ongoing operation of the Committee.

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

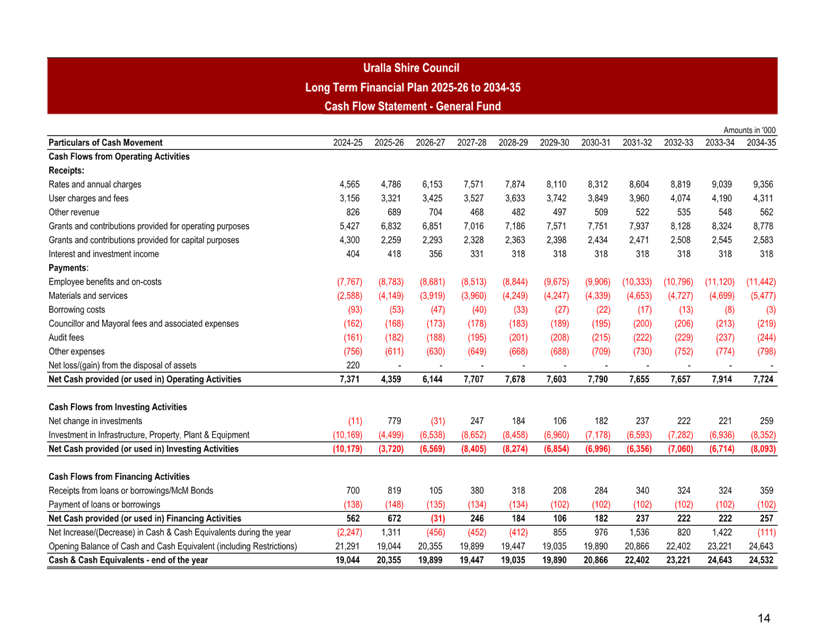

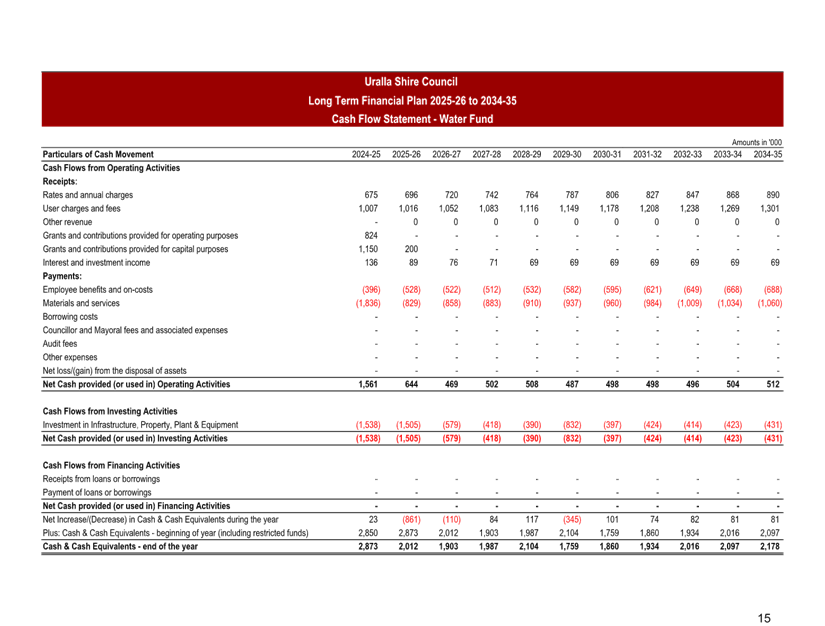

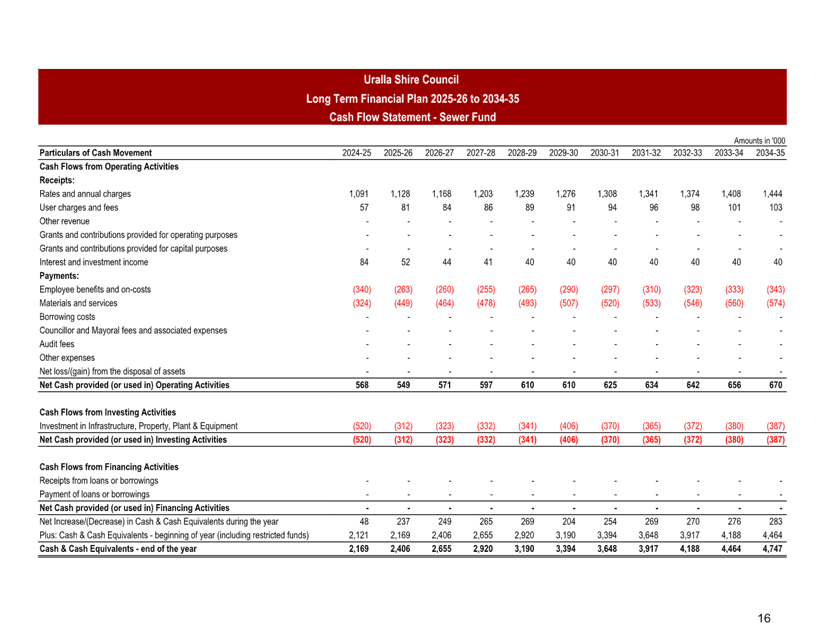

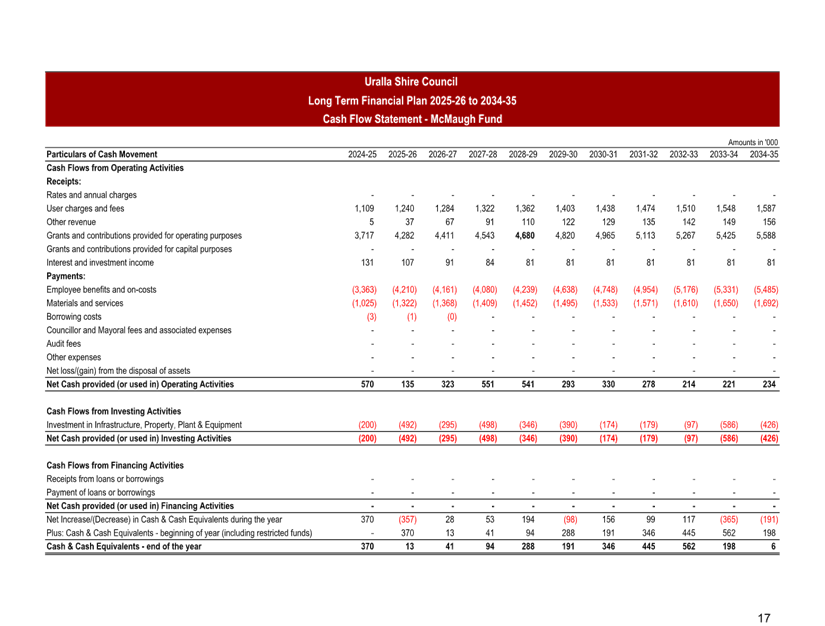

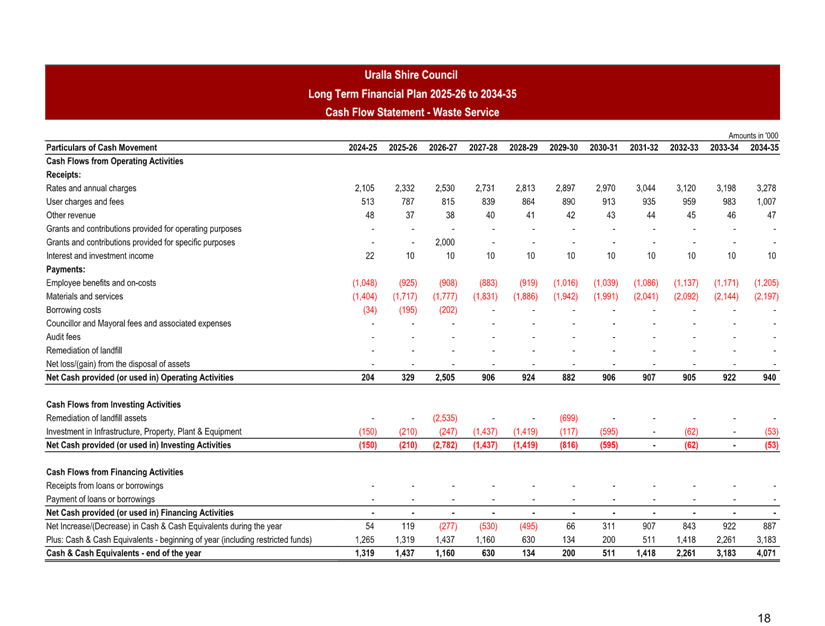

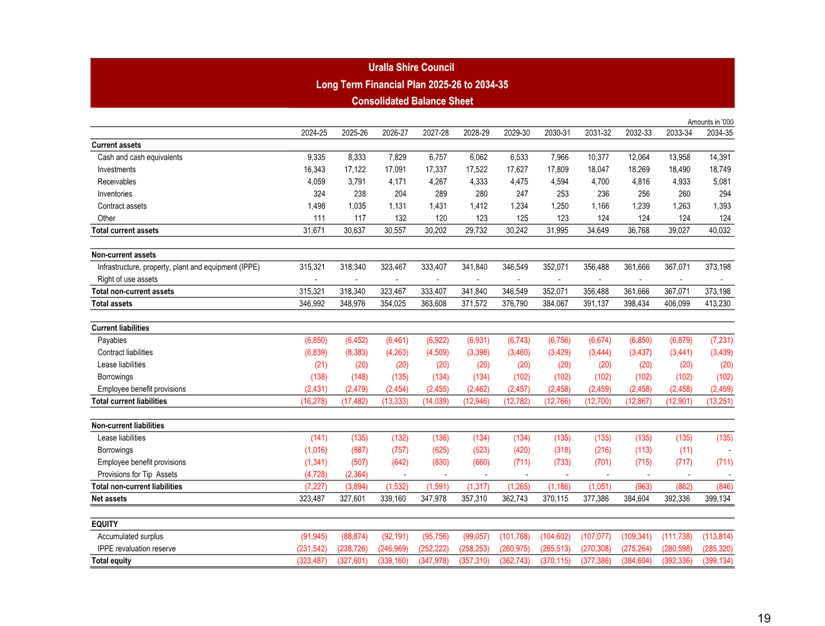

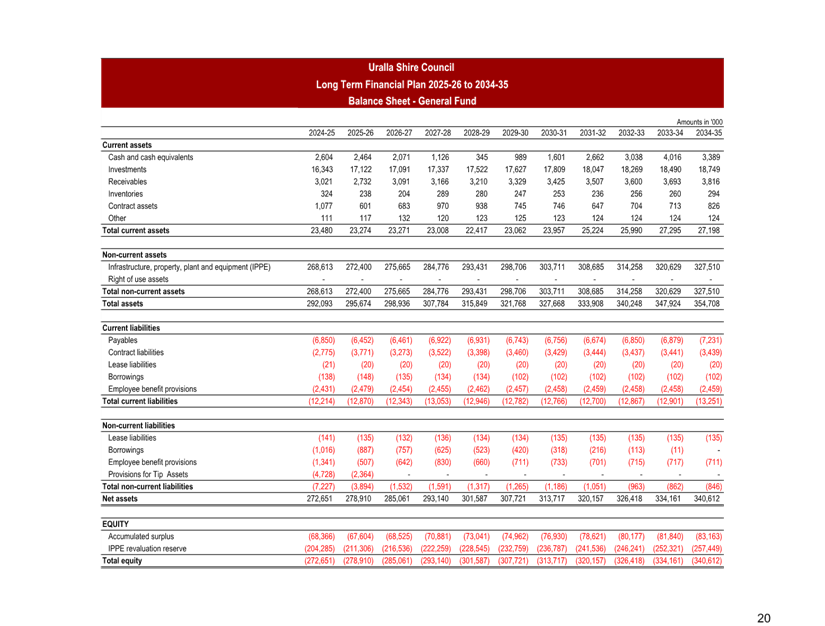

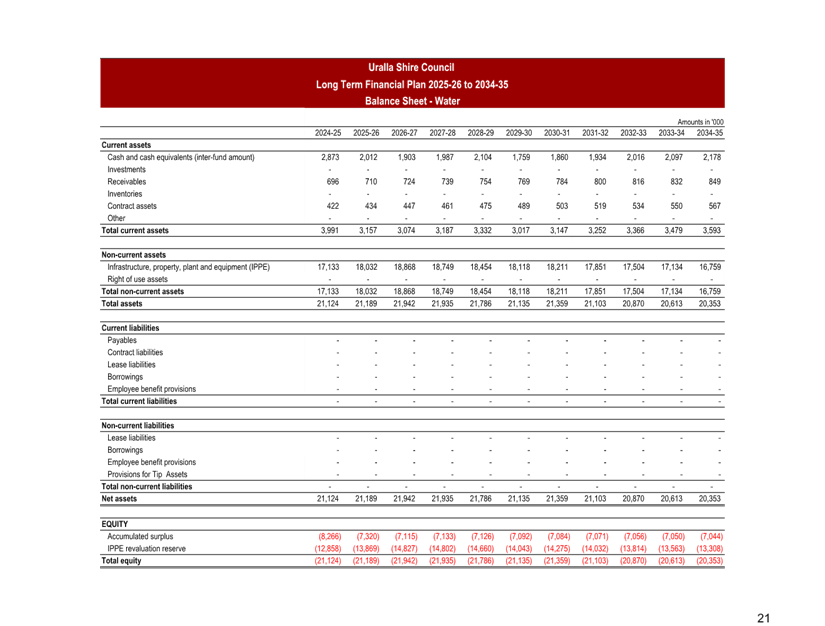

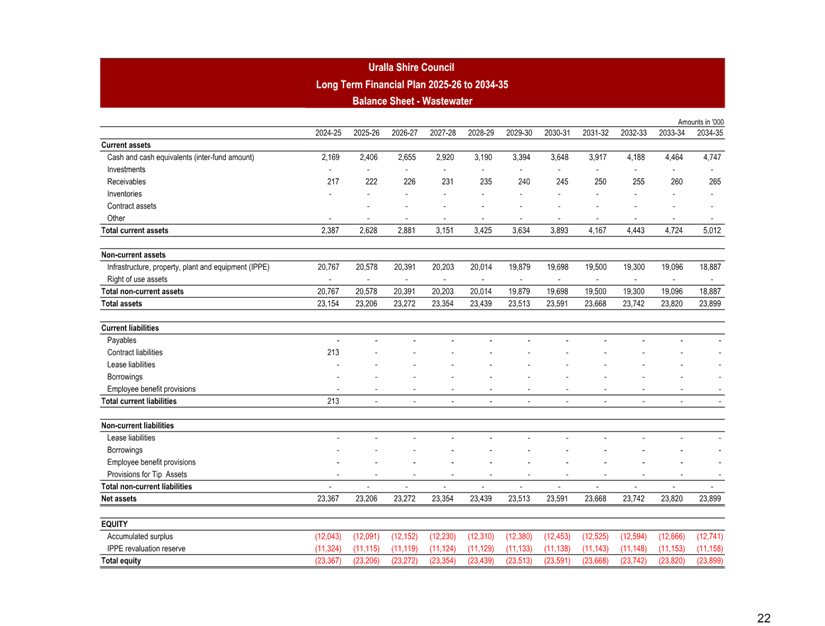

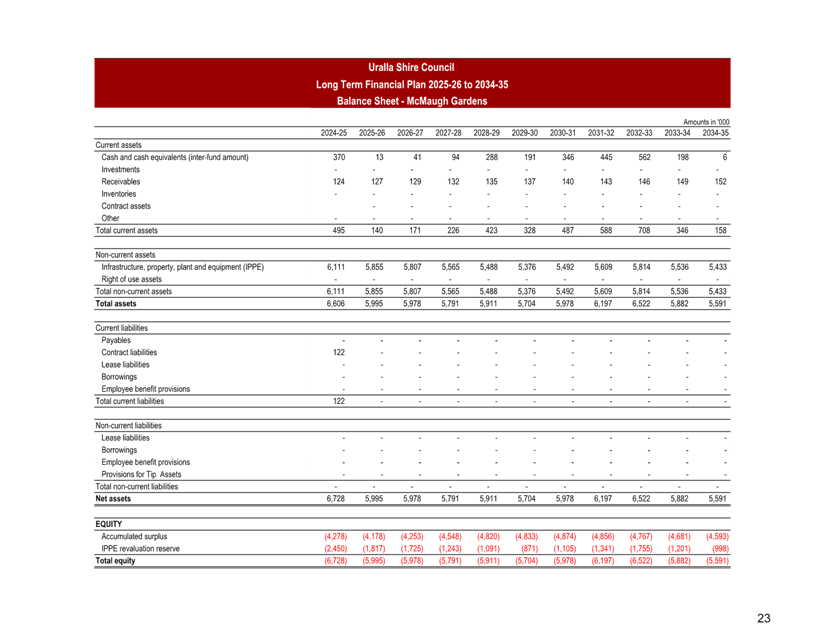

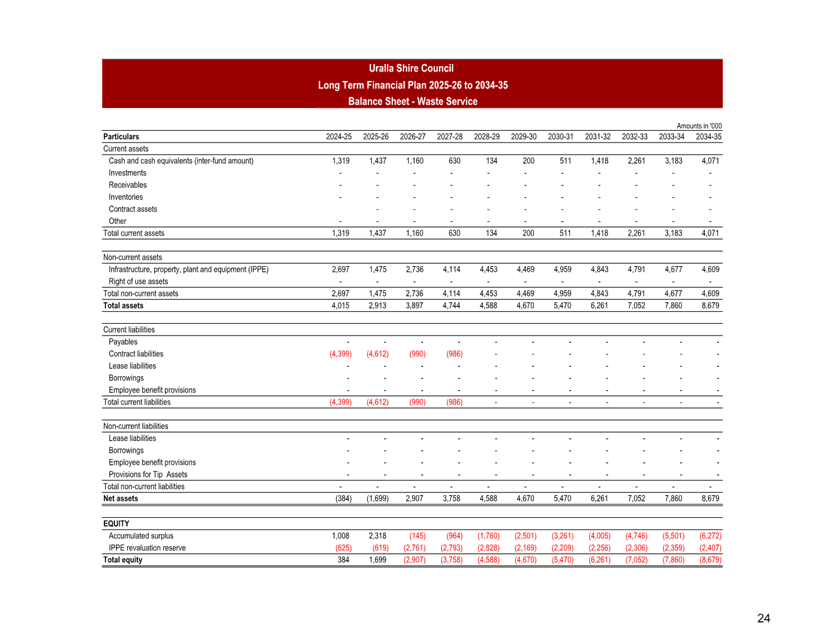

14.5 DRAFT

Long Term Financial Plan 2026-2035

|

Department:

|

Corporate & Community

|

|

Prepared By:

|

Manager Finance

|

|

Authorised By:

|

General Manager

|

|

Reference:

|

UINT/24/18144

|

|

Attachments:

|

1. LTFP

Report 2025-26 to 2034-35 ⇩

2. LTFP

2025-26 to 2034-35 Combined Report - Base Model ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.1. Informed

and collaborative leadership in our community

4.2. A

strategic, accountable and representative Council

4.3. An

efficient and effective independent local government

|

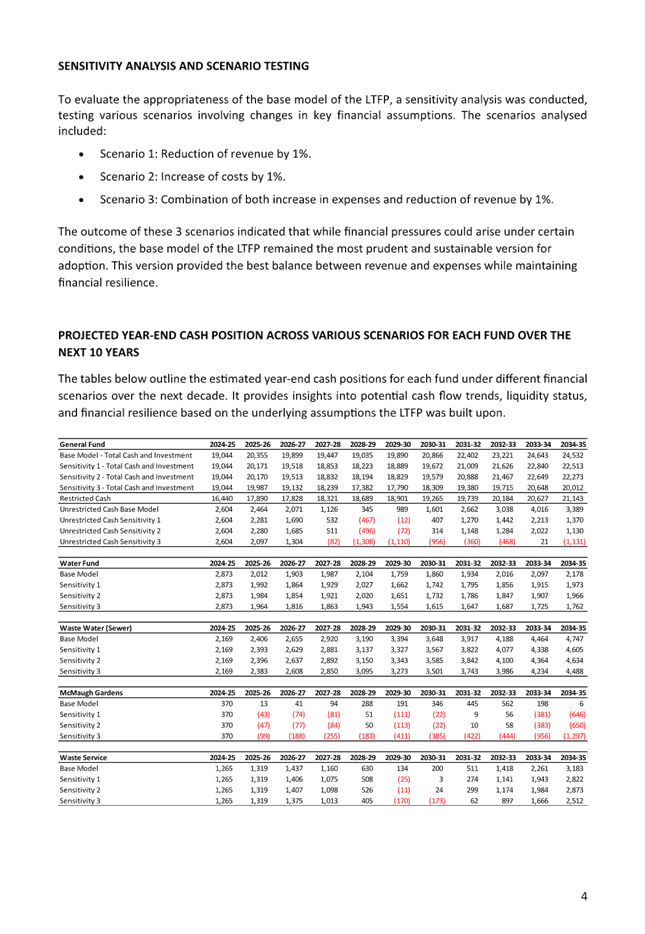

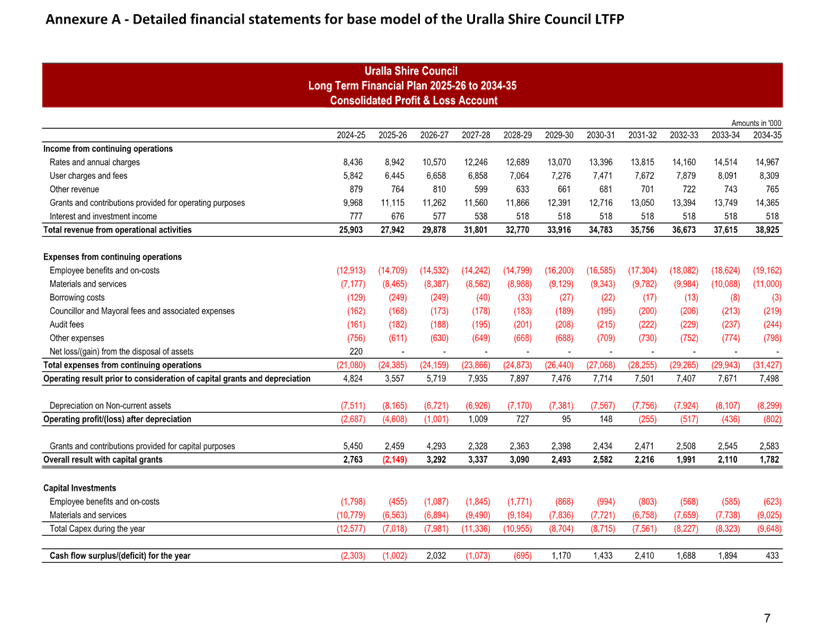

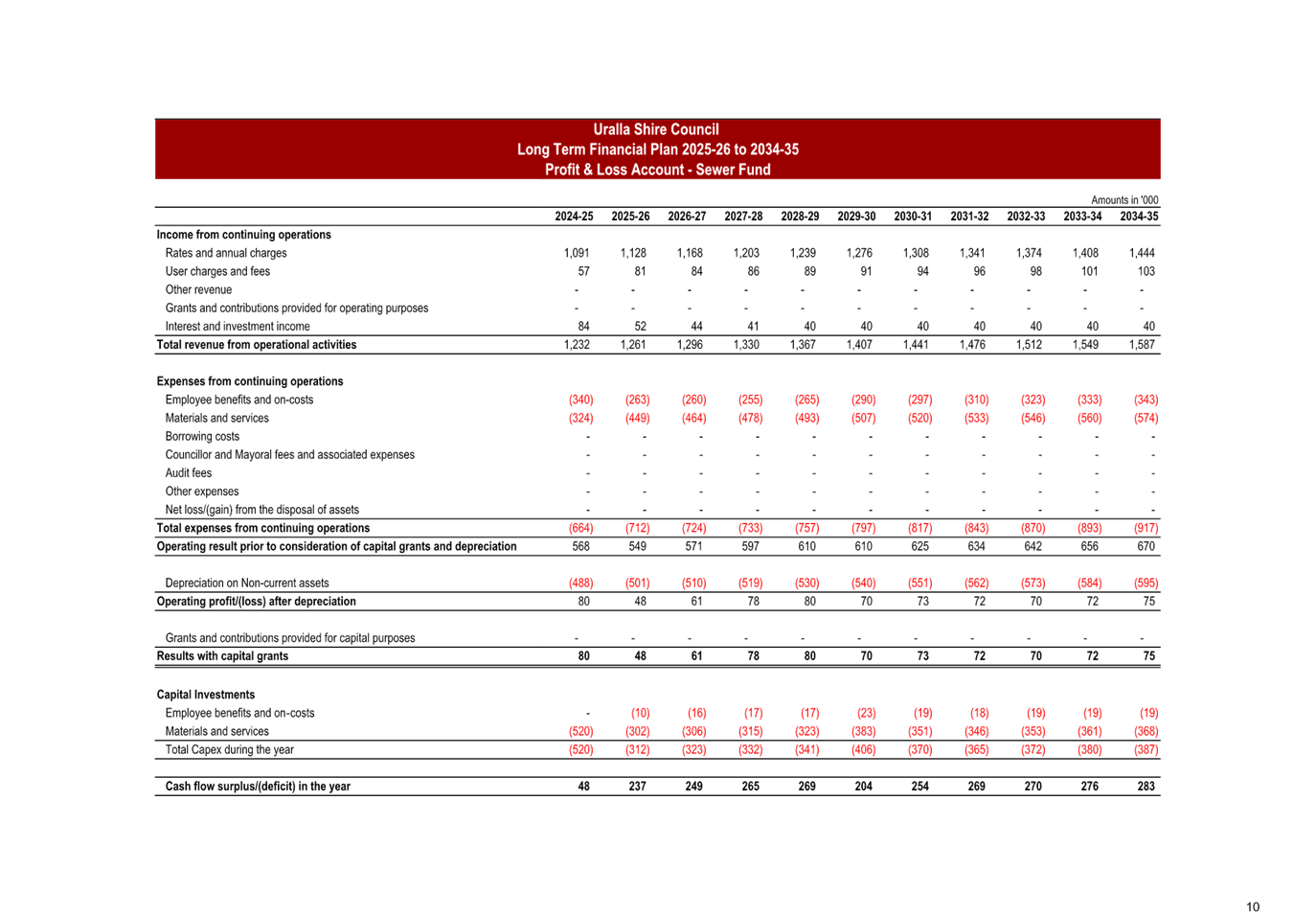

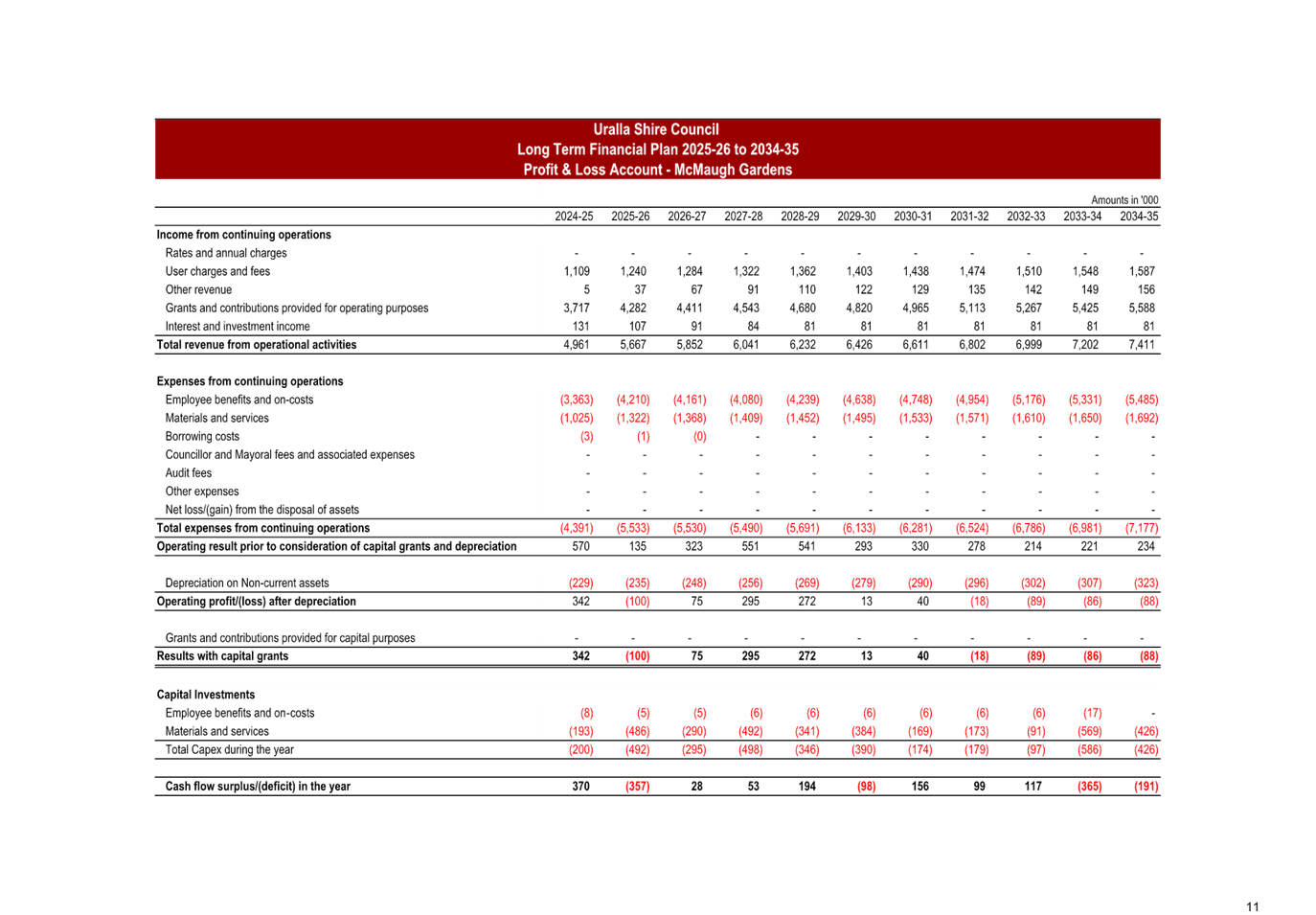

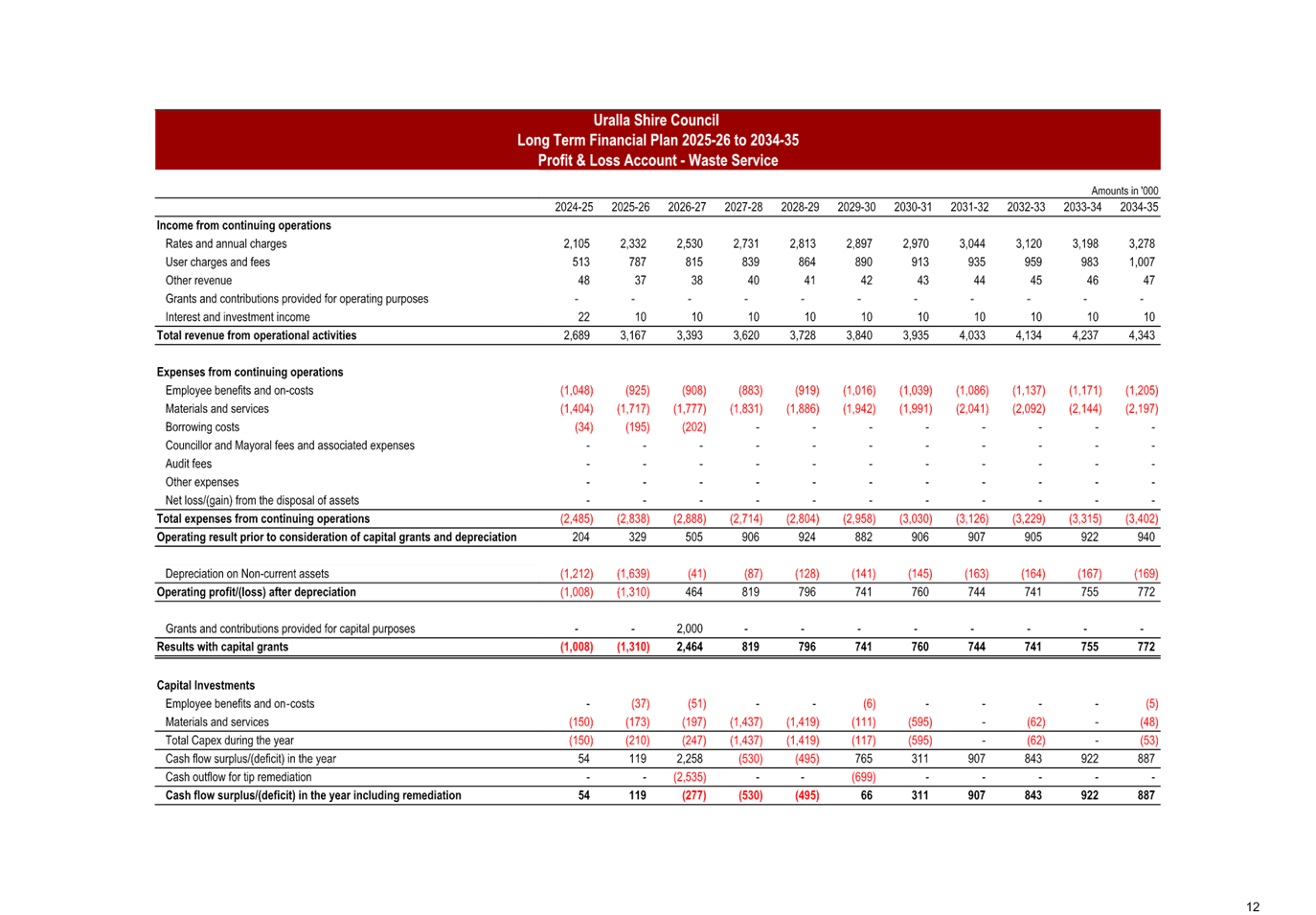

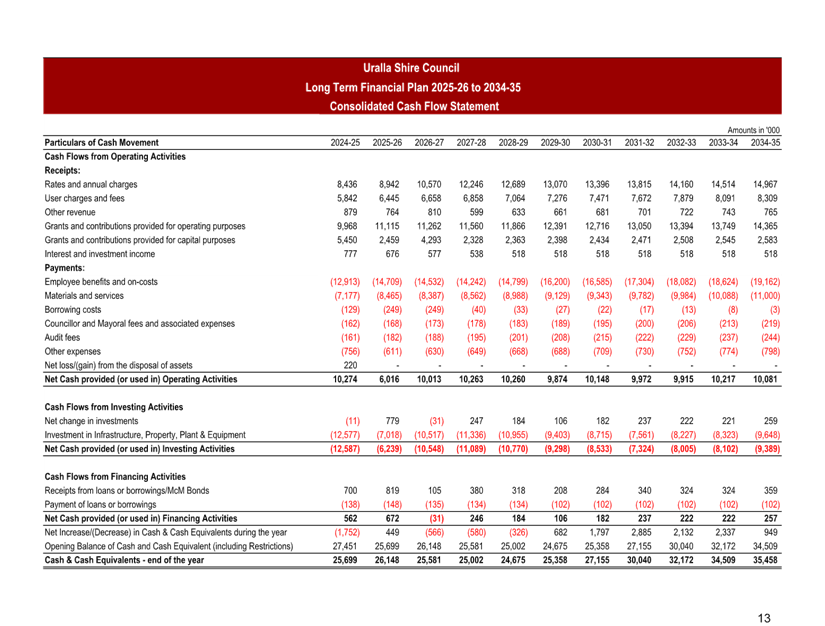

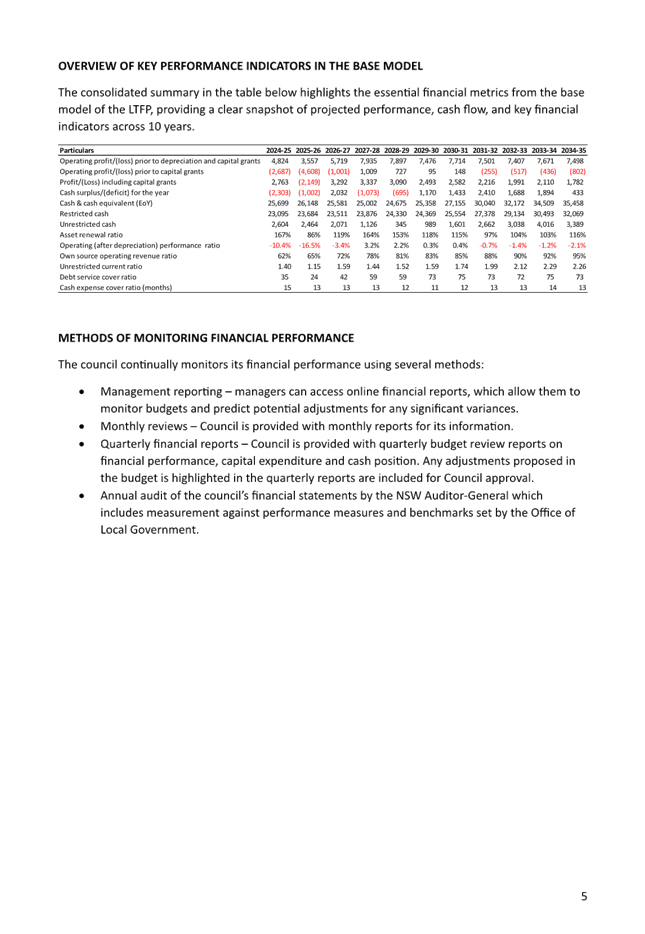

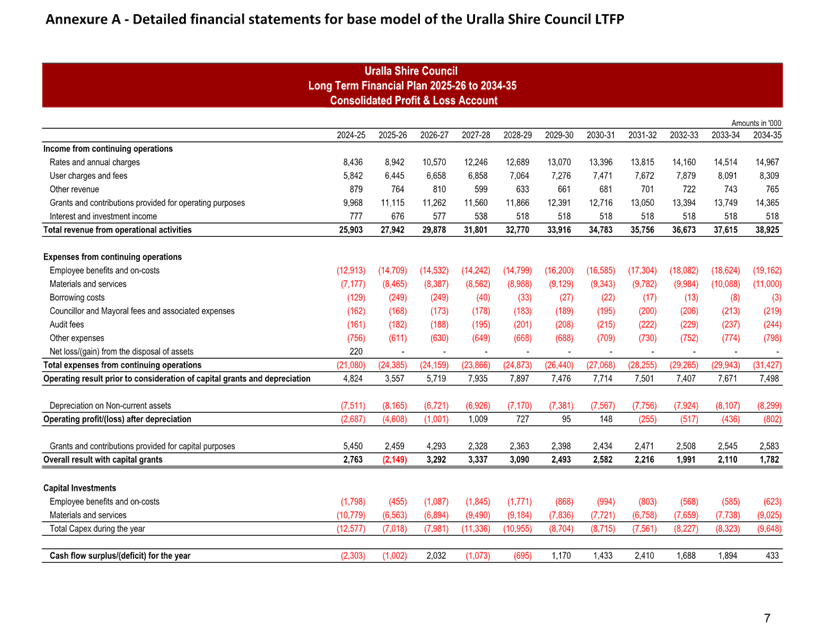

Summary

The Long-Term Financial Plan (LTFP) models the

financial implications for a term of 10 years. The LTFP consolidates

Council’s current and future financial obligations, informs

decision-making and demonstrates how the objectives of the Community Strategic

Plan and commitments of the Delivery Program, Asset Management Plan and

Operational Plan will be resourced and funded.

This

report presents the LTFP model for Council consideration, analysing the annual

cash position in both the base model and in various scenarios. The first

version of the LTFP highlighted significant cash flow challenges which would

undermine the long-term financial sustainability of Council. These

challenges were addressed in the recommended Version 4 through the

rearrangement of capital investments and revenue enhancements, a proposed Special

Rate Variation, increased waste service fees, and additional bond income from

McMaugh Gardens, leading to a positive cash flow to support Council’s

long-term objectives.

It is recommended that Council endorses Version 4 of the

LTFP for public exhibition. Subject to the outcome of the public exhibition

process, a further report will be prepared for Council for adoption of the

LTFP. Noting the recommended Version 4 relies on a Special Rate

Variation, a comprehensive community engagement program will be recommended for

Council approval.

|

Recommendation

That Council:

1. Endorses

Version 4 of the draft Long Term Financial Plan for public exhibition for 28

days.

2. Receives

a future report detailing all submissions received during the exhibition

period and any recommendations arising.

3. Subject

to consideration of the public submissions, undertakes a comprehensive

community engagement program regarding the proposed Special Rate Variation

for financial years 26/27 and 27/28 included in Version 4.

|

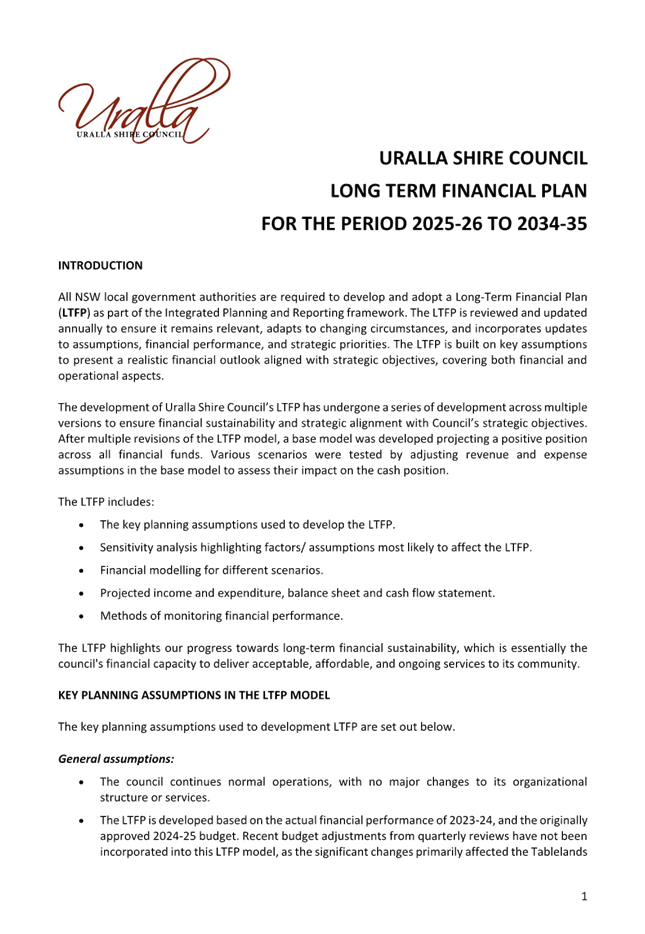

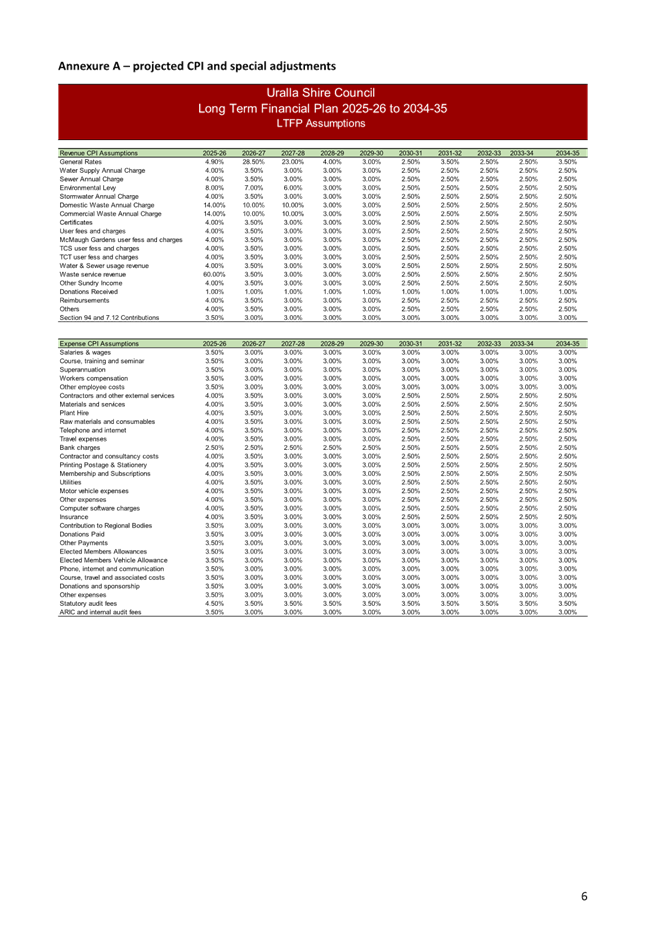

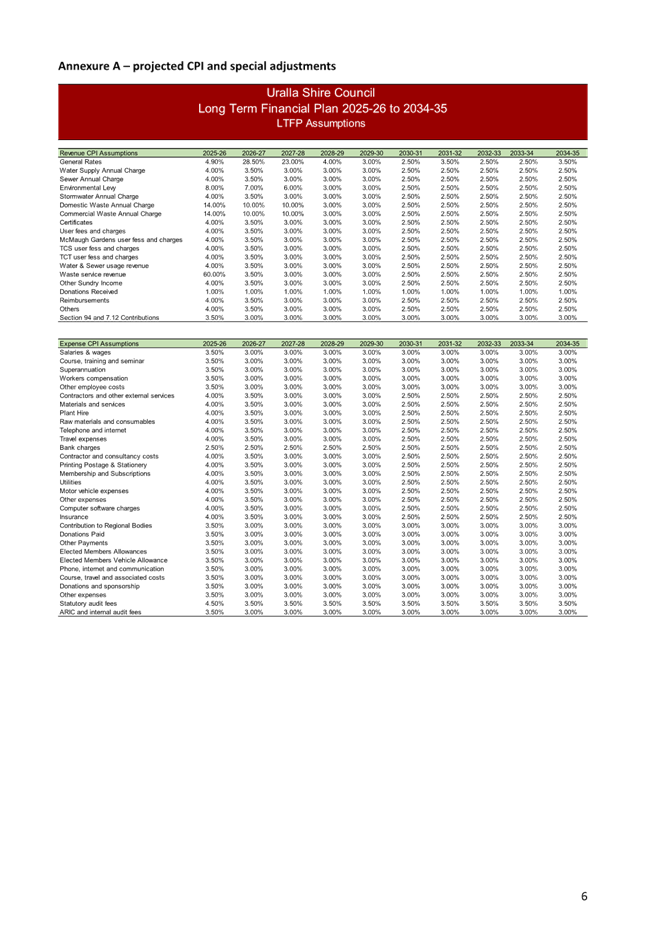

Report

All

NSW local government authorities are required to develop and adopt a LTFP as

part of the Integrated Planning and Reporting framework. The LTFP is reviewed

and updated annually to ensure it remains relevant, adapts to changing

circumstances, and incorporates updates to assumptions, financial performance,

and strategic priorities. The LTFP is built on key assumptions to present a

realistic financial outlook aligned with strategic objectives, covering both

financial and operational aspects.

The

development of Uralla Shire Council’s LTFP has undergone development

across multiple scenarios to ensure financial sustainability and strategic

alignment with Council’s strategic objectives. After multiple revisions

of the LTFP model, a base model was developed projecting a positive position

across all financial funds. Various scenarios were tested by adjusting revenue

and expense assumptions in the base model to assess their impact on the cash

position.

The

LTFP includes:

· The key planning

assumptions used to develop the LTFP.

· Sensitivity analysis

highlighting factors/ assumptions most likely to affect the LTFP.

· Financial modelling

for different scenarios.

· Projected income and

expenditure, balance sheet and cash flow statement.

· Methods of monitoring

financial performance.

The

LTFP highlights our progress towards long-term financial sustainability, which

is essentially the council's financial capacity to deliver acceptable,

affordable, and ongoing services to its community.

The

preparation of the LTFP was a collaborative process, with the financial model

created in-house and input gathered from stakeholders. The LTFP serves as a

strategic roadmap for managing resources, investments, and expenditures over an

extended period. Its primary objective is to ensure financial sustainability

while meeting the community's needs and maintaining service levels. This report

outlines the various stages involved in the preparation of the LTFP for a

ten-year period across financial years 2025-26 to 2034-35.

The

initial version of the LTFP, showed significant cash deficits across the

10-year period. Subsequent refinements resulted in improved cash flow and

financial sustainability.

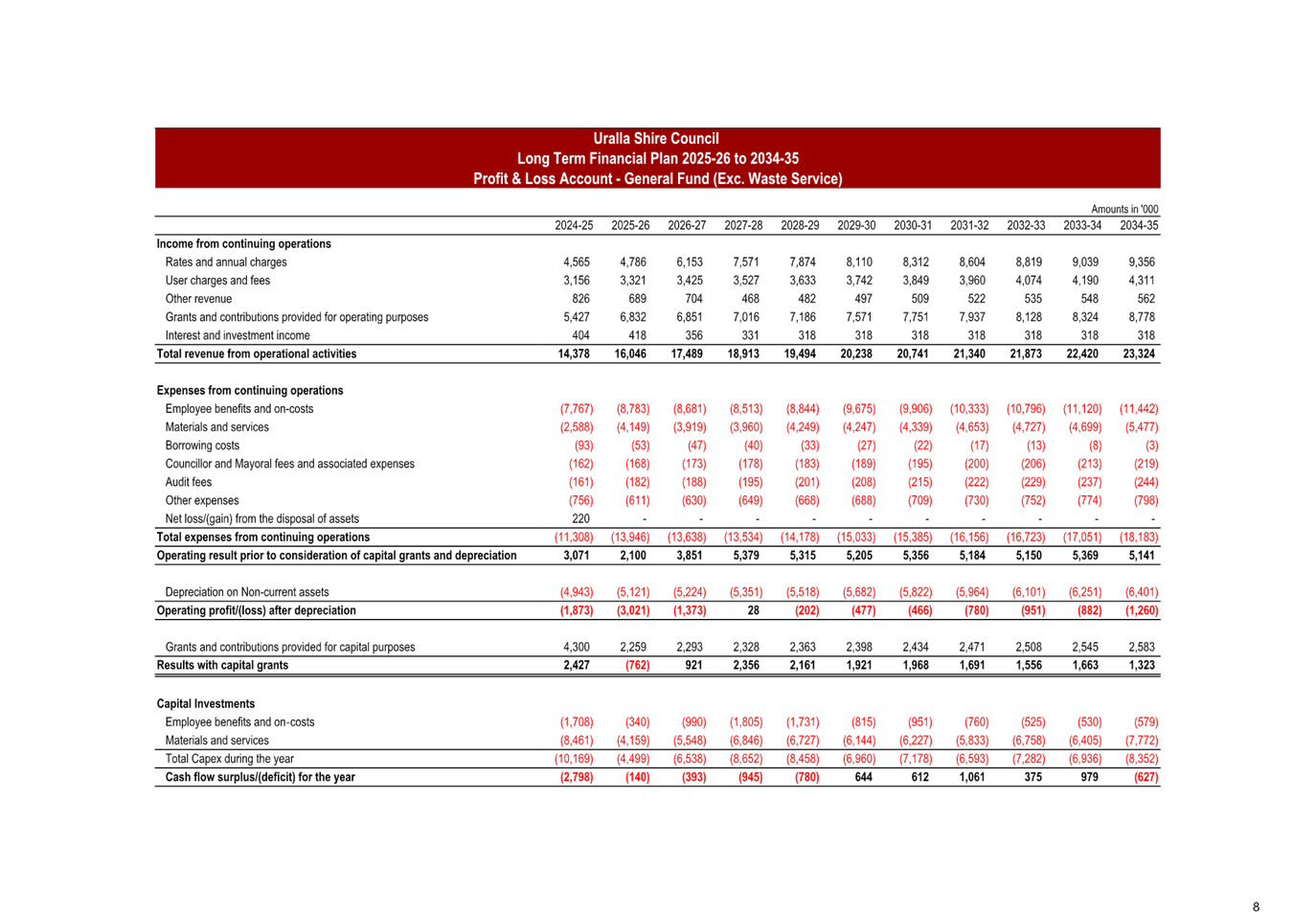

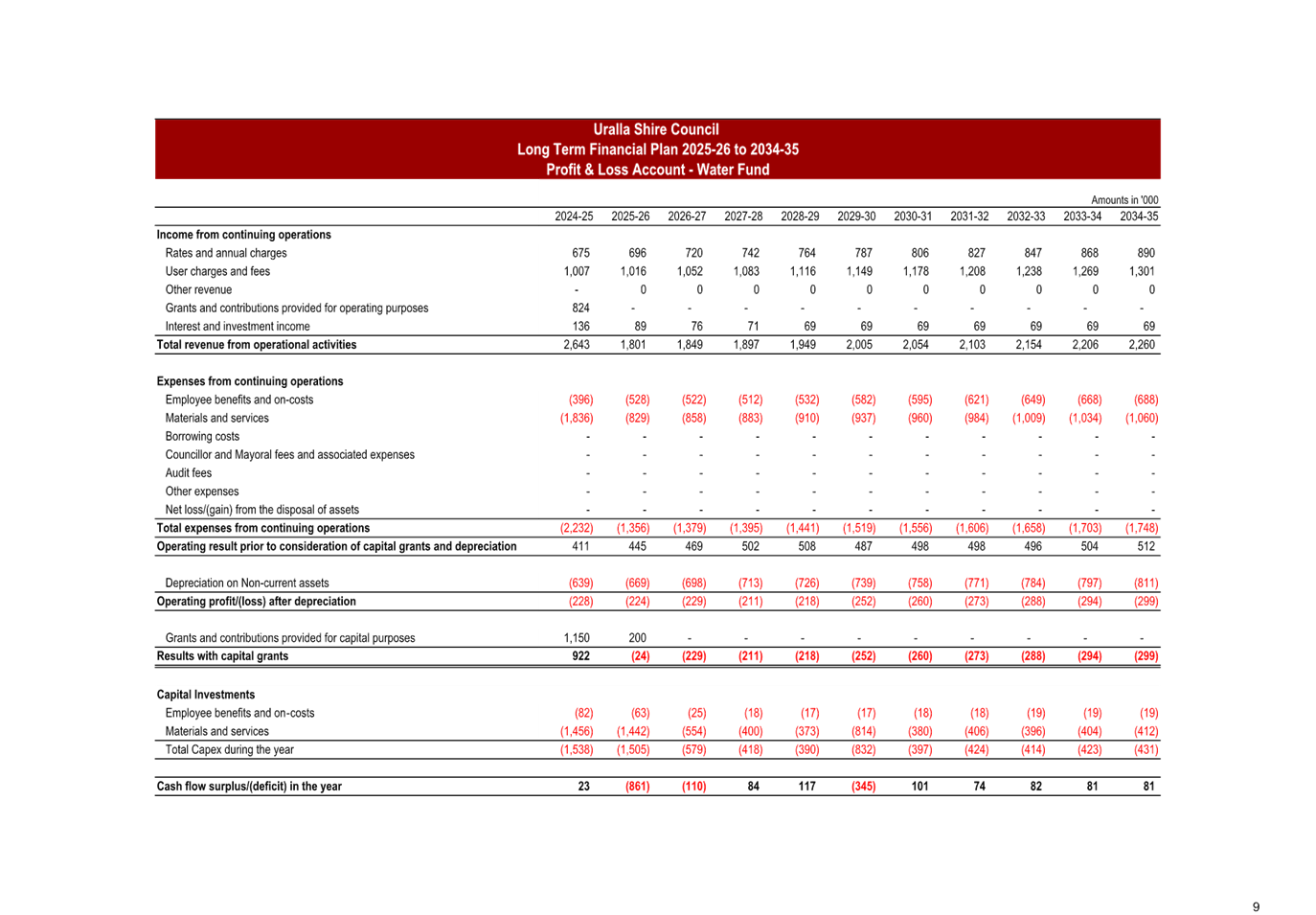

To

provide a more detailed segment-wise analysis, an additional financial fund was

created, bringing the total to five funds. The funds now include the General

Fund, Water Fund, Wastewater Fund, McMaugh Gardens Fund, and Waste Services

Fund.

Long term financial sustainability challenges

Uralla Shire Council provides a wide range of services to

our community. Maintaining our roads and footpaths, managing waste

collection and landfill, looking after parks, library services, Visitor

Information Services, and delivering community events and programs are all

services that our communities rely on every day.

In recent years, there has been both a reduction in funding

from both the Federal and State Governments and a significant financial impact

from cost-shifting, particularly from the State Government.

Key future financial challenges for Council include waste

management and the future capital investment required at the Uralla landfill,

aged and community care services, new biodiversity and weed management

responsibilities, and the ongoing strategic and planning response to renewable

energy development.

Just like households and businesses, Council has also been facing

rising costs. As a Council, we have done everything we can to reduce spending,

including improving efficiencies, reviewing fees and charges, sharing staff

with other councils and securing grants wherever possible.

The development of the LTFP model has demonstrated that

Council cannot continue to deliver the current level of services, meet the

current service standards and deliver capital programs without additional

revenue. The scenarios detailed below tested a number of assumptions to

arrive at a model that ensures Council’s financial sustainability over

the forecast 10-year period.

Principal to the recommended Version 4 model, is the

assumption of a Special Rate Variation spread over financial years 26/27 and

27/28. Any Special Rate Variation is subject to approval by the

Independent Pricing and Regulatory Tribunal (IPART).

Subject to Council approval and the outcome of the public

exhibition process for the LTFP, the proposed implementation timeframe allows

for a robust community engagement program prior to an application to IPART.

LTFP scenario models

Four LTFP scenarios were developed to model

Council’s projected financial expenditure, cash flow and revenue over the

10-year horizon. These are discussed below.

Version 1 - Initial Plan and Cash Deficits

The

first version of the LTFP focused on Council's baseline financial situation,

using a combination of past trends and the current year's original budgets for

income, expenditure, and capital investments, as per the asset management plans.

Various assumptions, including general rates, waste service fees, and capital

works, were applied to build this LTFP model.

Key

Results

· Operational expenses

and capital investments exceeded forecast income, resulting in a negative cash

flow.

· The

projections indicated a cumulative cash deficit of $6.5 million. This included

a $19.7 million deficit in general funds, a $4.1 million surplus in water

funds, a $7.2 million surplus in sewer funds, a $0.7 million surplus in McMaugh

Gardens funds, and a $2.6 million deficit in waste funds.

· This gave rise to concerns

regarding Council’s ability to maintain service levels and meet financial

obligations without substantial revisions.

Issues

Identified

· High capital

expenditure not aligned with available cash flow.

· Insufficient revenue

growth in key areas, such as rates and waste services.

Version 2 - Rearrangement and Deferral of Capital

Investments

In

response to the significant cash deficits in the first version of the LTFP, the

second version of the LTFP included some strategic adjustments, particularly in

capital investments, to reduce the negative impact on Council's cash flow.

Key

Adjustments

· Rearrangement of

Capital Projects - Capital projects were rescheduled, with some large-scale

investments deferred to future years, reducing immediate cash outflows.

· Capital Investment

Prioritisation -

Less urgent or non-essential capital works were postponed to allow for the allocation

of resources to critical infrastructure needs.

· Cash Flow Adjustment

-

With the deferral and reallocation of capital expenditures, the immediate

pressure on Council’s cash flow was alleviated, resulting in a less

severe deficit.

Key

Results

· The cash deficit was

reduced, but the cash position remained negative.

· The deferral of

capital works provided temporary financial relief, but it highlighted the need

for generation of ongoing revenue to ensure long-term sustainability of Council

operations and provision of services.

Version

3 - Special Rate Variation and Waste Service Fee Increase

The third

stage of LTFP development aimed to achieve a positive cash flow while

maintaining key services and required capital works.

Key

Adjustments

· Special Rate

Variation - A special rate variation was modelled to increase general rates

above the forecast standard rate peg, ensuring the rate base aligns with rising

service delivery costs and infrastructure investment needs.

· Increase in Waste

Service Fees: To cover the estimated $4.6 million required for landfill

remediation starting from 2026-27, and approximately $4 million for new

landfill facility development, increased fees and charges for waste management

services were applied in this version of LTFP.

Key

Results

· These refinements

generated a positive cash flow in the later years of the LTFP model.

· Although short-term

projections indicated tight cash positions, these are manageable, enabling Council

to confidently plan future investments and maintain service delivery.

Version 4 - McMaugh Gardens Capital Investment and

Additional Revenue from Bonds

The

fourth version of the LTFP incorporated additional investments identified at a

later stage following a consultant’s review of McMaugh Gardens asset

renewals.

At

the same time, a new revenue source emerged from recent changes resulting from

the Aged Care Act 2024 (Cth), enabling Council to retain 2% of bond

money annually for up to 5 years, capped at 10% in total.

Key

Adjustments

· Retention Income from

Bonds -

Allows Council to generate more revenue and accommodate the requirement of

additional capital investments for future renewals and upgrades to McMaugh

Gardens infrastructure.

Key

Results

· The updated version,

built upon all previous adjustments to the LTFP model, demonstrates a positive

cash position across the 10-year period.

· This version of the

LTFP model aligns with Council’s objectives for financial sustainability,

effective service delivery, and long-term growth.

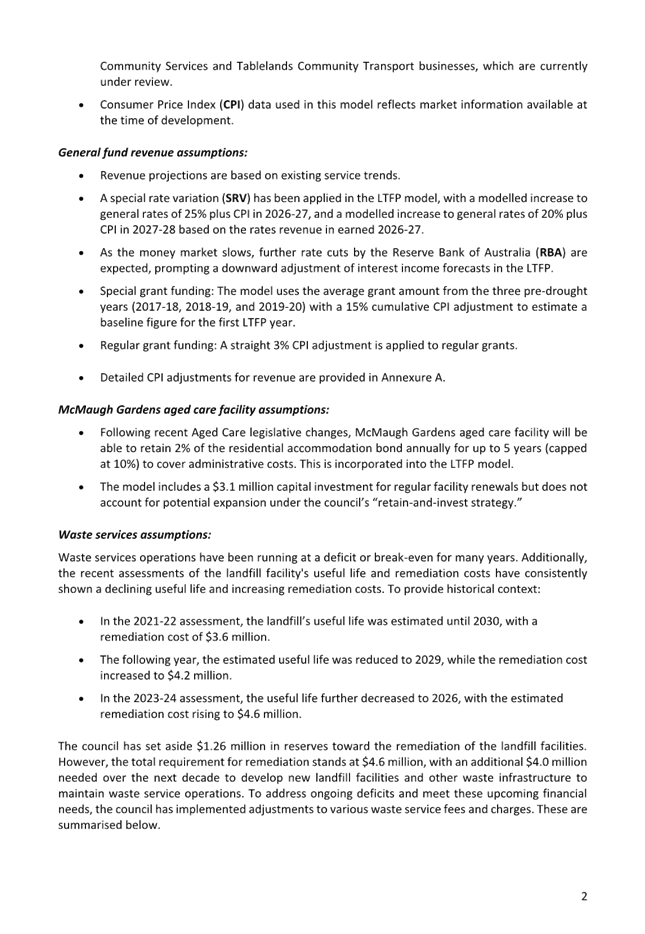

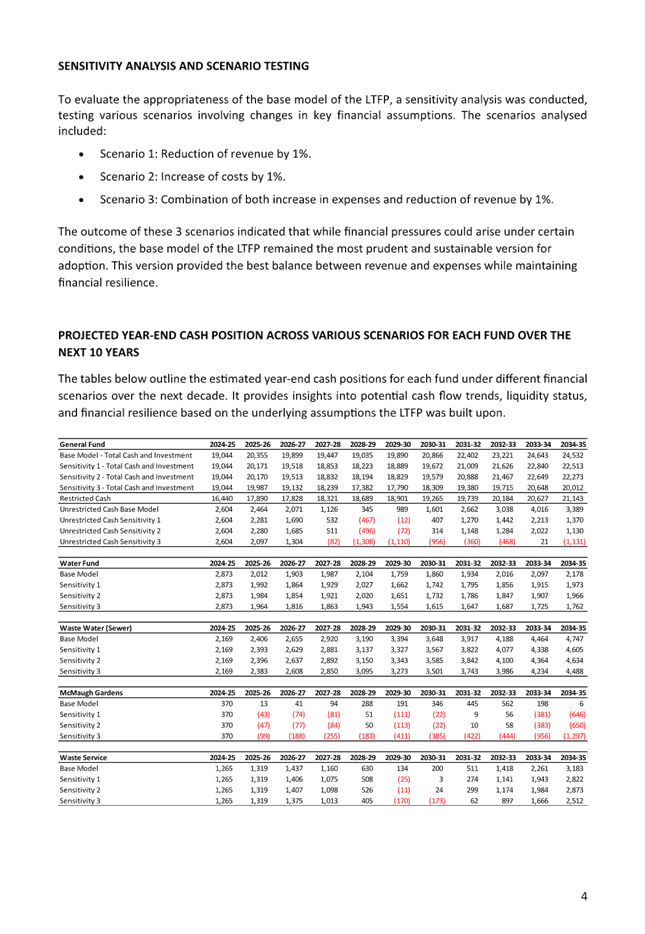

Sensitivity

Analysis

Sensitivity analysis in the LTFP help to assess the impact

of changes in key assumptions and variables regarding financial outcomes. Sensitivity

analysis involves testing how the plan's projections respond to different

scenarios, mainly in revenue and expenses.

After developing the base LTFP model through to Version 4,

three sensitivity scenarios were developed to assess the financial impact, and to

enable Council to make informed decisions. The scenarios are:

· Base model –

Version 4 of the LTFP model

· Sensitivity 1: 1% decrease in

revenue.

· Sensitivity 2: 1% increase in

expenses.

· Sensitivity 3: Combination of a 1%

revenue decrease and a 1% expense increase.

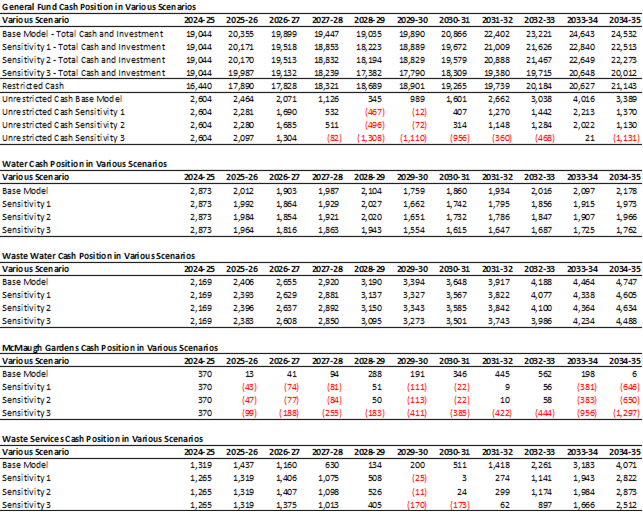

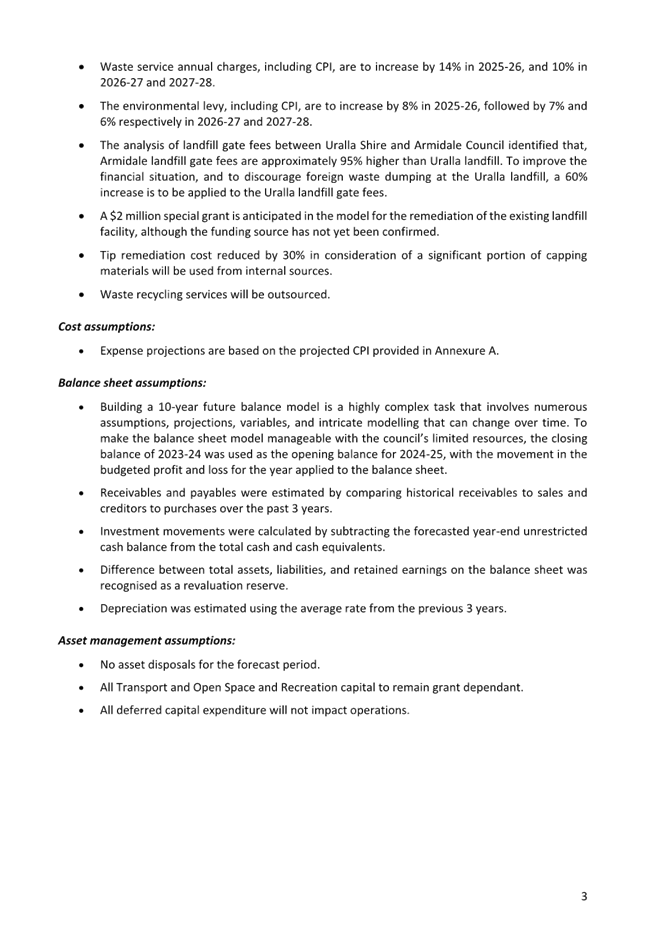

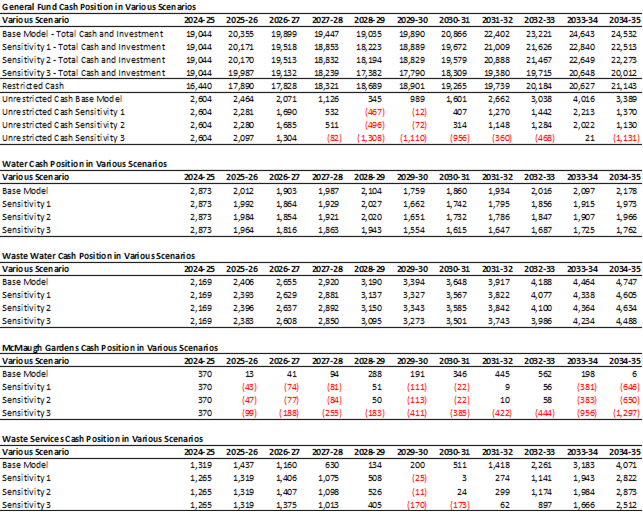

A snapshot of the cash position in each of the scenarios

for each of the five financial funds is provided in the table below:

As demonstrated in the above table, the base model of the

LTFP is the only scenario which provides a positive cash position across all

funds.

Financial sustainability and factors contributing to the

need for a Special Rate Variation

· For 48 consecutive year’s Council’s annual rates

increases have been less than CPI because of the ‘Rate Peg’ applied

by the NSW Government.

The NSW Government’s Forced Rate

Peg – The ‘Rate Peg’, applied to

NSW Councils 48 years ago (1977) by the NSW Government introduced the practice

of capping the annual increase that a council could apply to its previous

year’s total rates revenue.

The standard principle, which continues to

be applied by consecutive NSW Governments, is to ensure that each successive

annual rate increase will be less than the actual CPI increase for the previous

year.

In short, Council’s costs of

delivering its core service functions go up each year by more than Council is

allowed to collect. This process has ensured a steady diminution in the real

purchasing power of all NSW councils’ rates revenue, year on year, for

the past 48 years.

Assuming Council collected $100 per

ratepayer in 1977, then an annual rate cap which is say 0.2% less than each CPI

over the 48-year period has now resulted in Council collecting, in real terms,

less than $70 per rate payer of purchasing power in 2025.

· An amount now equal to $460 per Ratepayer, per annum of costs have been

unilaterally shifted from the NSW Government onto NSW Councils

Cost Shifting - is the annual process of consecutive NSW Governments unilaterally

making councils responsible and accountable for the delivery of what were

previously NSW Government responsibilities and services without providing

sufficient compensatory revenue or funding to the councils affected.

The most recent analysis on the matter “How State

Costs Eat Council Rates” (LGNSW 2024) found that the burden of cost

shifting has skyrocketed 78% in the past five years to $1.36 billion a year.

The LGNSW calculation notes that NSW councils (after decades

of ‘successful’ cost shifting by the NSW Government) are now

annually responsible for delivering more than $460 per ratepayer of what once

were NSW and Federal Government responsibilities (with limited, if any,

offsetting revenue).

· The

Diminishing Level of Federal Assistance Grants

Financial Assistance Grants – A vertical fiscal

imbalance (VFI) refers to a mismatch between the spending

responsibilities and revenue-raising capabilities of different levels of

government, particularly between the Federal Government and NSW Government on

the one hand, and Local Councils on the other.

Local government

councils only collect around 3.5 percent of taxation nationally and cannot

effectively execute their duties without support from other spheres of

government (ie. Commonwealth and State) to provide and maintain the

infrastructure their communities need such as swimming pools, playgrounds,

sports facilities, regional airports, and roads.

This disparity

was formally acknowledged by the Commonwealth Government more than 30 years

ago. To address this disparity the Commonwealth Government committed at the

time to providing local councils with an annual 1% share of the Commonwealth

Government’s total taxation takings each year.

That commitment

was not maintained over time and real value of Financial Assistance Grants

provided to local government has steadily declined over the past three decades

from the promised 1 percent share of Commonwealth taxation revenue to around

0.55 percent today.

Conclusion

The

preparation of Council’s LTFP involved a series of strategic adjustments

to overcome initial projected cash deficits and to achieve financial

sustainability across the 10-year period which the LTFP covered. The first

version of the LTFP highlighted significant cash flow challenges, which were

addressed through the rearrangement of capital investments and revenue

enhancements through a special rate variation, increased waste service fees,

and additional bond income from McMaugh Gardens, leading to a positive cash

flow to support Council’s long-term objectives.

The

LTFP is now well-positioned to support Council’s future goals while

maintaining financial stability. The LTFP will continue to be reviewed

annually, with any changes in circumstances addressed through future updates.

After analysing the annual cash position in both the base model and in various

sensitivity scenarios, we recommend that Council endorses Version 4 of the LTFP

for public exhibition. Subject to the outcome of the public exhibition process,

a further report will be prepared for Council for adoption of the LTFP.

Noting the recommended Version 4 relies on a Special Rate Variation, a

comprehensive community engagement program will be recommended for Council

approval.

Council Implications

Community Engagement/Communication

The draft LTFP be placed on public

exhibition for community consultation.

Policy and Regulation

Local Government Act 1993,

Local Government (General) Regulation 2021, Office of Local Government Integrated

Planning and Reporting Guidelines.

Financial/Long Term Financial Plan

Council is exploring other possibilities to generate

additional revenue for the delivery of services and capital expenditure.

Asset Management/Asset Management Strategy

Asset

Management Plan projections have been incorporated in the LTFP. The decision

regarding the suggested financial models within the LTFP could influence the

lifespan of assets and the ability to sustain the use of infrastructure.

Workforce/Workforce Management Strategy

Work force management plan projections have been

incorporated in the LTFP.

Legal and Risk Management

Continued review of costs and revenue raising opportunities

is necessary to confidently assess the risk of financial sustainability.

Performance Measures

The Long Term Financial Plan will be supported by the

Delivery Programme and the Operational Plan which include performance measures.

Project Management

Project management for the LTFP is the responsibility of the

Chief Financial Officer.

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council Meeting Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

14.6 Loans

as at 28 February 2025

|

Department:

|

Corporate & Community

|

|

Prepared By:

|

Senior Finance Officer

|

|

Authorised By:

|

Director Corporate & Community

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.2. A

strategic, accountable and representative Council

|

Summary

This report provides Council with a reconciliation of

borrowings as at the end of the reporting month.

|

Recommendation

That Council notes that the total loan position as of 28

February 2025 is $1,203,016.

|

Report

This report is provided to inform Council of the

reconciliation of borrowings on a monthly basis. A reconciliation of borrowings

for the month of January confirmed that the loan position as of 28 February 2025

is $1,203,016.

The table below provide details of interest applied and instalments paid since

the last report.

Conclusion

I, Mustaq Ahammed, Chief Financial Officer hereby certify

that the above borrowings have been made in accordance with the requirements of

the Local Government Act 1993 (the Act) (Chapter 15, Part 12 –

sections 621 to 624) and the Local Government (General) Regulation 2021 (the

Regulation) (Section 230).

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

14.7 Investments

as at 28 February 2025

|

Department:

|

Corporate & Community

|

|

Prepared By:

|

Senior Finance Officer

|

|

Authorised By:

|

General Manager

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.2. A

strategic, accountable and representative Council

|

Summary

This Report contains a summary of bank accounts, term

deposits, cash management accounts and investments in structured credit

instruments. The investments have been made in accordance with Section 625 of

Local Government Act 1993, Regulation 212 of the NSW Local Government (General)

Regulations 2021, and Council’s Investment Policy 2019.

|

Recommendation

That Council notes the cash position as of 28 February

2025 consisting of:

· cash and

overnight funds of $3,683,615.

· term deposits of

$24,350,000.

· total

convertible funds of $28,033,615 ($3,683,615 + $24,350,000) (including

restricted funds).

|

Report

Current term deposits of $24,350,000 spread over the next

twelve months will receive interest rates ranging from 4.72% to 5.45%, with an

average rate of 5.06%. Council’s General Fund bank balances (refer to the

Schedule of Cash at bank and Term deposits below) have been reconciled to the

bank statement as of 28 February 2025.

An additional table has been added to this report to provide

movement of term deposits with different banks.

key issues

Official cash rate

As of 28 February 2025, the official cash rate set by the

Reserve Bank of Australia (RBA) was 4.10%, following a 0.25% rate reduction at

the RBA’s February Board meeting. This decision, along with any future

rate cuts, could potentially impact future investment returns. The timing of

potential interest rate changes will be guided by the incoming data and the RBA

Board’s assessment of the outlook for inflation and the labour market.

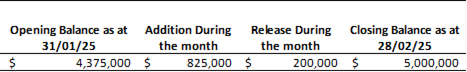

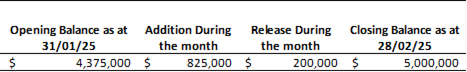

McMaugh Gardens - Bond Liability

As per the Department of Health’s prudential

guidelines, the council is advised to disclose the amount of McMaugh

Garden’s bond liability in the investment report. McMaugh Garden’s Bond

liability status as of 28 February 2025 is shown below:

Restricted and Unrestricted Cash, Cash Equivalents, and

Investments

Of the amount of cash disclosed in this report, not all the

cash is available for unrestricted use by Council. Most of the cash has been

set aside to meet external restrictions, being those funds that have been

provided for specific purposes such as developer contributions, government

grants, loans, water supplies, sewer services and Aged Care Bonds.

Additionally, a portion of the cash has been set aside to cover future

commitments that Council has made relating to asset renewals, remediation works

or leave provisions.

Most of the Council’s cash is externally restricted and not available for

day-to-day operational expenditure. As per audited financial statements

for the year ending 30 June 2024, the amount of unrestricted cash was $1,878,692.

Council updates its restriction status at the end of each quarter. Based on

latest reconciliation as of 31 December 2024, the Council’s unrestricted

cash is $1,954,963.

Conclusion

I, Mustaq Ahammed, Manager Finance, hereby certify that the

above investments have been made in accordance with the Section 212 of the

Local Government (General) Regulation 2021, and section 625 of the Local

Government Act 1993, and Council’s investment policy.

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

14.8 Monthly

Finance Report for February 2025

|

Department:

|

Corporate & Community

|

|

Prepared By:

|

Corporate Accountant

|

|

Authorised By:

|

Manager Finance

|

|

Reference:

|

UINT/25/4271

|

|

Attachments:

|

1. Monthly

Finance Report-February 2025 ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.1. Informed

and collaborative leadership in our community

4.2. A

strategic, accountable and representative Council

|

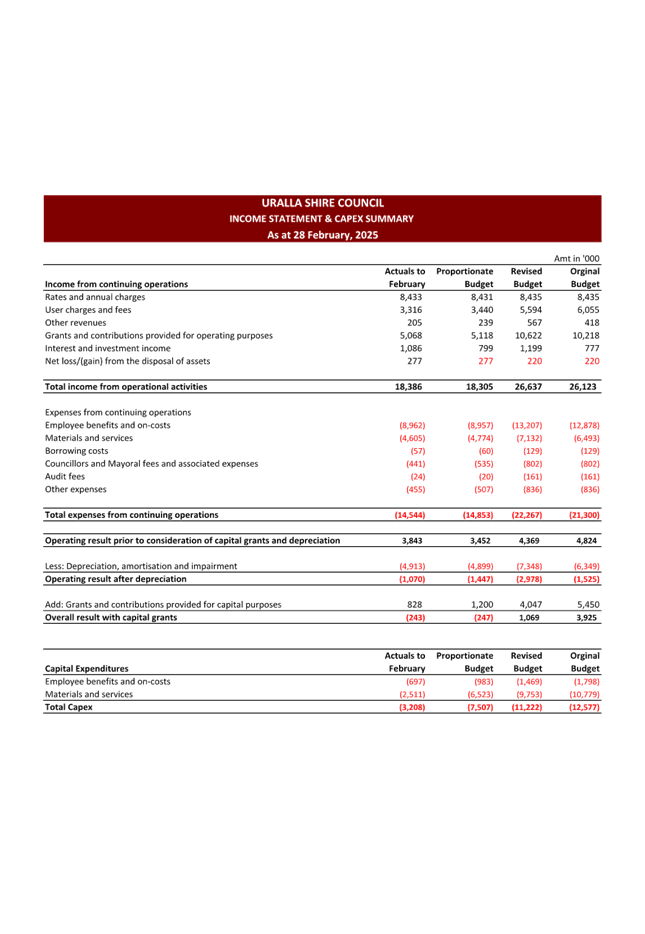

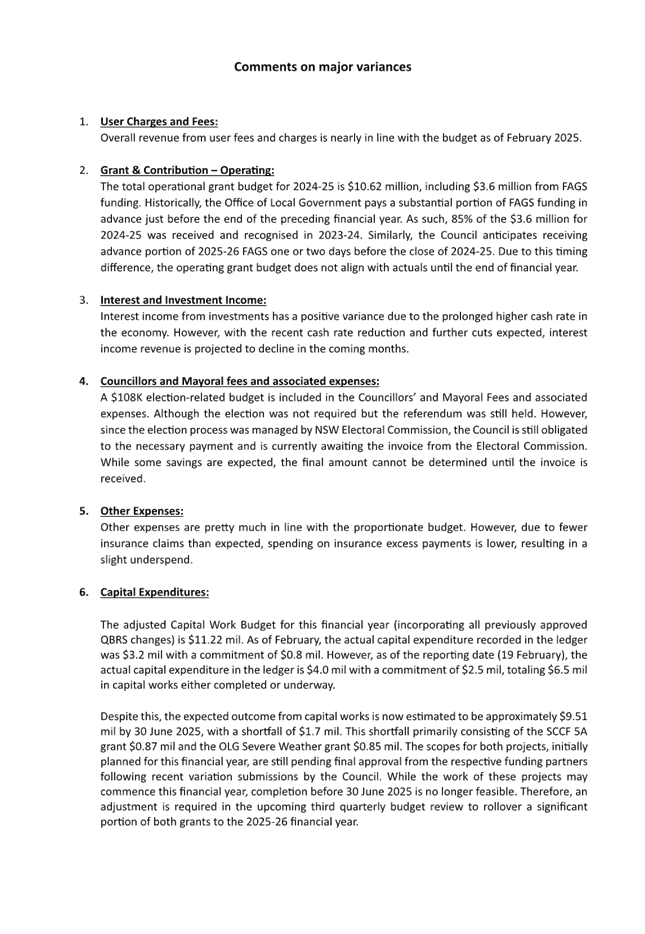

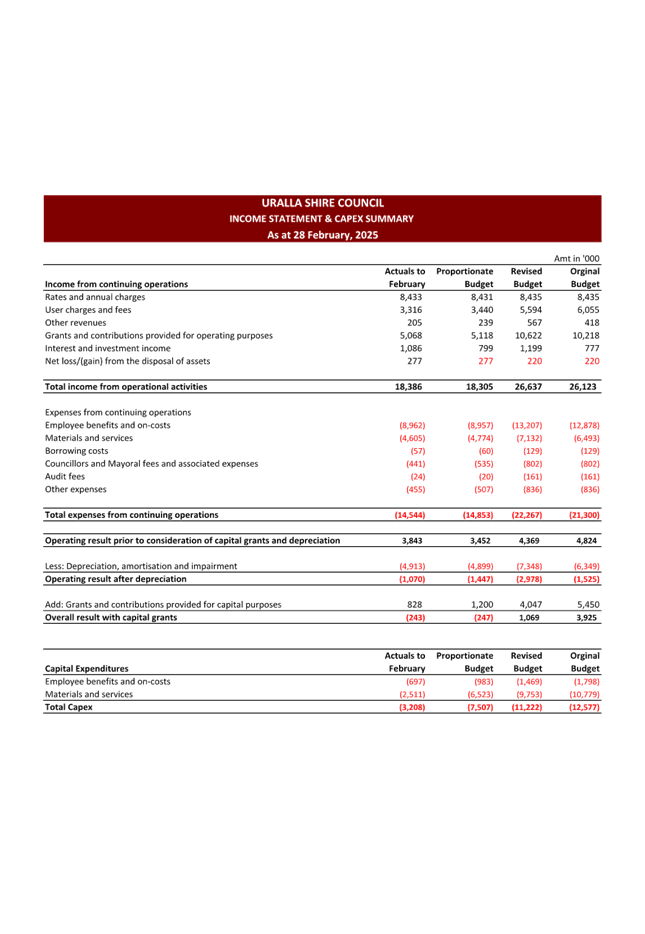

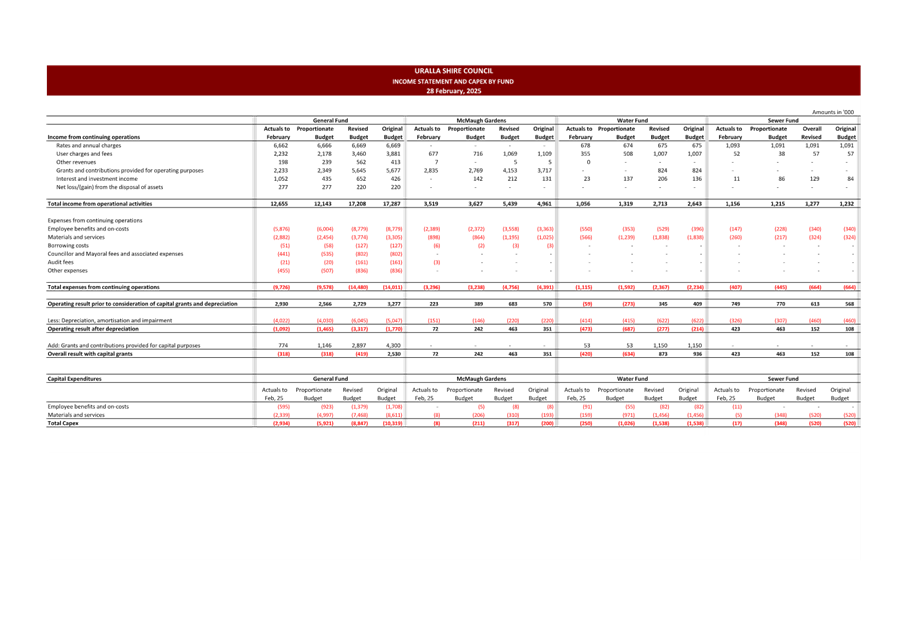

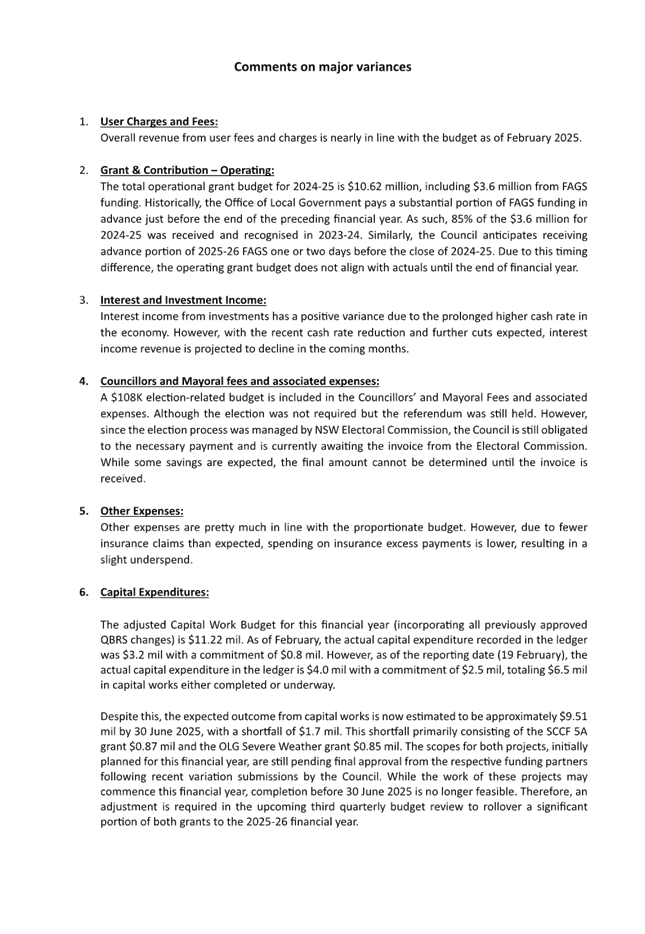

Summary

The purpose of this report is to provide an overview of the

Council’s financial performance up to the reporting date, along with

analytical comments on significant variances with the budget.

|

Recommendation

That Council receives the attached Monthly Finance

Report for February 2025.

|

REPORT

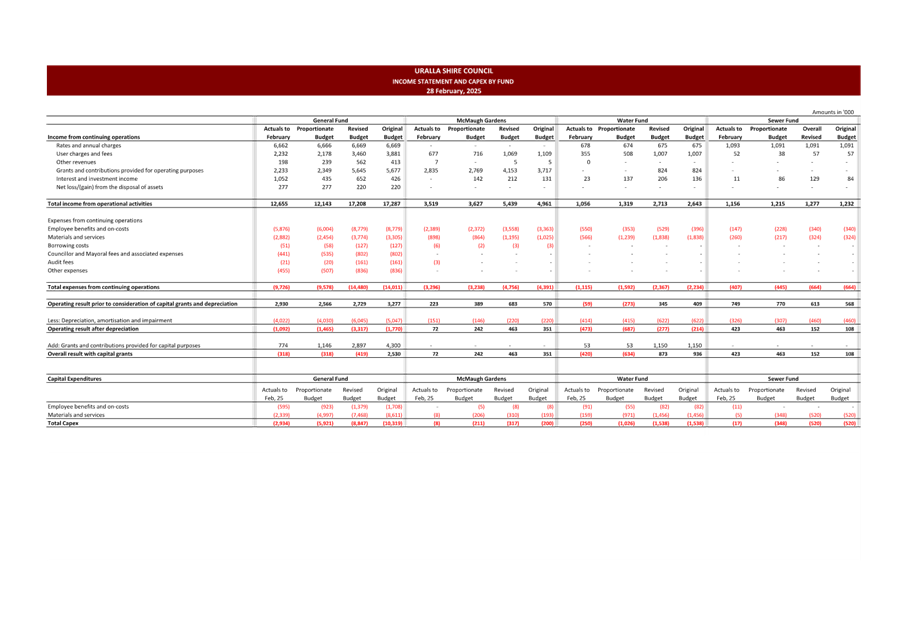

This report provides for the information of Councillors the

Income Statement and CAPEX Summary, including a breakdown by fund, for the

month ending 28 February 2025.

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

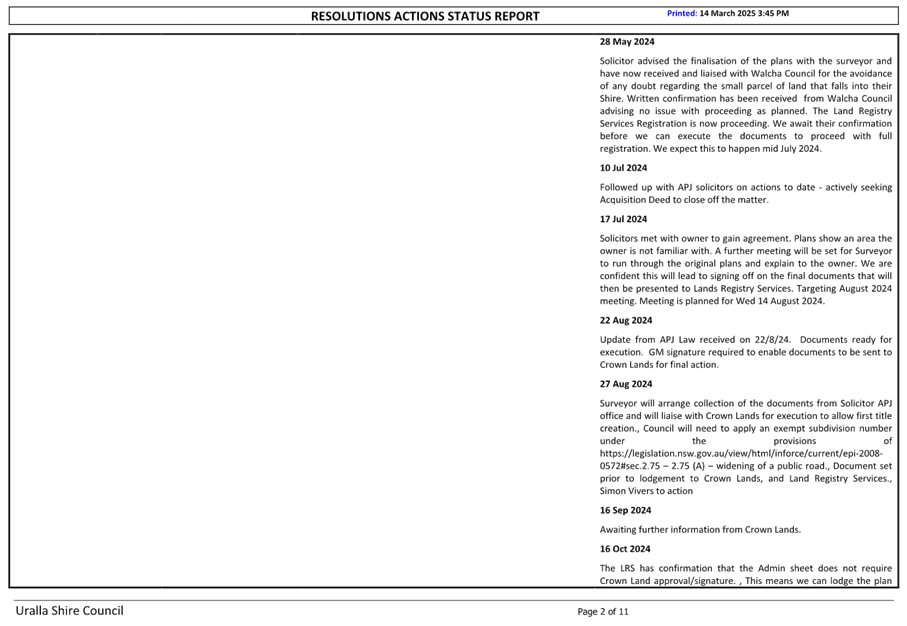

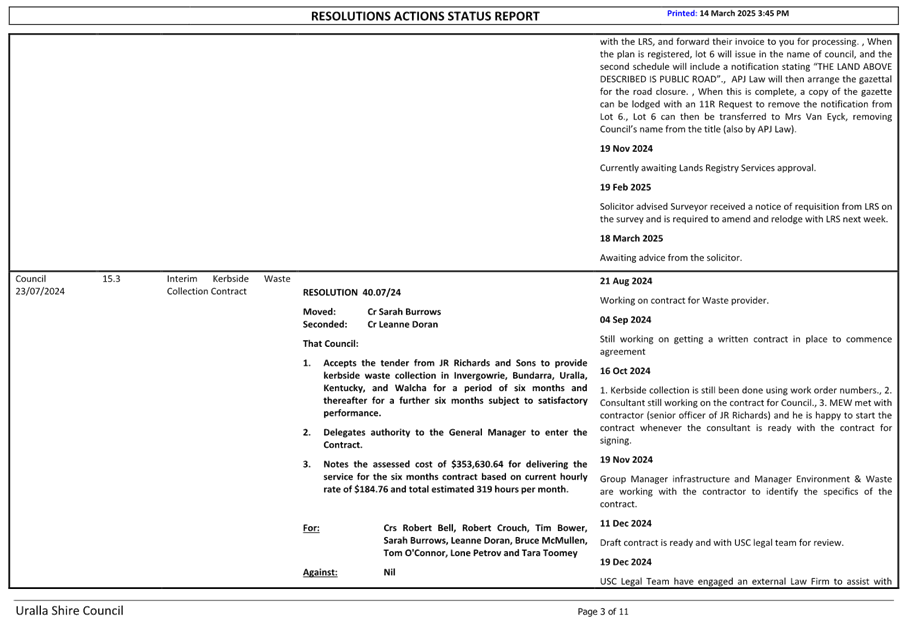

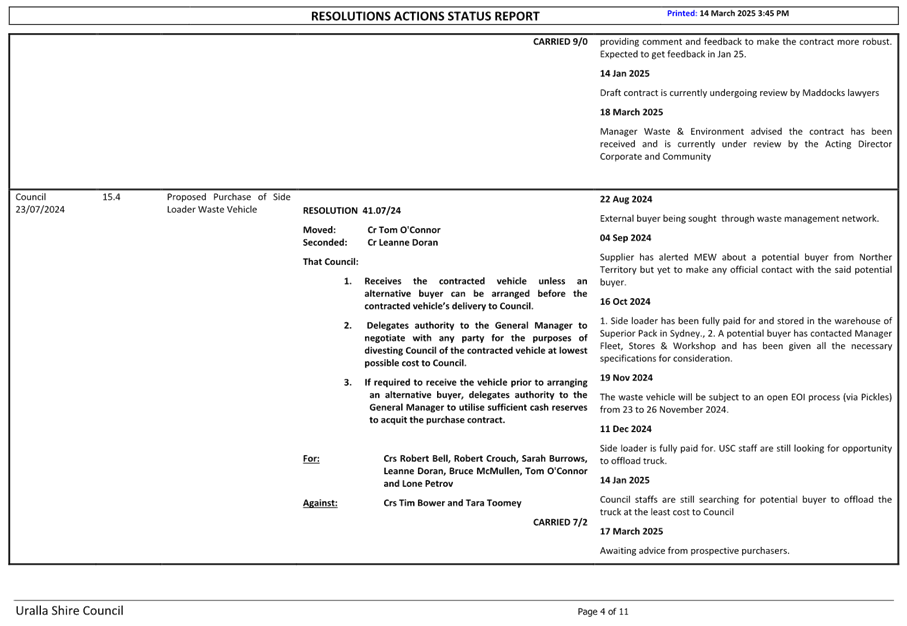

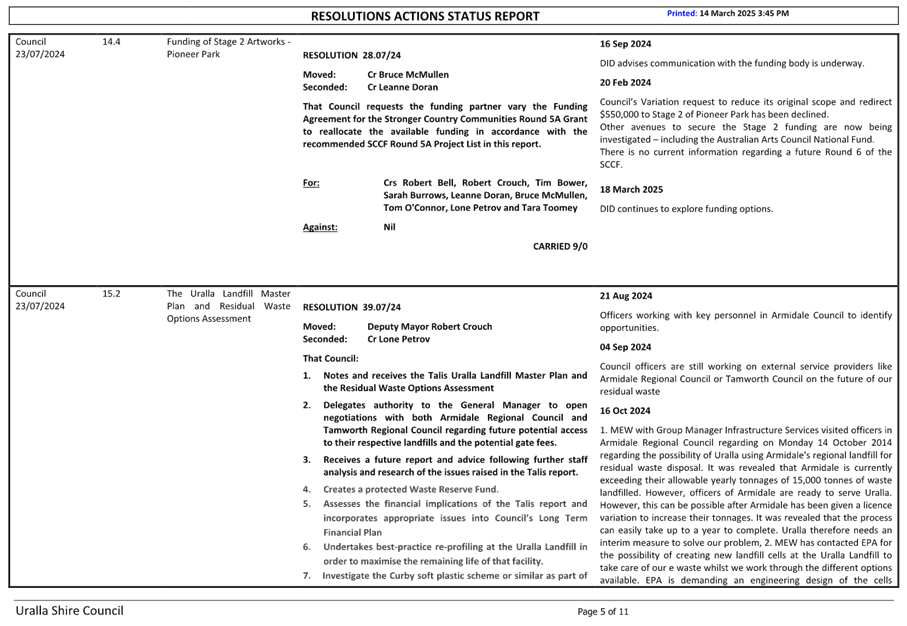

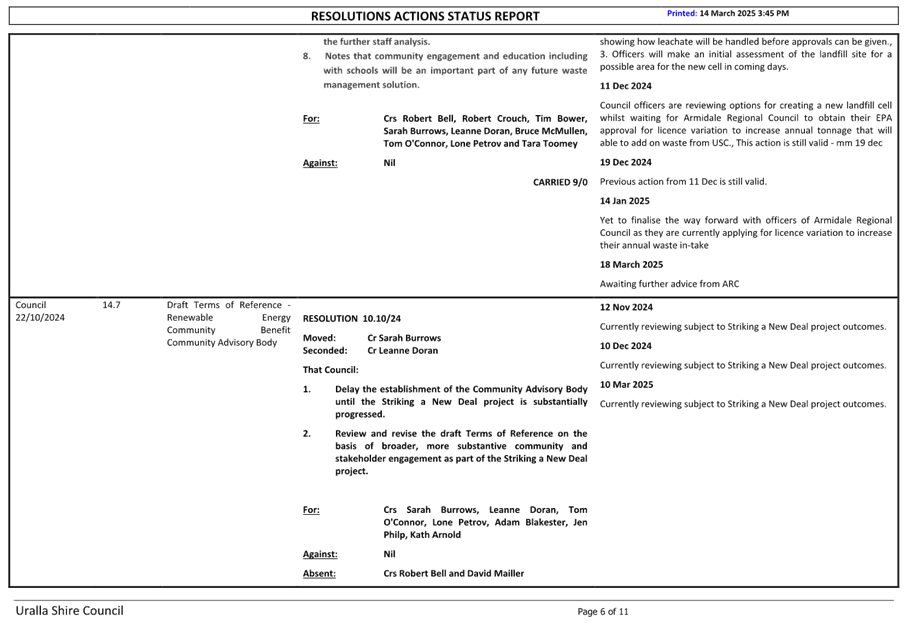

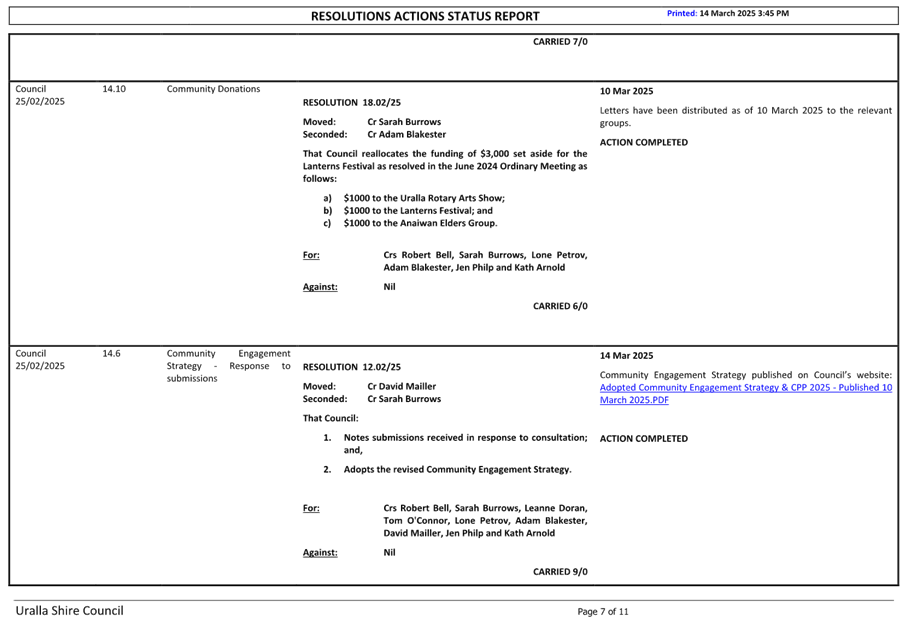

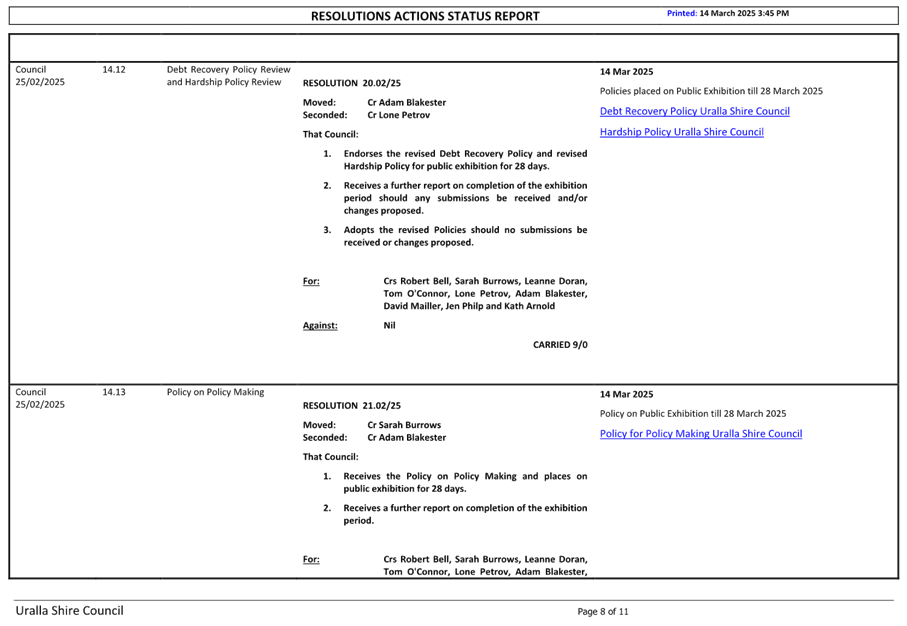

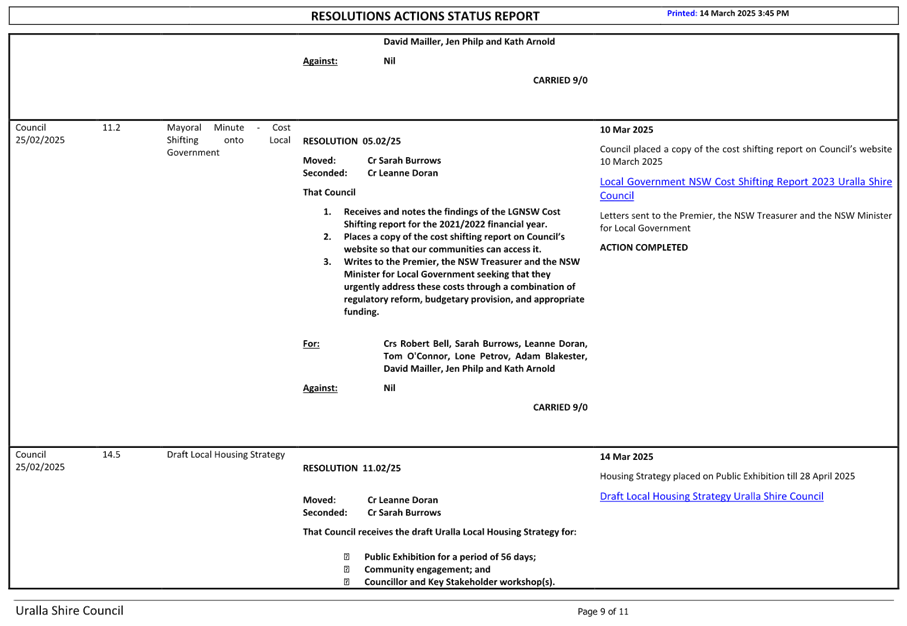

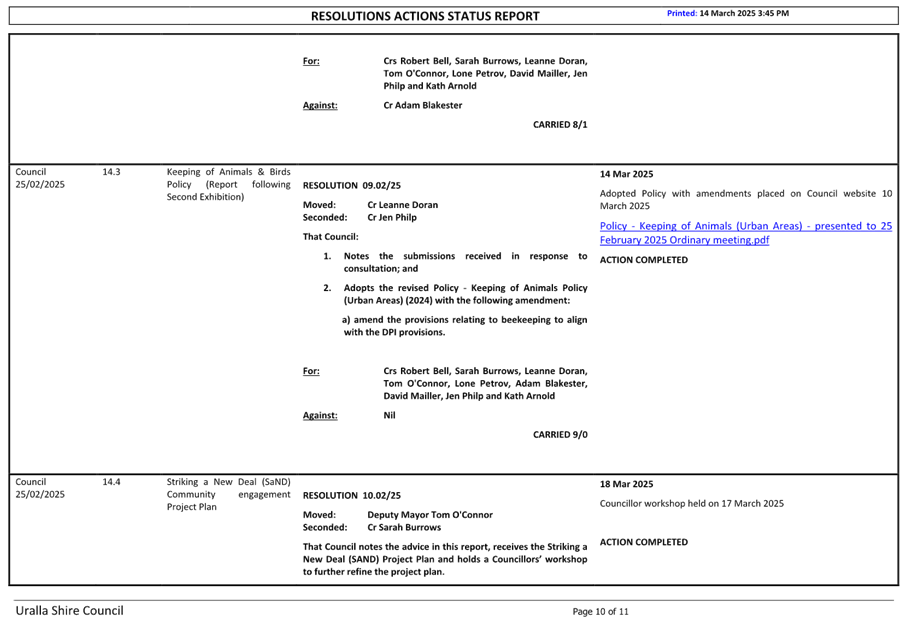

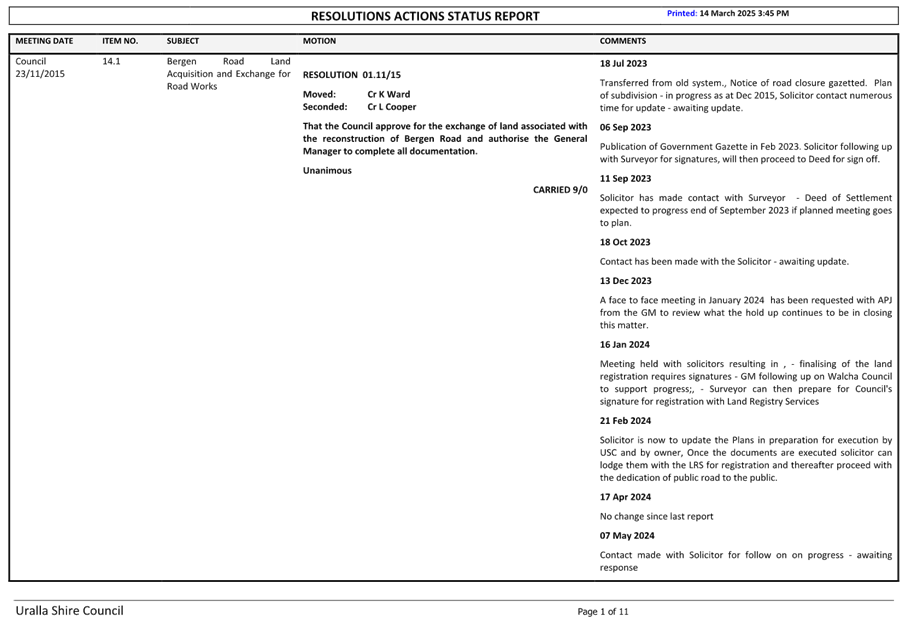

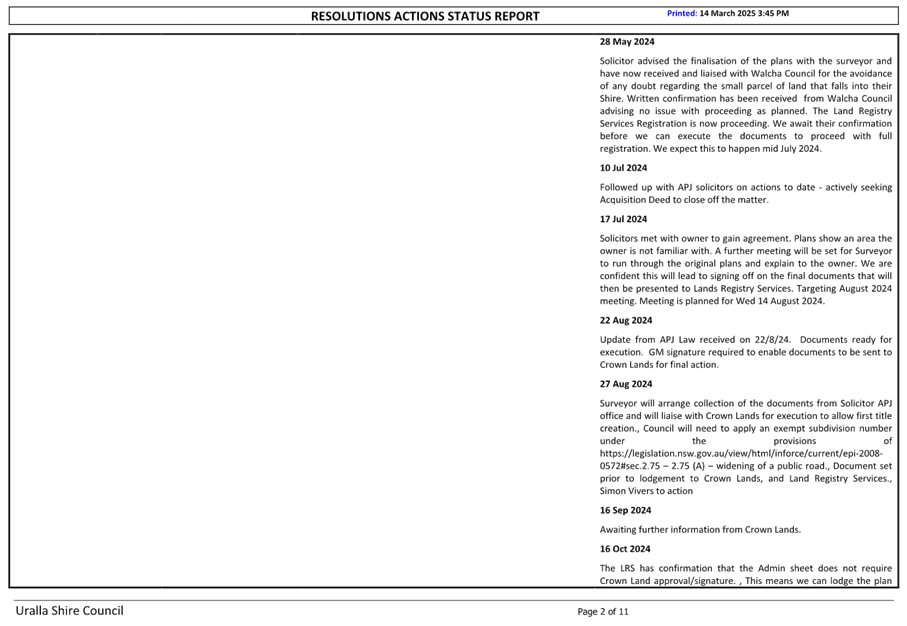

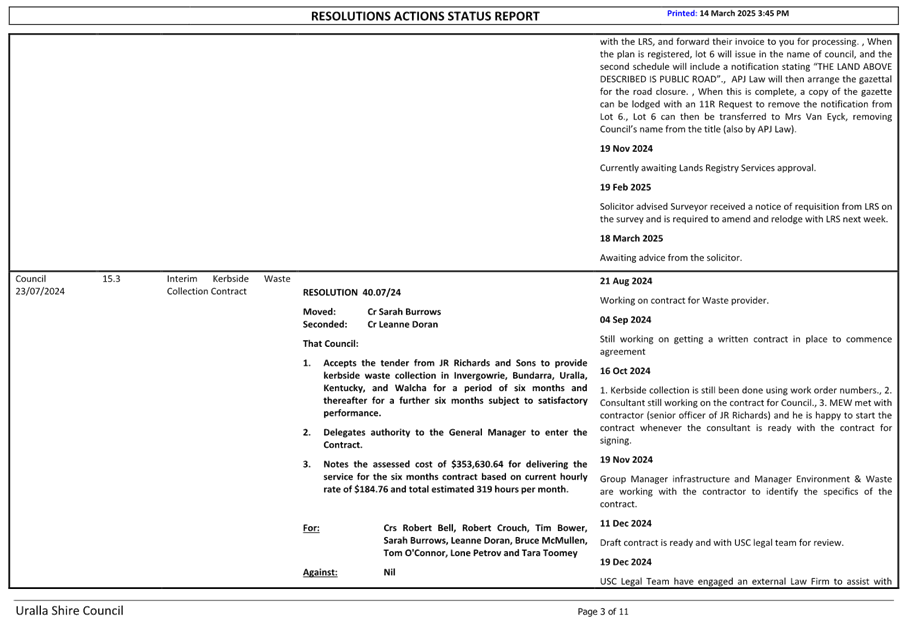

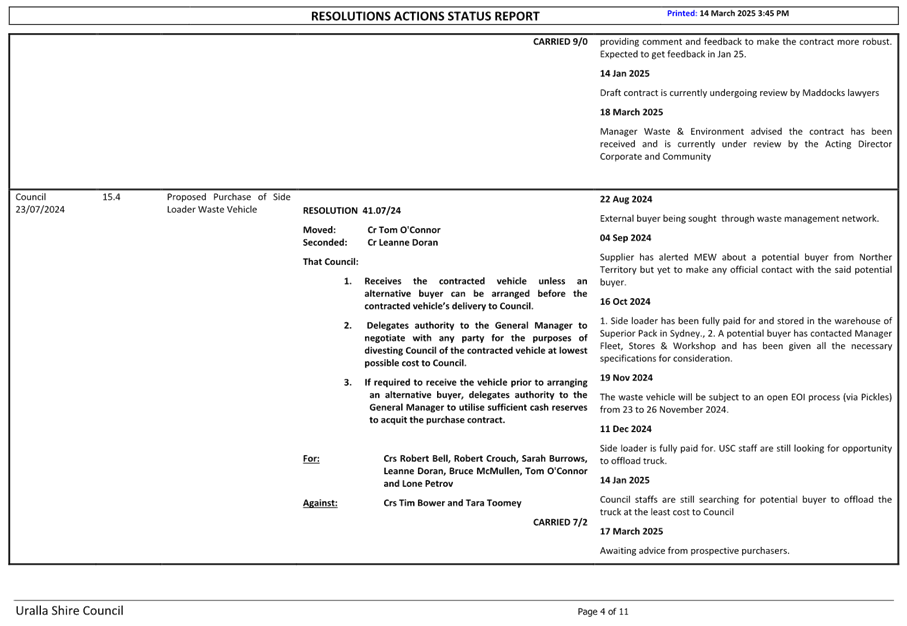

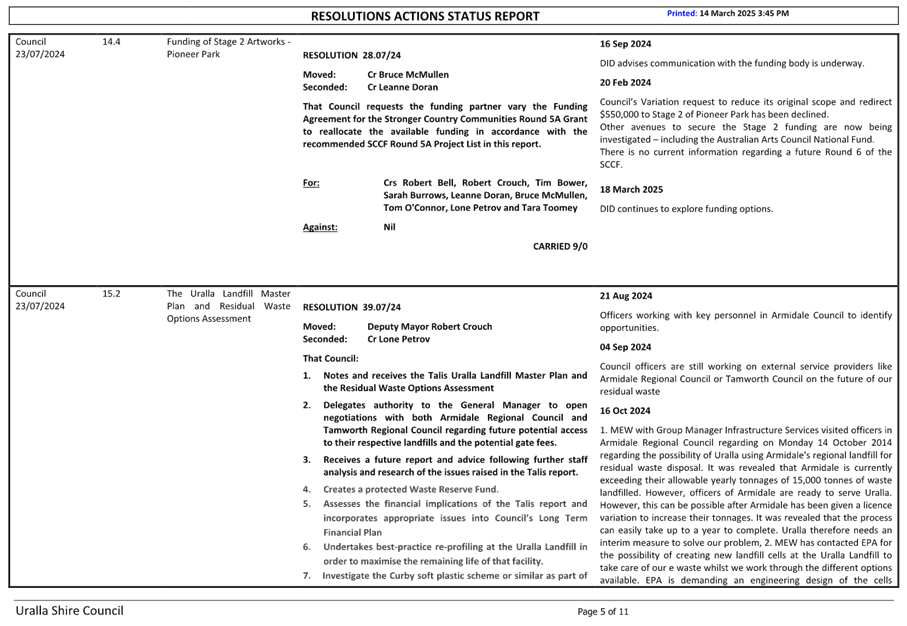

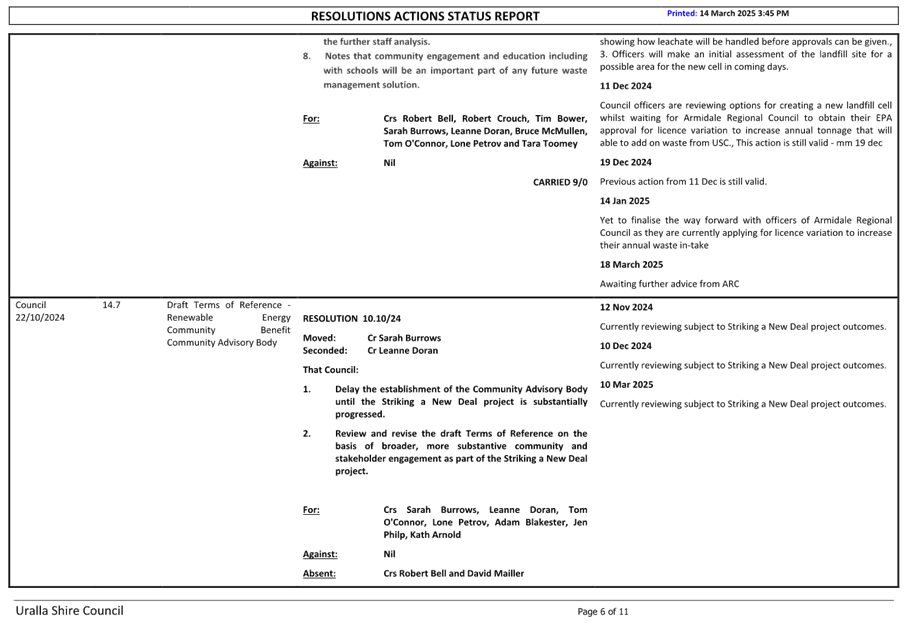

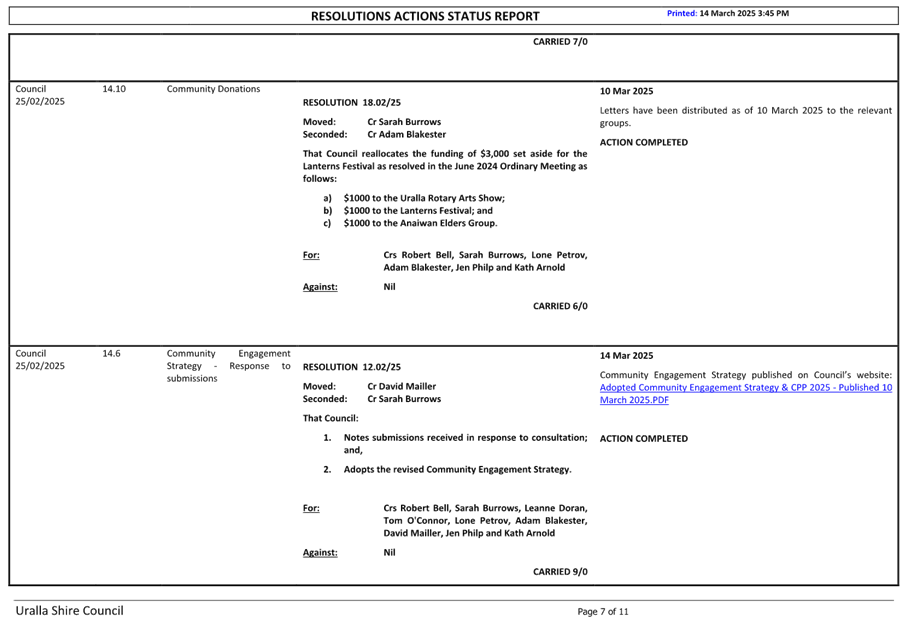

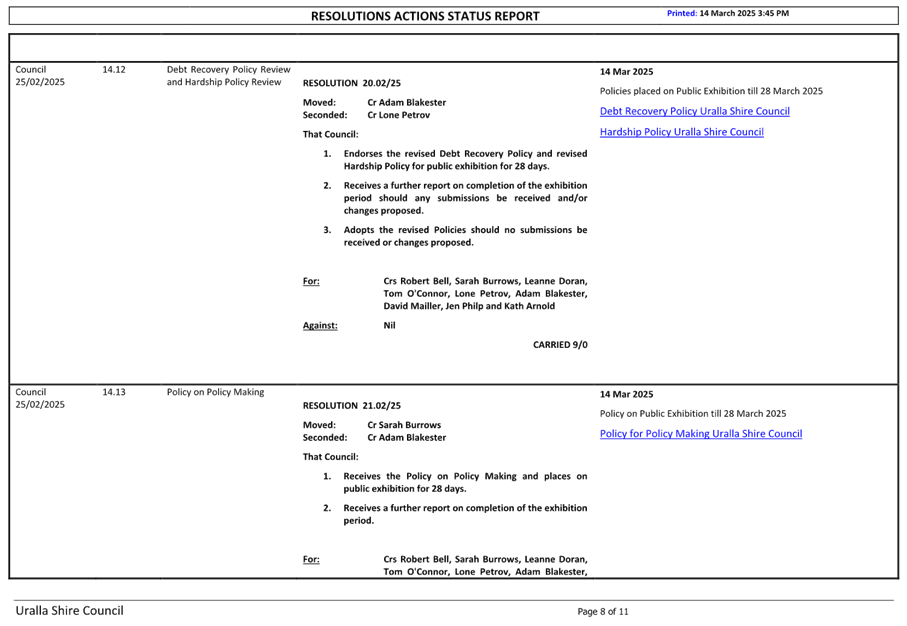

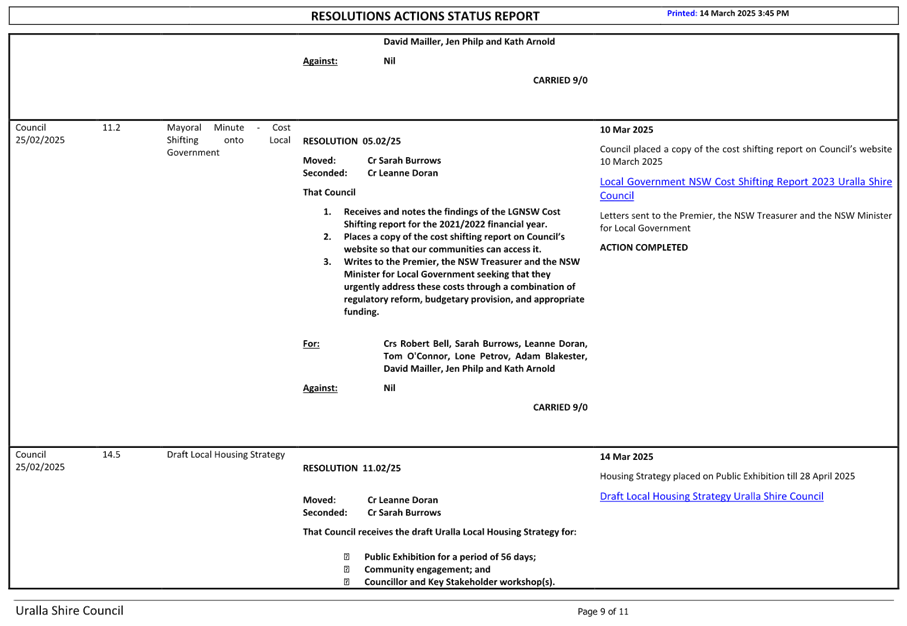

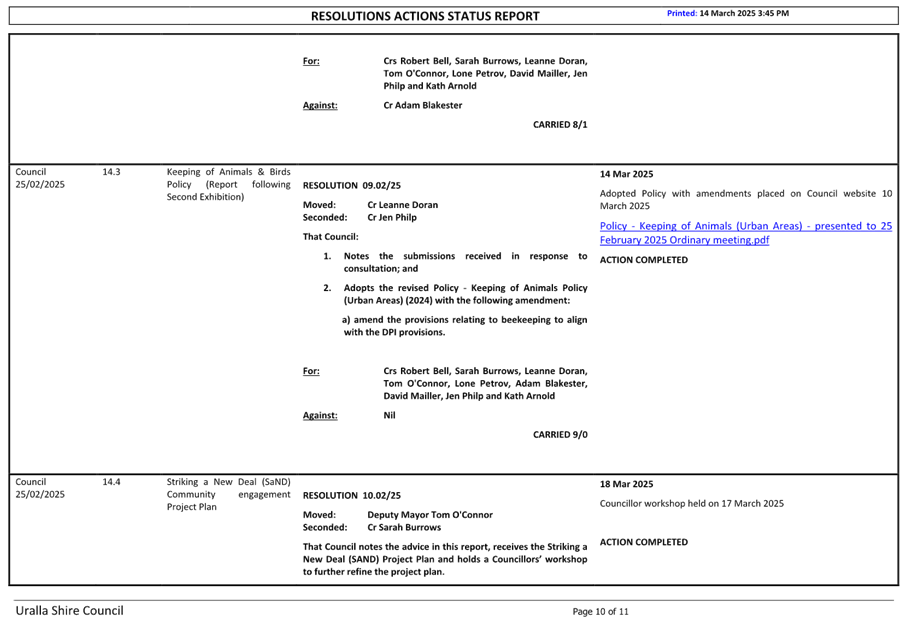

14.9 Register

Resolutions Actions Status as at 14 March 2025

|

Department:

|

General Manager’s

Office

|

|

Prepared By:

|

Executive Assistant

|

|

Authorised By:

|

General Manager

|

|

Reference:

|

UINT/25/4755

|

|

Attachments:

|

1. Resolutions

Actions Status Report as at 14 March 2025 ⇩

|

|

LINKAGE TO INTEGRATED PLANNING AND REPORTING FRAMEWORK

|

|

Goal:

|

4. We

are an independent shire and well-governed community

|

|

Strategy:

|

4.1. Informed

and collaborative leadership in our community

|

Summary

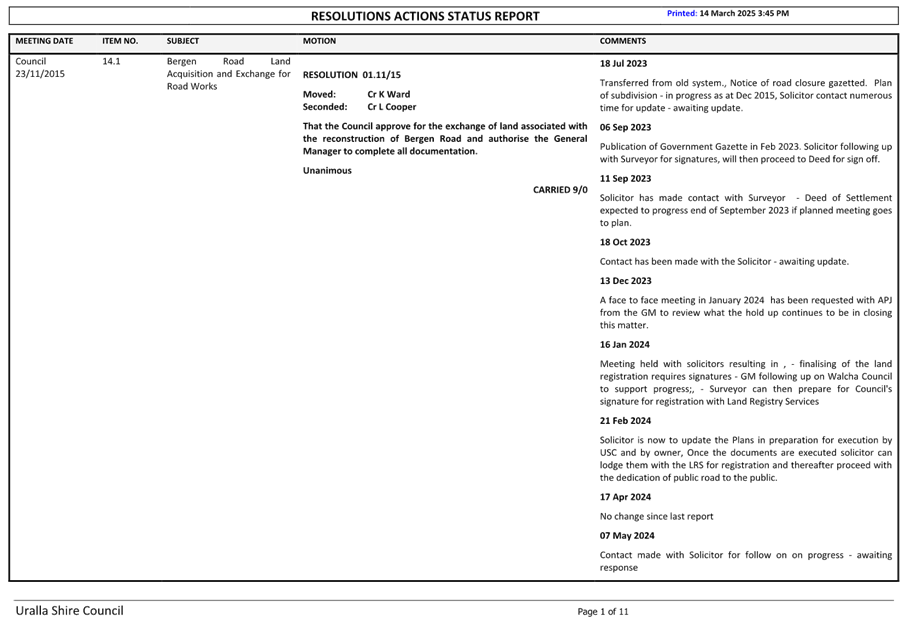

The purpose of this report is to provide Council with the Resolution

Action Status updates.

|

Recommendation

That Council notes the Resolution Actions Status Report

as at 14 March 2025.

|

Report

Following every council meeting, the resolutions of Council

which require action are compiled. This document is referred to as the

Resolutions Action Status Report.

The purpose of the Resolutions Action Status Report is to enable

Council to monitor progress of resolutions until they are actioned.

Once resolutions have been completed they are removed

automatically from the report.

Conclusion

The Resolutions Action Status Report is presented to Council

at each Ordinary Meeting.

|

Ordinary Council Meeting

Business Agenda

|

25 March 2025

|

|

Ordinary Council

Meeting Business Agenda

|

25 March 2025

|

15 Confidential

Matters

|

Recommendation

That Council considers the confidential report(s) listed

below in a meeting closed to the public in accordance with Section 10A(2) of

the Local Government Act 1993:

15.1 New

England Weeds Authority Update Report

This matter is considered to be confidential under Section

10A(2) - d(i) and f of the Local Government Act 1993, and the Council

is satisfied that discussion of this matter in an open meeting would, on

balance, be contrary to the public interest as it deals with commercial

information of a confidential nature that would, if disclosed prejudice the

commercial position of the person who supplied it and details of systems

and/or arrangements that have been implemented to protect council,

councillors, staff and Council property.

15.2 Audit

Risk & Improvement Committee Quarterly update and presentation of 4 year

strategic work plan

This matter is considered to be confidential under Section

10A(2) - f of the Local Government Act 1993, and the Council is

satisfied that discussion of this matter in an open meeting would, on

balance, be contrary to the public interest as it deals with details of

systems and/or arrangements that have been implemented to protect council,

councillors, staff and Council property.

15.3 McMaugh

Gardens Aged Care Facility - Strategic Direction

This matter is considered to be confidential under Section

10A(2) - d(ii) and d(iii) of the Local Government Act 1993, and the

Council is satisfied that discussion of this matter in an open meeting would,

on balance, be contrary to the public interest as it deals with information

that would, if disclosed, confer a commercial advantage on a competitor of

the council and information that would, if disclosed, reveal a trade secret.

15.4 General

Manager's Annual Performance Review 2025

This matter is considered to be confidential under Section

10A(2) - a of the Local Government Act 1993, and the Council is

satisfied that discussion of this matter in an open meeting would, on

balance, be contrary to the public interest as it deals with personnel

matters concerning particular individuals (other than councillors).

|